The reality of making high student loan payments can be harsh, especially for graduates with lower earnings. If you have federal student loans, such as Direct Loans, you can lower your monthly student loan payment to 10% to 20% of your discretionary income with an income-driven repayment plan.

Unfortunately, private student loan borrowers aren’t eligible for repayment programs like this, leaving you wondering, “How can I lower my private student loan payments?”

There’s no private student loan income-driven repayment option. But if you want to lower your monthly payment amount for your private student loans, there’s a workaround.

How income-driven repayment generally works

The architecture of IDR plans takes your family size into account and includes:

- Limiting borrowers’ federal student loan payments to 10% to 20% of their adjusted gross income (AGI)

- Repayment terms at 20 to 25 years, depending on the federal student loan repayment plan

- Forgiving any remaining loan balance after the repayment term is complete

As a private student loan borrower, you can’t limit the amount of your payments as a percentage of your AGI or work toward student loan forgiveness.

You're also not eligible for the IDR payment plans like Pay As You Earn (PAYE), Saving on a Valuable Education (SAVE) — formerly called REPAYE — Income-Based Repayment Plan (IBR) or Income-Contingent Repayment (ICR) Plan. Why? Because you have a private lender, one that is not the U.S. Department of Education.

But, you can get a lower student loan payment by extending your repayment term through refinancing.

Lower private student loan payments with refinancing

Refinancing lets you obtain a new loan with a lower interest rate while paying off your current education loans. This strategy is risky for your federal student loan debt because you’ll lose access to loan forgiveness programs, like Public Service Loan Forgiveness (PSLF) and repayment options, like New REPAYE / SAVE (formerly REPAYE), ICR, PAYE and IBR plans. However, borrowers with private loans are already ineligible for those benefits, so there’s less at stake.

In addition to potentially getting a lower interest rate through student loan refinancing, you’ll get a new repayment term.

If your current repayment term mirrors a 10-year Standard Repayment Plan, you can effectively double the duration of your repayment timeline. Doing so lowers your monthly student loan payments significantly. If later, you still need more time to pay off your loans, you can refinance again.

Caveat for lowering private student loan payments

It’s important to note that lowering your payments through this strategy will cost you more interest charges over time. Unlike federal student loan income-based programs, you can’t just have your remaining balance forgiven at the end of your term. All the unpaid interest can quickly add up and cost a lot more over the life of the loan thanks to capitalization. Take time to consider the long-term impact of this strategy.

4 Refinancing steps for reduced private student loan payments

If you feel this private student loan income-based repayment strategy is right for you, here are the next steps.

1. Research student loan refinancing companies

Take a look at various refinancing lenders and look specifically at their longer repayment term options. In many cases, that’s a 20-year term. Review the eligibility requirements, credit score, refinancing minimum amounts and associated fees.

2. Apply for a refinancing loan

After selecting a lender, apply in-person or online for a specific loan amount, and provide any necessary paperwork, personal information and financial documentation. Check that you’ve applied for a longer loan term than you currently have.

If your application meets the lender’s qualifying underwriting criteria and approves your loan application, continue making payments to your original lender(s) until you’re notified otherwise.

3. Make payments toward your new plan

Your refinancing lender will pay off your current private student loans, and you’ll be left with the new refinanced student loan. Start making on-time payments to chip away at your new refinanced loan and begin your repayment period. With a longer loan term, you should see monthly payment amounts that are more affordable (albeit with more interest charges over time).

4. Refinance again later, if needed

As you pay back your refinancing loan, you can refinance again later if needed. For example, if at year five you apply for another refinancing loan, you’ll essentially create a new refinance loan with a longer repayment term to get an even lower monthly payment (assuming you’ve already paid off some of your original balance).

Using this formula, you can continue stretching out your repayment timeline and lowering your monthly payments. Just remember the long-term impact of occurring more interest over time and having to carry student debt for a longer period.

Private student loan refinancing strategy in action

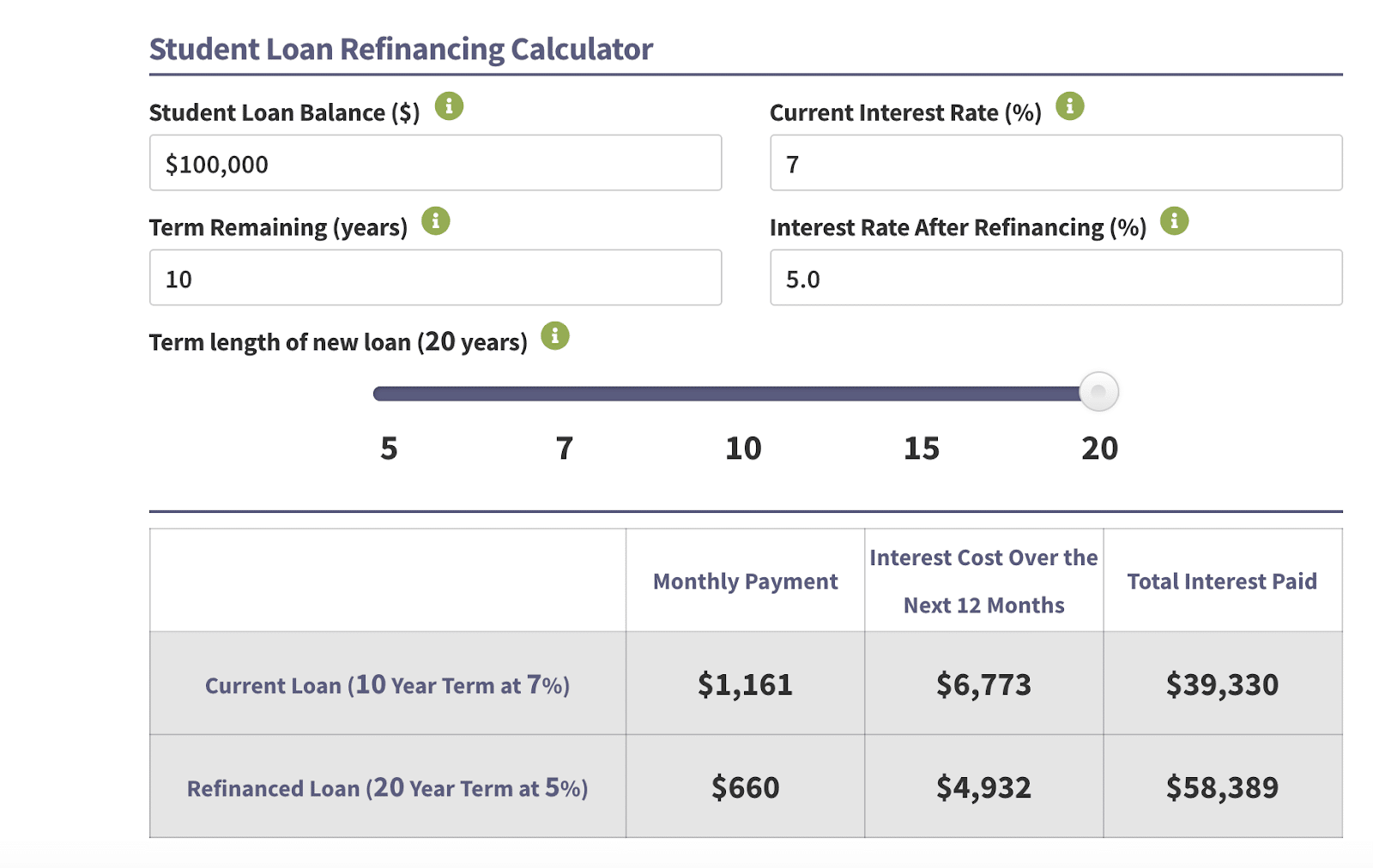

Let’s say that you have $100,000 in private student loan debt at 7% with 10 years remaining on your term. When applying for a refinancing loan, you’re approved at a 5% interest rate and a 20-year repayment term. Using this strategy, our student loan refinancing calculator shows that you can slash your monthly payment almost in half.

In the example above, your original $1,161 monthly payment is reduced to $660. If you're struggling to make student loan payments each month and can’t access income-driven repayment options, this is your next-best solution.

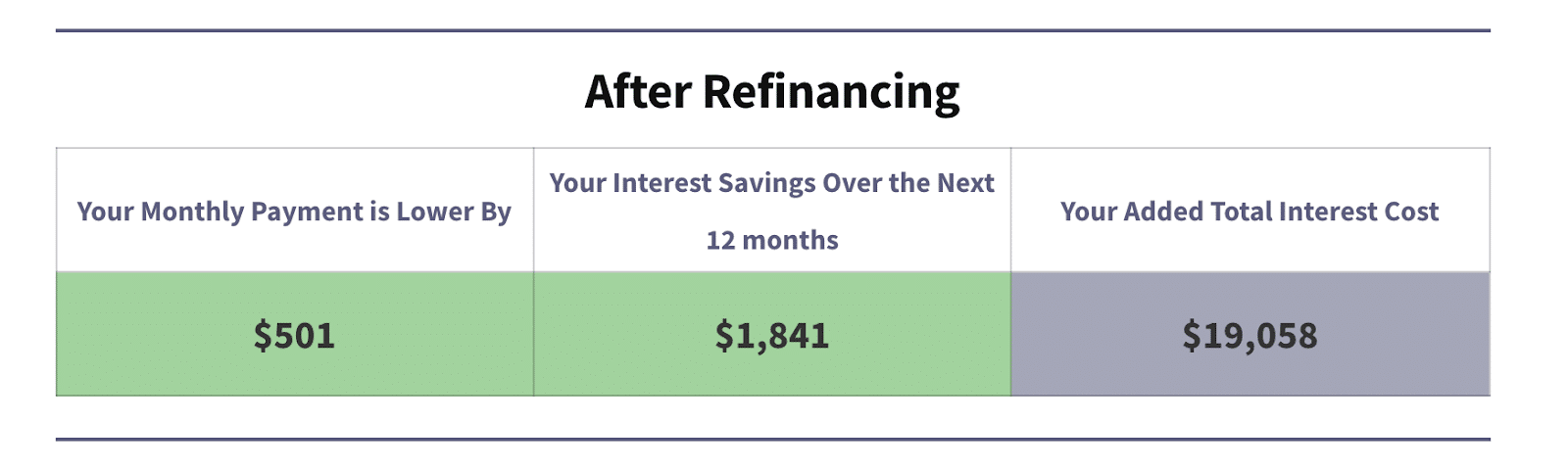

After refinancing, you effectively have $501 per month for other expenses, like rent, savings or other bills. The lower interest rate saves you $1,841 in the first year of repayment. However, the longer repayment term accrues much more interest over time; you’ll owe an additional $19,058 over the entire term.

That’s the “price” of getting lower payments through this strategy — if you understand this reality and believe it’s a fair tradeoff, there’ll be no “gotchas” later on.

Refinancing lenders to consider

Before refinancing for lower private student loan payments, talk to your current lender and see if there are short-term forbearance or deferment options available to you. This can help you avoid delinquency or default if you're currently experiencing financial hardship. But that may be a short-term band-aid and refinancing might be a longer-term solution.

There are many refinancing student loan lenders out there, and some can get you cash-back bonuses as well. Here are some private lenders that specialize in refinancing to check out:

- Earnest has customized loan terms, an in-house loan servicer and lets you skip up to one payment per year.

- Laurel Road has no fees, low rates and offers other financial products you may need.

Whether or not you choose this route to lower your payments, you have options. If you need help figuring out the type of loan to look out for or a debt repayment action plan, get in touch with us for a consultation.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

Bonus for eligible users who refinance $100k or more (bonus from SLP, not SoFi)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.35 - 10:49% APR

Variable 5.88 - 10.49% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.35 - 10.74% APPR

Variable 4.86 - 10.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.99 - 11.09% APR

Variable 4.31 - 12.05% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).