Podiatrists fly under the radar. There are only about 10,000 podiatrists in the United States right now, even though they work on one of the more important and complex parts of the body, the feet. But with the high cost of school, is podiatry worth it?

The foot and ankle region of the body has dozens of bones, tendons, ligaments and muscles. Any injuries to the lower extremities can cause a chain reaction of problems through the hips and back. Common foot problems and conditions podiatrists manage include ingrown toenails, bunions, heel pain, ankle conditions like sprains, fractures, inflections, and much more. The work that podiatrists do is critical to a person’s overall bodily structure and alignment.

Because of the complexity involved (e.g. diagnosis, treatment plan, surgery, etc.), the time and cost to become a doctor of podiatric medicine (DPM) is significant. The journey to become a podiatrist starts with earning a bachelor’s degree, followed by four years at a school of podiatric medicine and a three-year residency. There's also the option to become more specialized through fellowship programs. It takes the same amount of time for an MD to become an attending physician. Medical school tuition isn't cheap. Oftentimes, it’s more expensive than most other graduate schools.

So, is the potential podiatrist salary worth it compared to the typical amount of podiatry school debt? Take a look at the average podiatrist salary and student loan debt. We've put together a sample student loan repayment strategy to equip you with the information you need to decide whether the typical podiatry student debt is worth pursuing a career in podiatric medicine.

What's the average podiatrist salary?

Let’s examine a few different sources to see how much podiatrists make because it’s hard to find a consistent answer.

The Bureau of Labor Statistics, for example, shows that the mean salary for podiatrists is $157,970 after completing their residency. Salary.com shows a median salary of $226,478, whereas ZipRecruiter says the average podiatrist salary is $147,232, and Indeed says the average salary for podiatrists is $245,509.

The Bureau of Labor Statistics information consists of the most comprehensive data on almost all 10,000 podiatrists out there. The other sites have merit, though, because that’s where employers are advertising jobs. That’s the data employers and candidates are considering in salary negotiations. These sites’ numbers might show more volatile swings based upon the marketplace from week to week. Whereas the BLS might be more steady.

Podiatrist salaries vary widely by city and state

Sticking with the BLS data, the average salary of the 60 DPMs in the Sacramento-Roseville-Arden-Arcade, CA area is $235,930. In comparison, the 150 podiatrists in the Tampa, FL area earn about $176,110 each.

Minnesota ($220,200), Nebraska ($214,760), Connecticut ($210,340), Washington ($196,130) and Virginia ($189,940) are the top five highest paying states for podiatrists.

As far as the lowest paying states, Kentucky ($109,710) and Rhode Island ($112,070) are the worst paying. California is near the bottom, too ($123,130).

There’s a great deal of fluctuation by year, too. A Forbes article shows the fluctuation in podiatrist salaries from 2013 to 2018. Podiatrist income dropped by 30% in Connecticut and 29% in Oregon. Rhode Island and Iowa were among the largest increases at 106% and 30%, respectively. Note that Rhode Island found itself at the top of the highest paying list for the Forbes article, yet it's now at the bottom based on the most recent BLS data.

For podiatrists, location does matter. It’s about $130,000 from top to bottom between different states. Just keep in mind that salaries can fluctuate quite a bit.

Average podiatrist student debt is high

Podiatrists go through extensive training, and podiatry school is one of the more expensive medical schools out there.

Kent State University College of Podiatric Medicine’s tuition, for example, is projected to cost about $80,000 per year for four years. The average DPM from Western University of Health Sciences graduates with $241,833 in debt.

At Student Loan Planner®, the average podiatrist we’ve worked with has $295,000 in student loans. That student loan balance is among the highest for the graduate-level professionals we work with.

So, what’s the best way for podiatrists to pay back these podiatry student loans and make it worth it?

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Smart student loan repayment strategies for podiatrists

We’ve worked with over 5,875 individual clients across all different professions advising on $1.44 billion in student loans. Starting with the the bigger picture, we’ve found there are two optimal ways to pay back student loans:

1. Aggressive repayment

The strategy here is to do everything you can to pay off debt as fast as possible. This plan should take no more than 10 years. You want to pay as little in interest as possible, so it often means refinancing to pay less in interest and put more money toward paying off the loan.

This method works best for podiatrists who owe less than 1.5 times their income in student debt. For example, a podiatrist who makes $150,000 and owes $225,000 or less in debt.

2. Use an income-driven repayment (IDR) plan to maximize loan forgiveness

This strategy involves signing up for PAYE, REPAYE or IBR to keep the monthly payments as low as possible. Then, take advantage of the low payments to save aggressively, preferably by maxing out pre-tax retirement contributions and by saving up for the potential tax bomb you might have to pay on forgiven student loan debt.

This strategy works best for podiatrists who owe more than twice their income in student loans. For example, a podiatrist who makes $150,000 and owes $300,000 or more in student loans.

When podiatrists should refinance student loans

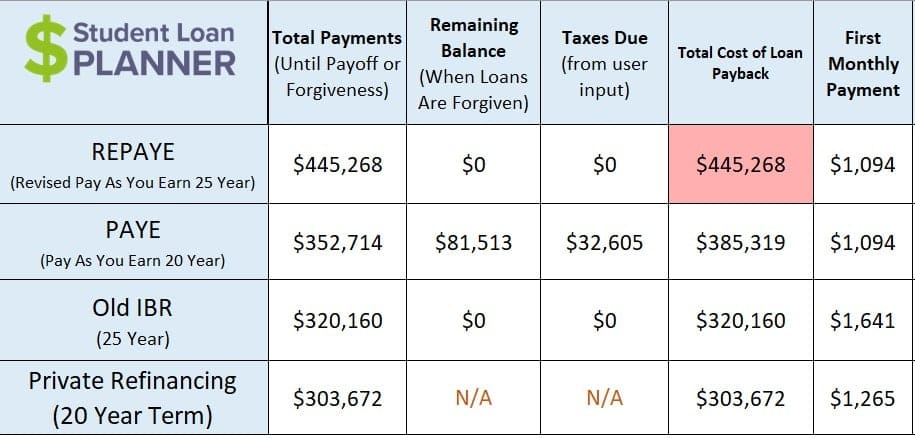

Let’s look at a hypothetical example to illustrate repayment options: Jason has $200,000 at 6.8% in student debt with a podiatrist salary of $150,000. His income is projected to grow slow and steady at 3% per year. Should he take the aggressive approach or go on income-driven repayment to make the cost of podiatry worth it?

Let’s compare the numbers for IDR versus refinancing:

This is a clear refinancing case because refinancing will save Jason the most money compared to the other two options.

REPAYE and IBR are out of the running. His income is high compared to his loans, which means that his payments will be high enough to pay off the loans in full before getting any loan forgiveness. More specifically, he’d end up paying off a 6.8% loan over a long period of time when he could have paid off a 4.5% loan more aggressively.

PAYE is projecting to offer some loan forgiveness in the end but not nearly enough. Even with that forgiveness, it would cost about $111,000 more to pay back his student debt and double the amount of time until he’s debt free (20 years versus 10 years).

Why refinance with a private lender rather than leave it on the 10-year standard plan? Refinancing could lower his interest rate from 6.8% down to 4.5%, reducing the total cost of paying back his debt. His monthly payment would be lower by about $300 per month and he’d save nearly $35,000 over 10 years. Refinancing to save $30,000 would be worth it.

When podiatrists should get on an IDR plan

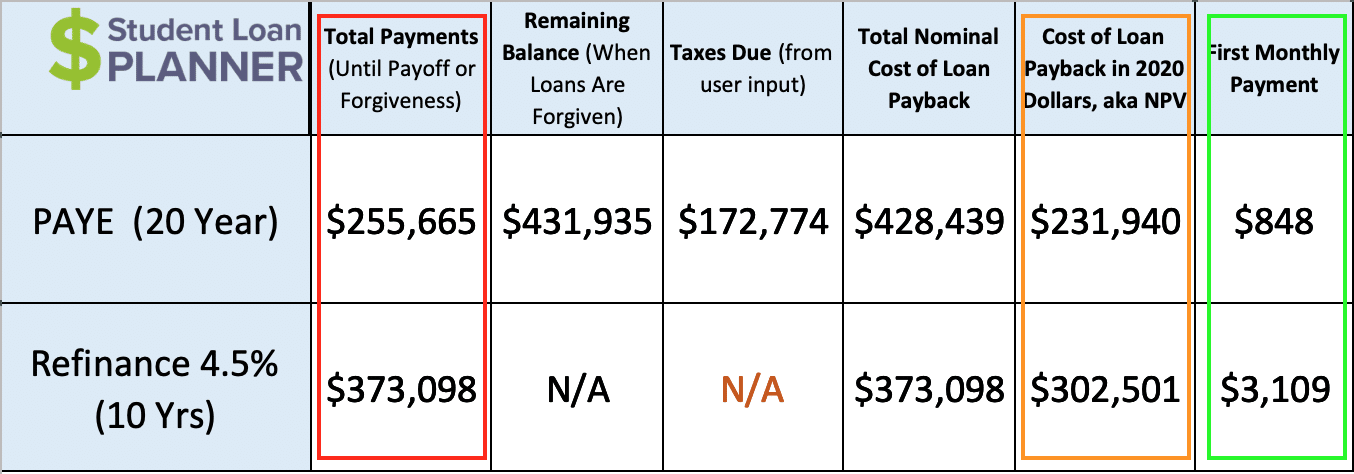

Let’s look at a different example involving IDR: Rebecca is a podiatrist who lives in Southern California. Her income is $120,000, and she owes $300,000 in student debt from undergrad and podiatry school. Her income should grow at the normal rate of 3% per year.

Although it looks like refinancing costs less out of pocket, it isn’t actually the most affordable or optimal plan. Those payments of $3,109 per month would be crushing on her salary.

Mathematically speaking, you want to go with the option that has the lowest net present value (NPV), or the cost in today’s dollars. Looking at it there, PAYE is nearly $70,000 less than refinancing. Essentially, this means it’s cheaper to keep the payments low so she can save a lot money.

Here’s what I mean by the lower NPV being more important than the total cost:

The combination of a high refinance payment ($3,109/month) and a lower salary doesn’t leave much room to reach other financial goals, like buying a house or saving for retirement.

Her lifestyle would be pretty much nil as well. Let’s say her take-home pay is about $7,500 per month. More than 40% would go toward her refinancing payments over the next 10 years. This leaves her with just over $4,000 for regular monthly outflows while living in expensive Southern California. That’s pretty much a no-go.

On PAYE, however, her payment would start at $848, which would leave her with about $6,500 per month in take-home pay. Now we’re talking.

Remember, though, that you need to save aggressively while on a PAYE plan. If Rebecca could save about $2,000 a month by maxing out her pre-tax retirement plan while also saving for the loan forgiveness tax bomb ($500/month), she could reach other financial milestones along the way. By sticking with this strategy consistently, she could be debt free, pay the tax bomb and still have a $500,000 nest egg in 20 years.

Is podiatry school worth it?

Whether or not a podiatry degree is worth it is a mixed bag. A podiatrist’s starting salary and the promise of a potentially fulfilling career can be attractive. But it’s scary to owe $300,000 in student loans.

This career path might not be worth it financially for those who are planning to move to a lower compensating area of the country. They’d also be much further ahead financially if they didn’t have $300,000 in student loans, even if they’re using an income-driven repayment plan to optimize their loan repayment.

On the other hand, podiatry could be very financially rewarding for those who set up a practice in a higher compensating area like the upper Midwest. They could earn enough money to take the aggressive approach to student loan repayment. They’d be debt free in 10 years or less and have the rest of their career to focus on saving aggressively with a high income.

The good news is that no matter what situation a podiatrist is in, there’s an optimal plan to pay back the cost of the degree and make podiatry school worth it, whether you’re in a situation where it makes more sense to refinance your medical school loans or get on a PAYE plan and aggressively save.

If being a podiatrist is something you really want, despite the potentially high student loan debt, then it is absolutely imperative to make lifestyle sacrifices early in your career so you can save aggressively to reach financial independence.

How to maximize a podiatrist’s salary and pay off debt

Podiatrists can find a clear path to pay back their student loans using actionable steps that save them money. Student Loan Planner® can help you figure out which repayment strategy is right for you in just one hour. Plus, we also include email support after the consultation to answer follow-up questions and help you implement your plan. Learn more about our consultation process.

If you have a clear-cut refinancing case, there’s no need to get a consultation. But I’d suggest applying for a refinance loan using our cash-back link. You may be able to cut your interest rate and get the most affordable terms for your situation plus get a few hundred bucks cash.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*