Taking out student loans for medical school may not be a no-brainer for medical students. The average physician salary varies greatly based upon specialty, and so does medical school affordability.

Physicians have a lot of grit. (I know this personally because I couldn’t cut it!)

My dad is a primary care physician with a focus on internal medicine. All of his friends were doctors, and I loved the conversations around the dinner table. I wanted to be a doctor my whole life. At least, until I got through three semesters of pre-medical and decided it wasn’t going to happen.

It takes four years of a grueling pre-med undergraduate curriculum followed by four more years as a poor med school student. That's a ton of time for a medical education. Then after you graduate from med school (probably with a ton of medical school loans), congratulations! You now need to work three to five years in a pressure cooker. All this while being very underpaid and highly overworked in residency and possibly fellowship. So much for a nice physician starting salary.

For those doctors who go into fellowship or other specialized fields, my hat’s off to you!

The six-figure attending physician salary is well-earned since they’re one of the most highly trained professions and are extremely valuable to all people.

Not only does a physician’s path take time and effort, it also incurs a high financial cost and debt burden not to mention burnout.

Physicians graduate with more student loans than anticipated

According to an Association of American Medical Colleges (AAMC) survey, the median M.D. graduates with $200,000 in student debt. But that average medical school debt number may not represent what doctors actually owe in total student debt.

Here at Student Loan Planner®, we’ve had over 300 physician clients, and their average debt is $320,000. That’s 60 percent higher than the AAMC survey results. It also tells the whole story.

The physician clients we work with come in with educational debt from undergrad, which usually has been deferred. Some of that debt has then accrued interest. Others may have had an inefficient plan to pay back their loans, leading to significant loan growth even three to five years out of med school.

So is the physician salary worth the cost of medical school tuition and fees?

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

How much do physicians make?

The average physician salary is $299,000, according to the Medscape Physician Compensation Report for 2018.

But there are more than 1 million doctors in the U.S., and the physician salary can vary greatly based upon the area of focus or specialty choice.

That 1 million doctor number is split between specialists who make an average salary of $329,000 and primary care physicians who make $223,000, according to the same survey.

Dissecting it even further, the highest physician salary belongs to plastic surgeons and orthopedic doctors. They earn about $500,000 on average. The lowest physician salary belongs to pediatricians, who earn $212,000 on average.

That’s nearly a $300,000 difference between the highest and lowest compensated specialty.

Student loan repayment can look vastly different between the radiologist who makes $401,000 and the family medicine doctor making $219,000 on average.

Related: Disability insurance for orthopedic surgeons: Costs and where to buy it

Physician student loan repayment options

Here at Student Loan Planner®, we’ve done 2,000 consults and advised on over $500 million of student debt. Our experience shows there are two optimal ways for physicians to pay off student loans. These options happen to be on opposite ends of the spectrum.

Option 1: Aggressive pay back

For people who owe 1.5 times their income or less (e.g., physician salary of $250,000 with loans at $375,000 or less), their best bet in most cases is to throw every dollar they can find into paying back their loans as fast as possible for no more than 10 years. Often it involves refinancing to get a lower interest rate.

Physicians who are eligible for loan forgiveness programs like Public Service Loan Forgiveness (PSLF) may not want to refinance, even if they owe less than 1.5 times their income. They want to take option two.

Option 2: Pay the least amount possible and save aggressively on the side

For people who owe more than twice their income (e.g., a physician salary of $250,000 and owes $500,000 or more), the goal is to get on an income-driven repayment plan through the federal government that will keep their loan payments low and maximize loan forgiveness. This could be through PSLF or taxable loan forgiveness.

Most physicians we work with take this path if they’re going for PSLF, ignoring their student loans or they have a spouse with six-figure student loan debt as well.

That being said, physicians could benefit by starting on this repayment path as a resident with that low physician starting salary. Then they can either move to a more aggressive approach or stay on the PSLF path when they become an attending physician.

Related: Disability insurance for thoracic surgeons: Benefits and costs

Physician salary and specialty dictates student loan repayment

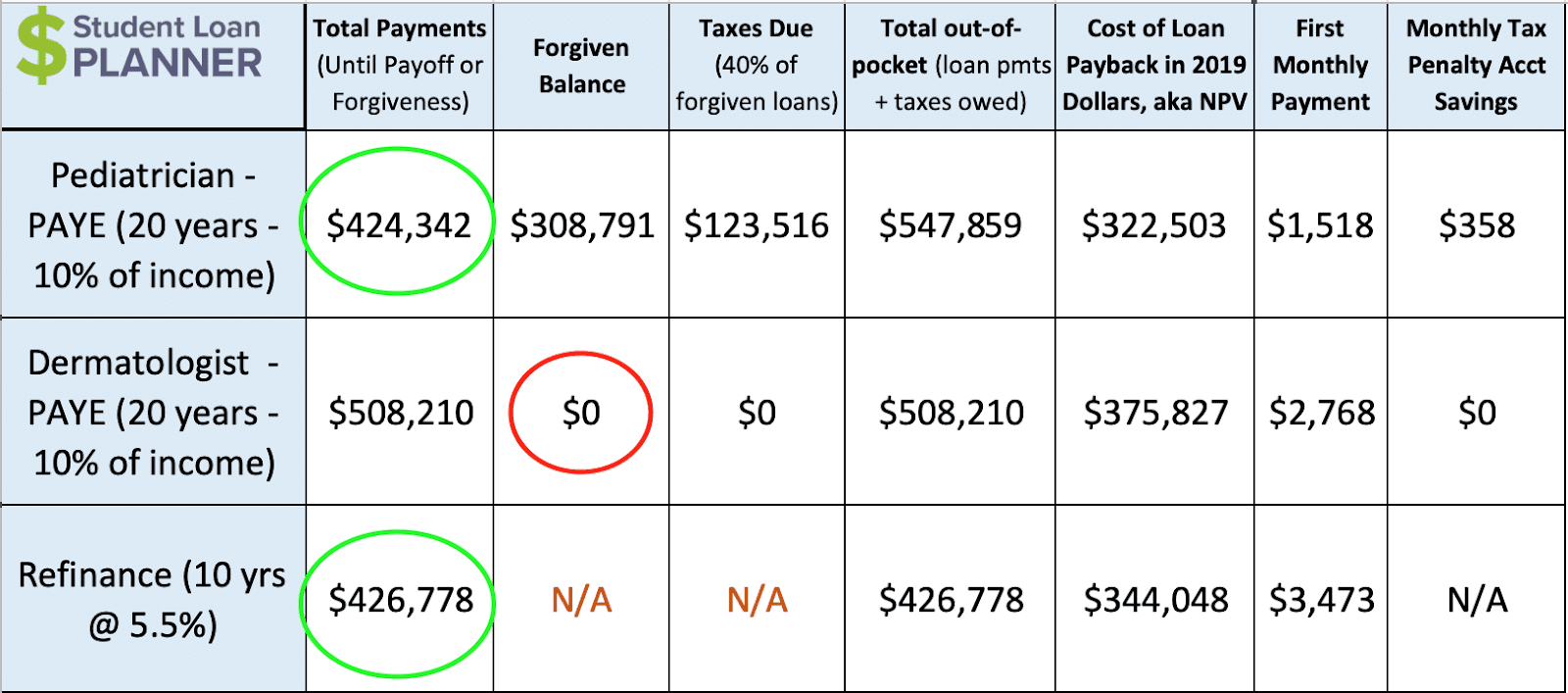

Let’s take a look at the difference in loan repayment between a dermatologist and a pediatrician who both work in private practice.

Say the dermatologist makes $350,000, and the pediatrician makes $200,000 with 2% salary growth over the next 10 years. They both owe $350,000 in student debt at 6.8% interest and are five years into their career as attending physicians.

Let’s start with student loan refinancing on the bottom row of this spreadsheet and say it would be identical for both the pediatrician and the dermatologist. Each physician is offered a 5.5% interest rate for 10 years.

Think of it like a 10-year mortgage where they would have the same payment each month for 10 years. By the end, the loan would be paid off in full. The total cost of paying back the loan would be $426,778 (monthly payments of $3,473 for 10 years).

It’s a no-brainer for the dermatologist to refinance if they’re ineligible for PSLF. If they stayed on the Pay As You Earn (PAYE) repayment plan, they’d end up spending $508,210. With high income comes high payments on PAYE. They’re projected to pay off the loan in full in 13 years with no loan forgiveness (the red circle above).

Basically, paying off a 6.8% loan over 13 years would cost about $82,000 more in interest versus refinancing to a lower interest rate and paying it off in 10 years. My guess is they’d prefer to keep the $82,000, especially since they can afford the refinancing payment.

The pediatrician’s situation is interesting, though. They could refinance, but those payments might be tight on the pediatrician salary. PAYE for 20 years might be the better way to go.

If you look at the green circles on the table above, you’ll see the cost of refinancing over 10 years is about the same as the PAYE payments. But those payments are spread over 20 years instead of the time. The more affordable payments means the pediatrician could save a bunch of money for their other financial goals along the way.

The only difference is the tax bomb. But if the pediatrician saved $358 per month and earned an average return of 5 percent, they’d have the money to pay the taxes. Very affordable on a $200,000 salary.

As you can see, refinancing could be better for some doctors and maybe not for others. It all depends on physician salary.

Related: The Doctor’s Dilemma: PAYE vs. REPAYE vs. SAVE / New REPAYE for Student Loan Repayment

Student loan repayment for physician vs. college grad: Is the physician salary worth the debt?

We’ll compare an attending primary care physician, a specialist and the average college grad to make the determination.

According to the Bureau of Labor Statistics, the median wage for a college graduate is about $66,000. Here’s a graphical summary from The Balance Careers if you want more info. And according to The Institute for College Access & Success, the average college graduate who had student loans left school with around $28,950 in student debt as of 2019.

We already know the average primary care physician makes $223,000, and the average specialist makes $329,000.

So the average primary care physician salary is an extra $157,000 in earnings per year. And a specialist earns $263,000 more versus the average college grad.

Let’s assume that extra physician salary remains steady throughout their 30-year career. That works out to an extra $4,710,000 in lifetime earnings for a primary care physician and $7,890,000 compared to someone with a bachelor’s degree. That’s a huge number!

Taking out $200,000 in loans to make an extra $1,740,000 tends to make financial sense on the surface. But remember the extra earnings will be taxed.

If we assume a combined 40% tax rate for federal and state, we can reduce that $2,826,000 in extra take-home pay for a primary care physician and $4,734,000 for the dermatologist.

If we subtract the $547,000 cost to pay back student loans for the pediatrician and $426,000 for the dermatologist versus $39,544 of the college graduate, then becoming a doctor could lead to $2 million to $4 million in extra take-home pay versus the college graduate.

Seems like medical school is worth it on the surface. But it all depends on what the physician does with that extra money. Do they save a good amount or spend it all?

Financial mistakes made by physicians can sabotage extra salary

Physicians work hard, pay their dues and live in a pressure cooker being wildly underpaid during residency. Then all of a sudden, they can earn four to six times their resident salary and need to blow off some steam. Expensive houses, cars and vacations are well-earned and can be done affordably by physicians. But most squander that extra income and don’t use it to set themselves up for future financial success.

It’s not entirely their fault, though.

Physicians are targeted by some of the worst scam artists out there. Life insurance salespeople, financial advisers and shady investment characters all incentivized to collect as much commission as possible can easily find them. Auto dealerships and mortgage bankers convince them to buy more than what they need.

These people are masters of persuasion, and physicians have limited time and energy to devote to due diligence after intense work days.

In the end, a physician can be 20 years into their career having spent the majority of this extra take-home pay and have very little extra net worth to show for it. It’s a scary feeling to have earned a high income for a long time without much to show for it. All this while wondering how much longer they need to work in a stressful environment to live a dignified retirement.

Squandered take-home pay makes the wheels fall off the argument that medical school was worth it.

The fact is, income is not nearly as predictive of future wealth as savings rate. But doctors can have the best of both a high physician salary and a large savings rate if they do it right.

Physicians should live it up, though. They worked hard for it. If they increase their savings rate while their income increases, they can have everything they want, reach their financial goals and retire when they choose.

Part of that is focusing on paying back student loans in the most efficient way and using that extra take-home pay to pay back the debt that financed their nice physician salary.

Physicians need a plan for student loan repayment

The biggest financial rock doctors need to focus on post-graduation is their student loan repayment.

Physicians can waste hundreds of thousands of extra dollars with the wrong student loan repayment strategy and not fully understanding the loan repayment programs available. Maybe they're on the federal student loan graduated or extended plan or even the wrong income-driven plan.

It’s important for physicians to have a clear path to pay back their student loans so they can keep as much of their physician salary in their pockets and have less go to paying back their loans. Often this means optimizing PSLF or refinancing.

The problem is physicians have limited time and energy to figure this out. And there’s a ton of misinformation out there.

Student Loan Planner® has done over 2,000 student loan consults for clients with over $500 million of student loans. We can help you figure out the optimal path in just one hour.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Comments are closed.