Today on the Student Loan Planner® podcast, we will be discussing Public Service Loan Forgiveness (PSLF) and how the approval rate will snowball to a larger percentage in future years.

Only a small number of people were approved for PSLF in the first year of eligibility; I expect the 1% acceptance rate for PSLF is the lowest we will ever see and we should look forward to an increase each year. The media has put out quite a few clickbait headlines on PSLF while sharing plenty of inaccurate information. PSLF became a major story in 2018, but I feel despite the backlash that the program is here to stay.

In today’s episode, you'll find out:

- The truth about the high rejection rate for PSLF

- Why people were mainly rejected based on these 4 factors:

- Had loans that didn't qualify.

- Used the wrong repayment plan.

- Failed to include their employer’s EIN tax number.

- Failed to check a box on the form saying they were currently employed by a non-profit.

- Whether there is a massive number of PSLF borrowers coming in the future

- Why many physicians aren’t eligible for PSLF anymore

- PSLF structural flaws that can get ironed out over time

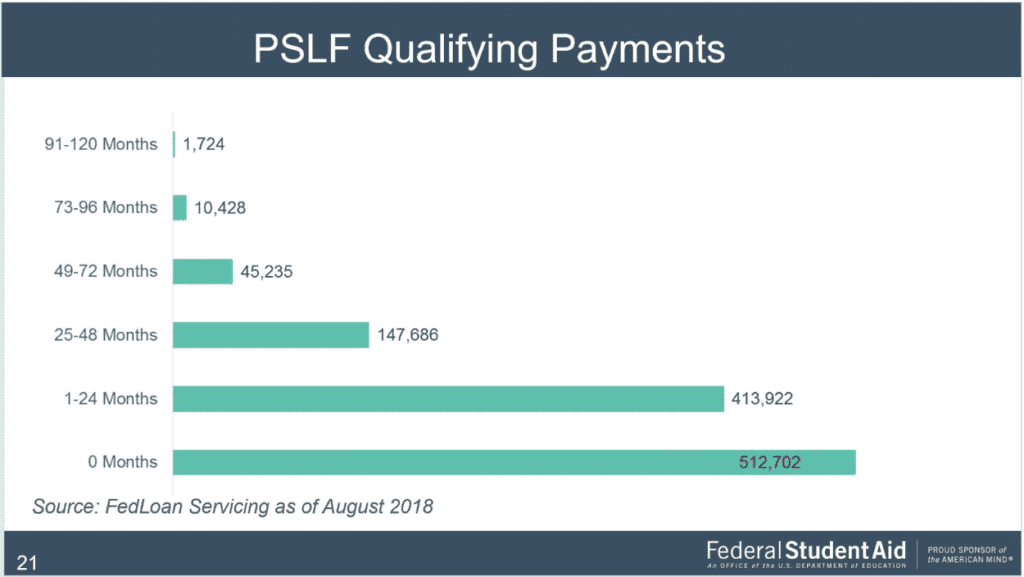

Check out this image from Dept of Education to view the snowball effect in action.

What you think you know about PSLF is wrong. However, don’t worry. This episode will provide you with more clarity on how PSLF works and how to qualify for it.

Links mentioned:

Like the show? There are several ways you can help!

Subscribe on Apple Podcasts, Stitcher, or TuneIn.

Leave an honest review on Apple Podcasts.

Follow on Facebook, Twitter, or LinkedIn

Feeling helpless when it comes to your student loans?

- Try our free student loan repayment calculator

- Check out the refinancing bonuses we negotiated

- Book your custom student loan plan

Episode 2 Transcript

Travis Hornsby: Hey and welcome to another episode of the Student Loan Planner® podcast. There is a ton of misinformation out there surrounding the Public Service Loan Forgiveness program.

Travis: It is so bad and ridiculous that I felt compelled to do this podcast episode just because I think that a lot of people are gonna get really hurt financially thanks to the media not understanding really anything about this program and the reasons for what's happening right now with only 1% of borrowers about 96 people getting approved for the latest round of public service loan forgiveness. So you had about 28,000 or so borrowers apply and about 1% got accepted. Why is that? First of all provisional acceptance was about 300 I think of the total borrowers and about 100 of them actually received the loan forgiveness of about 5.5 million total. Now I got excited about this and a lot of people were like Travis were you crazy? Like why are you excited that 100 people got it out 28,000 or so? The reason is that this proves for sure once and for all that this is a real thing.

Travis: People saying that PSLF is not real can no longer say that because there's literal proof that very much is. Now the effect that we're dealing with here is the Public Service Loan Forgiveness snowball effect. A snowball at the top of the hill might start off really small gradually it's going to roll down the hill and it's going to collect more and more snow and it's going to get larger and larger and larger before it's this massive thing that's unstoppable. This really defines the PSLF program in my opinion. The reason for this is because of the way the program was designed structurally it's almost designed to fail in the first three years of people being eligible for it. Let me explain why direct loans were only available at certain schools before 2010.

FFEL Loans

Travis: So in 2008 you had to pay for 10 years based on your income on an income-based program by the way while at a qualifying employer to be eligible for PSLF. So that means if you're starting off in 2008 and making payments based on your income in 2018 you could potentially be eligible if you were making payments on direct loans before 2010. There were two kinds of loans that were issued by the government. One was called FFEL loans. FFEL those loans were issued basically mostly from banks that were guaranteed by the government and they were not eligible for PSLF.

So this type of loan existed before the 2007 overhaul of the Higher Education Act that created IBR and public service loan forgiveness. And when the government makes changes the government can't turn on a dime it's this giant behemoth organization it takes time to make these changes so late 2007 they make all these changes and you're talking about a massive alteration to the way student loan rules are done in America. You know at the time hundreds of billions of dollars that had to get totally changed.

Income Contingent Repayment

Travis: So the government had to figure out how to implement all of this. So what happened was at the time the only repayment program that you had access to before September 2009 was called income contingent repayment. Now let me tell you something about income contingent repayment (ICR). You have to pay basically 20% of your income and you only get a deduction of about 100% of the federal poverty line. So if you are making $50,000 a year and you know your federal poverty line say is $15,000 and so you've got $35,000 over. You have to basically make payments of about $7,000 a year.

So that's pretty high you know on any kind of reasonable amount of school loan debt because so few people had direct loans in 2008 only 122 billion of about $500 something billion in total federal loans was direct. So it's about 21% of total federal loans that were in qualifying status basically.

Travis: So if you think about that in terms of the total amount of debt being only 21% of the eligible you also had to have that direct federal loan debt in a qualifying repayment program. So that means since IBR was only accessible starting in September 2009 the only thing that you could use before then was ICR. Now ICR is extremely difficult to understand compared to the other repayment programs. It's hard to sign up for. It's difficult to navigate.

You basically have to know exactly what you're doing to be able to get signed up for ICR. So if you look at the percentage of borrowers that was in a basically an eligible income-based repayment program in 2013 it was about 72 billion that was on a qualifying income-driven repayment option in 2013. So ICR, IBR, or pay as you earn and that's only 13% of the total debt at that time. So you had to have direct loans you had to have loans paid on a qualifying income-driven repayment program and you had to have payments for ten years while you're doing all these things correctly.

People Eligible for PSLF

Travis: So out of the 122 billion of direct loans that could potentially have been eligible for PSLF you want to take 13% of that and that's equal to about 15 billion. So 13 billion optimistically is what could have been eligible in 2008 for PSLF.

That 15 billion the issue with that, would be that it's very unlikely that there was actually 13% of the total direct loan debt on an income-driven repayment program back then because of how difficult it was to sign up for ICR because ICR was the only repayment program that existed. So if you were going to try to sign up for an extremely difficult repayment program to actually get on then the percentage realistically of the direct loans that was on ICR back in 2008. If I'm just gonna make up a guess say 5% really optimistically 5% of the total direct loan that was around in 2008.

That could be eligible in 2018 for Public Service Loan Forgiveness as about $6 billion. And we know that out of the existing workforce in America that could be eligible for public service loan forgiveness there's about 25% of the US workforce that could be eligible for public service loan forgiveness. So if we wanted to take 25% of that $6 billion number of people that could be eligible for PSLF at that time it's about 1.5 billion. So out of the total debt are the $575 billion that existed back in 2008 only about 1.5 billion of that could have been in a situation to potentially be eligible for Public Service Loan Forgiveness.

Travis: By my optimistic standards of measurement here that's about 0 to 6% of all people that could've been eligible for Public Service Loan Forgiveness and that's people who would be in a qualifying job for even for part of the 10 years at the start of it. And then you had to have been on it on an ICR type of plan for a 10 year period of time and then you had to have only direct loans and not have FFEL loans.

So that pretty much rules out most people that went to graduate school approximately in that time because if you went to graduate school back then you were probably taking out FFEL plus loans or something like that. That's why you're not seeing any physicians right now for example that are eligible for PSLF because you basically had no people out there that were at a med school getting only direct loans that were in a qualifying program at that time because of how difficult it was to access it. So 0.26% Of the 577 billion that existed in 2008 could've been eligible but it's even worse than that.

Employment Certification Form

Travis: And why is it worse not because you had to be at a qualifying employer not for profit or government right full time for 10 years. So meaning that you would have had to be continuously employed for those ten years without any gaps in employment without any gaps of forbearance or deferment without any just lack of doing the paperwork right now on top of that. All the problems that I mentioned that makes even that 0.26% of loans being eligible for PSLF on top of those problems.

The PSLF certification form the employment certification form only came around in existence in 2012. So 2012 is obviously significantly farther into the future than 2008 when people were having to first set this thing up for the first time to be eligible in 2018.

Travis: If you want to be extremely optimistic you might say that people who are working towards PSLF immediately applied as soon as the certification form went live in 2012 2013 fixed any problems with their certifications, contacted all employers, got all the signatures that they needed, got all the paperwork put together in the right way, and then finally applied.

Travis: Once they had the 10 years of service that they needed to get eligibility and they submitted everything that they needed to do at that time. That's too optimistic because as we know most people I have for example feel like I'm unfairly informed about the loan debt and I obviously didn't pay attention to it until 2015 when I met my now wife who was a fellow in the surgical specialty at the time. That's when I studied about this a lot and we actually didn't even understand what Employment Certification form was until we located it on after doing a ton of Google research back then.

So I think that most people that would be applying right now would be applying without having done that Employment Certification form because of the form existing after when they started repayment. And so if you think about the problems with that you basically are trying to get 10 years worth of signatures from employers proving that you are fully employed during that timeframe.

Travis: That is extremely difficult. Okay, imagine me I'm in my late 20s here. Imagine me trying to contact. I used to work as a security guard at my church which is basically meaning I just sat at the front desk when I was in high school or just helping people find different rooms in the building they needed to find. Then walking the doors at night. So that was it. It was a great job because I got to do some homework and relax and read stuff on the computer.

So imagine if I had to go track down my supervisor back then from ten years ago and get a signature that I was working a specific schedule. Back then it would be very very difficult. I maybe could have tax returns that could show this. They're happy. But do you have your tax returns from 10 years ago? I mean, to be honest with you I don't.

How Many People Were Rejected for PSLF

Travis: So that is a big problem right there. If you look at the distribution of people that got denied with the PSLF application the total folks that were denied for this program they had 70 percent that were denied that did not meet one of the eligibility rules for the programs I showed you why only 0.26% in my estimation of the total federal loan debt could have been in a situation to be eligible for PSLF back then so that makes tons of sense that people would be declined.

Now I think about 28-29% in total weren't rejected because they didn't have a signature or they were incomplete so they were advised to submit more complete application. So again I think that's probably a deal where they had to find signatures from all supervisors people that could go back and attest to them actually being employed during the timeframe in question and filling out the forms correctly. Think about this out of your friends you are probably more knowledgeable about student loans and forgiveness than the majority by far. Think about the typical person in America.

Does anything do they know about the issue in question that they're trying to get help with. Does a typical American know a lot about retirement savings or about Social Security or about claiming Medicare or about Medicaid and getting access to that or like you know ACA health insurance and getting access to that. Most people have no idea about the program rules for the thing that they're applying for.

Travis: They just know that they think that they should qualify. Right. When you're when you're 65 years old you're going to call your your social security office and ask about getting money from the government for the rest of your life because you paid in for 40 years. Like that's the typical American. So if you think about the typical American applying for PSLF and this window of 2018 right now the typical person knows a little bit about PSLF to be dangerous but not a ton about it. They're not experts.

So this typical person applying is a part of this group that has the 10 years of eligibility but was on the wrong repayment program like an extended program instead of ICR. Or maybe they were under the wrong type of loan. So maybe they were under the wrong they were on fell loans FFEL loans and they should have been on direct loans and the only way they could have known that is if they had consolidated the debt. So you basically had to have a best friend of the department education before 2010 to qualify for PSLF.

PSLF Snowball Effect

Travis: Now I want to talk about the PSLF snowball effect that I mentioned earlier in the show. Why do I think that the 1% acceptance rate for PSLF is the absolute lowest that we are ever going to see if this program in September 2009 you have IBR come online and so suddenly IBR income-based repayment you can pay 15% of your income with 150% deduction of the federal poverty line.

So that's a much easier program to understand and get access to than the income contingent repayment program. So suddenly in September 2019 you've got all these folks that for the very first time are getting online that have IBR right and ensure enough you know if you look at the data in 2013 there are two and a half times as many people on IBR than ICR.

Travis: So this is going to drastically expand the pool of potential people that could be eligible for PSLF. Now in 2010 the federal government took over all lending away from all of the banks and became the only lender for student loan debt really in America. Now that responsibility being the only lender is now means that all of the ones that exist after 2010 are direct federal loans pretty much so direct federal loans.

That means that that's the type of loan you have to have to qualify for the PSLF program. So fast forward 10 years from 2010 and 2020 we're going to see all of these folks that suddenly have by default the right kind of loan to receive PSLF. So that's going to be maybe additional tens of thousands of folks in 2012 basically. So this is kind of an interesting history of the Pay As You Earn program. Congress passed a law that you would be able to pay 10% of your income starting in 2014 if you were a brand new borrower. President Obama realized that through a presidential memorandum he could grant access to Pay As You Earn early through executive action. So he gave a campaign speech at the University of Iowa in 2012.

Travis: I learned about this by the way from Heather Jarvis another student loan expert. Basically what he said is effective immediately I am going to reduce the payments you will have to make on your student loan debt from 15% of your income to 10% of your income.

Obviously that's a very attractive thing for a group of people like that. But the problem was is an executive order like that did not come with any congressional authorization or appropriations to pay for it. For that reason they had to put a lot of limitations on this executive promise so that they could actually do it in the limited confines of law. They could do this for. That's why they said you had to have no loans prior to October 1st 2007 and you had to have at least one loan after October 2011.

Pay as you Earn

Travis: Why is that? It's basically so the class of 2012 could end. University of Iowa could receive Pay As You Earn. That's how Pay As You Earn came into existence. A pay as you earn didn't come around until 2012 approximately even in 2013. The data shows that only about a billion dollars of debt was on the page work programs.

Very small adoption rate at that point. But over that 2022-2023 timeframe you're gonna have all these Pay As You Earn borrowers coming online that have debt that qualifies. Now in 2012 you have the Employment Certification form that finally codified count me basically proving that you have cumulative credit towards PSLF instead of having to submit the application all at the last second which is a recipe for disaster.

More People will be Eligible for PSLF in 2020 and Beyond

Travis: That means that we're going to have a lot of folks in 2020 to become eligible. And what if you were a med school graduate in say 2012 you would have had to consolidate your loans to get them all converted to the ones before 2010 you'd have to convert them to FFEL loans to be able to get PSLF.

So if you straddle that 2010 timeframe when the government just started issuing only direct federal loans you're gonna have you're going to see people who graduated basically in four year programs. Basically all the way up to 2014 you're going to see people all way up to the Class of 2014. For any professional program have some problems qualifying for Public Service Loan Forgiveness. So for that reason you're going to basically see this gradual I think exponential curve of people that are starting to get approved for PSLF.

Travis: That's why it's going to take so much time because the program was designed so poorly and is designed frankly so poorly that the folks that are gonna get approved at the very beginning were the people who did everything perfect.

They were experts in the loan program, they had a best friend working at that part of education and they did everything right and the people who in that sort of 2010 timeframe you're going to see a lot more people become eligible I think a lot of these folks are gonna be people that were in one or two year graduate programs that we're able to get all direct loans by default where they didn't have to actually actively do anything to become eligible except for sign up for an income-driven repayment program.

Travis: Remember you know that 2010 to 2014 timeframe was the heyday of the Obama student loan forgiveness scams where everybody would be saying oh you know we'll get your loans wiped away just pay this upfront fee, we'll get your loans consolidated, you know we'll do your paperwork for you. And so there was all kinds of misinformation that existed back then even more than today really.

Travis: So for that reason if you're really looking to see massive PSLF Awards wait until 2024 that's when you're gonna have many years of IBR and Pay as You Earn existing, you're gonna have many years of the Employment Certification form existing, you're gonna have a process that's been beaten down a lot from so many thousands of people applying for it. By that time it should probably be a little bit more efficient than it is today. And if you want more proof the PSLF is really going to be a thing wait until 2020 when you're going to start seeing the first what I call a larger wave of people getting it because of those FFEL loans basically not existing anymore for the 10 year period after which you would have had to have them originated in.

Travis: So if you are questioning going for PSLF and wondering what the heck you're doing then you need to calm the heck down because the folks that are applying right now are just not eligible by and large they had to do everything perfect. There's no way that people are that perfect managing their finances. 65% of school loan borrowers supposedly according to some recent survey I saw online had a less than $1000 in the bank. And you know another survey says overall like the majority of Americans don't even have $5,000 to rub together. And that's kind of the minimum that you need for any asemblence of an emergency fund. And you think that people that are that unaware of financial matters manage their program perfectly when there was so many obstacles and hurdles to get everything set up the right way so if you are going for the PSLF program do not abandon it right now abandon it if you can make more money in the private sector by all means and pay it back. That's a fantastic strategy.

Travis: If you are a dentist working in a not for profit health clinic, for example, you could easily make more money by setting up your own private clinic and just focusing either on loan forgiveness with a 20 to 25-year version or just paying it back with the refinancing strategy. If you are an attorney you will make more money obviously working in a big law setting than you would and a public interest legal setting and public service loan forgiveness should not be used as a primary financial goal or strategy it should be used because you would do this anyway and you're going to get a nice benefit that you would not get otherwise if you didn't pursue the program. So you're basically seeing so much misinformation and confusion and the media sees 1% acceptance rate. And let's be real for a second. You know the media needs clicks because the media unless you're doing a paid subscriber model like a Wall Street Journal the only source of income you have is from advertising.

Media Take on PSLF

Travis: The way you sell ads is you get lots of views on pages. So I'm not necessarily saying that the media is actively trying to spread misinformation but the media is highly incentivized to run headlines that are not boring. Which means that they are sensationalist right. And with click bait headlines comes all kinds of issues where the information is just not that accurate. So that's why you're seeing things like there was a vice article that said. You're probably not getting that loan forgiveness you're counting on. That's a terrible title. That's basically saying that don't plan on PSLF just refinance it or pay it back or don't count on it at all because of this problem with the program.

Travis: You know the temporary expanded PSLF t PSLF that is the program where it gave $350 to folks that were on the extended plan where their payments were as large as an income-driven plan would have been. And that gives them credit towards PSLF. If they had direct loans. But the problem with that as I showed you. Very few people had direct loans prior to 2010 relative debt. The total debt that was out there. So very few people have the right kind of loans. So a lot of people read that and I think OK I've got to apply with my fellow loans for credit on my PSLF. Well no, you still have the wrong kind of freaking loans and I don't mean to sound insensitive here. It's just it just so much misinformation and it's so frustrating to see people being taken advantage of like this or at least misled.

Politics and PSLF

Travis: And so all these people apply for the temporary expanded PSLF and they're getting denied because they have felt loans and on direct loans. And if you have the direct loans will then the burden of proof is on you to show that your payment was at least as large as your income contingent repayment ICR payment plan would have been if you weren't on that program instead. Well, the only way to show that is if you can go back in time and prove that your income was a certain level and that you could be on the extended plan then that payment was going to be larger than your income based plan.

Now the temporary expanded PSLF the reason why that excites me so much is not because of the actual 350 million they're giving to borrowers to help them qualify for it because they were on the wrong repayment program. The reason is that a Republican Congress and a Republican White House decided that they were going to give hundreds of millions of dollars not already appropriated for the public service loan forgiveness program to try to help people qualify for it.

Travis: That means that if you were giving extra money that you've not already promised to something then you do not support the repeal of it. That's logical right.

Travis: If you were going to repeal something you would draw a line in the sand and say Not a dime more but instead the conservative members the Conservative Party is saying well let's give $300 million. Now the Democratic Party wanted$3 billion for temporary expanded PSLF. So the issue here is that PSLF is very clearly a thing. And in fact if you look at the reports that are out there for the number of people that are qualifying for PSLF the numbers are really quite encouraging and kind of extraordinary really.

Travis: So as of the second quarter 2018 which is the end of June 2018 there are a cumulative 936,029 borrowers that have received approval for at least one of their payments that are going for PSLF with.

Travis: So the total number of approved employment verification forms right now is like 1.68 million. Now they're been about 840,000 denied employment certification forms as of mid-2018 timeframe. And that means that there are almost a million borrowers out there that the government and the Fed loan is basically saying do qualify for PSLF. Now cumulative PSLF borrowers in 2012.

Travis: Guess how many cumulative borrowers there were when the employment certification form first came out. I'm going to let you come up with a guess a number in your head first before I tell you. If you said 25,683 then you would have been right. So in 2012 there was 25,000 people basically that had qualified their employment and in more on the right repayment program had the right kind of loans working towards PSLF. Now there's 937,000. This is the snowball that I'm talking about folks.

Travis: So you're going to have people get it in 2018. I 300 was the total number that they think are gonna be approved and then in 2019 they'll probably be maybe a couple thousand because you have the increased availability of income-based repayment in 2009. So ten years after. In 2020 you're gonna have the increased availability of direct loans which is the only kind of loan that's eligible for public service loan forgiveness that will probably be worth another say five thousand borrowers it'll get it something like that.

More PSLF Projections for the Future

Travis: My guess is you'll see a big jump because the direct federal loans were around with income-based repayment for a longer period then. So you'll probably see 10,000 to 20,000 or so get it now in 2012 the cumulative PSLF borrowers. It's not just the 25,000 that got there. Certifications in that year it's gonna be the people who went back and got it corrected in the past to fast forward to 2022.

You're going to see in 2022 maybe like 50,000-100,000 people get it then 2013 maybe double that or triple that in 2014 you had 191,000 people that had cumulatively been approved for PSLF at that point. And remember you don't have to get your employment certified when you apply. You can apply without having your employment ever been certified. So at that point, I think you're going to see a big uptick like maybe a couple hundred thousand people get approved in 2024 and then we're off to the races.

What Congress May Think About PSLF

Travis: The reality is that Congress is not going to realize what they did until after they start getting the bill for this $5 million. That is like saving like I don't even know like the Western you know red-tailed ferret or something like that's like nothing nobody would see that on a federal budget right. That's gonna be completely ignored when you see that bill in the tens of millions or even hundreds of millions.

I think you're still going to see that be ignored because in the federal budget of you know multi-trillions. It's a tiny line item. So people are still not going to notice that. And the political consequences for voting to repeal something like that are very high because you have high education borrowers that really depend on this program and the cost of the program on the books is not going to look like it's that high.

Travis: So Congress people representatives and senators are not going to really have a big incentive to repeal it now 2020 is an election year. Imagine all the fighting that's going to happen around student loan debt at that point. If we have a recession in between now and then it's gonna be even worse because you know loans are going to be an even bigger problem that people are weighed down by in the middle of a recession whether they're trying to keep their head above water. So in 2020 do you think that they're going to make the loans situation any worse?

I Don't think so. So really I think perhaps say you have the betting money I think would suggest maybe like a Democratic president in 2020 maybe a Republican Senate and a Democratic House I mean who knows what will happen. But certainly, you wouldn't have I think any big changes to PSLF of the split control of Congress and the White House in any case. So the very first moment I think you could even see any big changes with PSLF eligibility might be 2022.

Travis: You know speculation is very dangerous about the future. So this is just a best guess. You know as I say this in 2018 but say in 2020 you finally get some discussion of Wow this is really costing us a lot of money maybe we should reform this.

People Said Social Security Would no longer be Available

Travis: At that point it probably will be too late. Ran this program in because look at every single other program that's ever existed in the federal government. Everybody says well social security is not going to be around for our generation because it's going to go away then we're not going to have anything available to us.

Well the problem with that is whenever they have a problem of social security they either raise the payroll tax so they increase it a bunch of times in the past four years. Now it's like 15.3%. I think something like that of total wages below I think 120,000. You know I'm not a social security expert but basically they raise the taxes to cover the expense and then the other thing that they do is they push off the year that you can have the full retirement age so instead of 65 they'll push it to 66 and then push it to 67 and they'll just keep pushing it older and older and older so that the program's finances are basically become solvent that way.

Travis: If you look at other programs look at the ACA everybody was predicting its demise and it is alive and well it's not going away most likely because if people have gotten too used to it and become a stable program now basically look at Medicare. Medicare. You wouldn't touch with a ten-foot pole. The very best thing that you could do with Medicare is to try to have a discussion of either reining in costs or maybe trying to negotiate more heavily with physicians. But really if you think about Medicare and Medicaid costs have done nothing but just go up and they haven't reined in any at all.

Medicaid

Travis: Now compared to Medicare PSLF is a joke. It's a tiny program even if you had hundreds of billions of dollars getting covered one day over maybe over time maybe over decades. That's still a tiny program compared to something like Medicare and Medicaid. You know Medicaid. Medicaid has done nothing but expand since it passed in the 60s. You've seen nothing with Medicaid except for growing coverage of all kinds of different things so you know a lot more people have access to Medicaid.

Also, people don't know this but the primary Medicaid expense that's out there is for middle-class people going into nursing homes. Medicaid covers you are nursing home expenses. Once you have expended all of your assets and the majority of Americans that reach and very elderly age benefit for Medicaid because Medicaid covers nursing home expense so people that say well the government's going to pull the rug out from under us they're never going to honor this PSLF program. They're not going to keep it around for me.

What Has Been Done to Save Social Security

Travis: Here's proof that there's only a 1% acceptance rate. You don't understand the program. You don't understand the fine print. You don't understand the promise. I know you haven't read it you haven't considered the long history of the government keeping its promises with expanding programs and basically not curtailing them until they have to and then when they do have to they'll do it probably the way that they did with Social Security.

They will curtail those benefits for future borrowers not for current borrowers so for Social Security beneficiaries. Basically what the government says is if you're born after 1950 whatever you're gonna be under this set of rules where you're going to have an older retirement age but if you're born before this date then you're going to have access to this earlier retirement age.

Travis: So notice that they didn't ever suggest let's change the benefits for people already getting Social Security. They didn't do that because I'd be political suicide. The same thing would be true for PSLF I think. Or any of these loan forgiveness programs that they made them less generous. They could absolutely make them less generous or people who are not yet in a graduate program for the ones that they would take out for that graduate program.

That is always a risk but for people who already have the loans. Watch this PSLF snowball grow and grow and grow where it becomes such a big deal that it will become almost impossible to stop or slow down. Except for some future circumstance where they limit the eligibility of PSLF to borrowers in the future for future programs.

Travis: So when you're thinking about getting help with PSLF Obviously we spend a ton of time thinking about this. So if you have a bunch of school on that we would love to help you make a custom sit alone plan with one of our team the CFP and CFA consultants. If that's you if you have more than I would say $50,000 of student loan debt then you might benefit from a plan. Check out studentloanplanner.com/c/book. We want you to benefit as much as possible from all the free resources that are out there like this podcast, our blog, our YouTube videos, everything that we give away, the email list, we want you to do things on your own if you can.

PSLF is Here to Stay

Travis: If you feel like it's overwhelming you don't know how to maximize all the rules. You don't know how to stay calm and stay focused with getting the most free given possible. Then we would love to help make a plan for you and your family. With one of our team of folks. The fee for that is very reasonable compared to the typical cost for even a fee only planner that may or may not have any clue about what you're going through.

Travis: So do not trust the media do not trust what they're telling you about PSLF. Be very skeptical, and I will promise you one thing if there is ever a massive change to the rules. If you're paying attention to studentloanplanner.com You'll be one of the first ones to know about it. So do not believe all the misinformation. Just you wait until 2020 and beyond when you're going to see this exponential increase in people getting PSLF. And for goodness sakes don't go and refinance your loans just because you think PSLF is not going to happen. If you're planning on staying in at a not for profit employer that could be a $100,000, $200,000 or even $300,000 mistake.

Travis: Thanks so much for listening to the show. If you have any questions just reach out to us on the site. And until next time do not panic about the PSLF program.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.