A reader recently brought a report to my attention from Georgetown written in 2011 called “The College Payoff,” by Carnevale et. al. It’s notable because it was sponsored by the Bill and Melinda Gates Foundation and advocates strongly for getting as much education as you possibly can.

How relevant is the professional degree vs bachelor degree argument today that a certain type of degree is a necessary factor that contributes to your success in life? At the very least, this paper needs some serious updating.

The Gist of the Report I’m Disputing

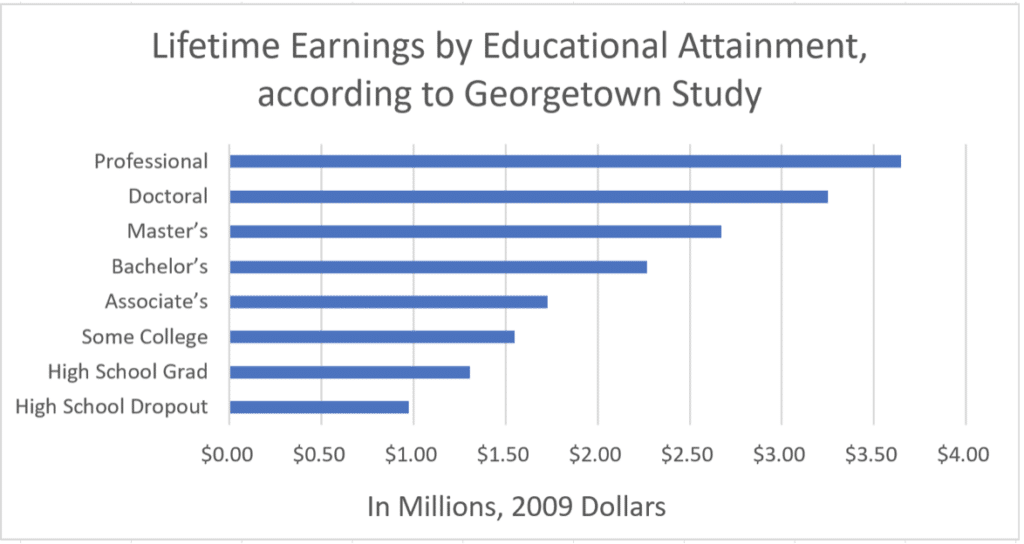

The authors found huge differences in lifetime earnings between borrowers with different levels of education. As you move up the ladder of years spent in school, you make more money. The only exception they point out is for Ph.D. graduates who are more likely to be in academia than their higher earning professional school counterparts.

Another proof point used in the study is that even within occupations, workers with higher levels of education make more money than those with less education.

Here’s the chart they use showing the difference in earnings across degree levels.

Big Problems with the Author’s Methodologies

Here is a list of assumptions the authors make that really seem to undermine their argument:

- The Georgetown paper uses total lifetime earnings without discounting for present value

- An investor would receive a 2.5% return from investing exclusively in bonds

- Careers are never interrupted by things like childrearing, caring for elderly relatives, disability, or early retirement

- The earnings difference is not taxed

- The cost of the education is not considered

All of these assumptions make educational investment look much better.

They Should Have Used Today’s Dollars to Estimate the Difference in Lifetime Earnings

As an example, say you could earn $50,000 each year for 10 years or get a $750,000 lump sum in 10 years. Which one would you pick? If you used the simple dollars as the authors of this paper do, you’d say that the gap is $250,000 in favor of the lump sum.

However, if you used the correct present value calculation, you’d say “well it depends on what I think I could earn if I invested that $50,000 each year.”

If you assume a 5% rate of return, then the lump sum of $750,000 would be worth about $460,000 in today’s money. That stream of $50,000 yearly payments over 10 years would be worth about $386,000.

Thus, the gap in the two choices is $74,000, not $250,000.

I personally believe they did not do this in the paper because 1) it was more difficult to do 2) it made the paper more difficult to understand and 3) it undermined their argument for education that they received a large grant to write.

Their Investment Return Assumption Assumes Workers Save Nothing

The authors choose a 2.5% rate of return to show the discounted lifetime earnings in their appendix to downplay the gap in lifetime earnings by education level is less than it looks.

They say that it’s ok because 2.5% is the real return on long-term government bonds, and state that the gap in lifetime earnings can be reduced by 39% if the reader chooses to, which still shows strong evidence for trumpeting the returns of education at all levels.

A return assumption of 2.5% for anything is laughably low. With improved access to index funds, robo advisors, fiduciary financial planners, and retirement account protections, the average worker is going to invest now more than ever. What’s even more exciting is that they’re going to keep more of their returns.

That means a 2.5% return assumption is not realistic. I use 5% in my own projections when I’m doing student loan plans, partly because I want to be not too aggressive but also not too conservative.

If the authors chose a return like that, then the premium in earnings for higher educational attainment would be 65% lower approximately.

Hence, if a Bachelor’s degree holder earns $2.268 million over a lifetime and a professional degree holder earns $3.648 million over a lifetime, that difference is $1.38 million. If you used the present value approach I’m advocating, the real difference in today’s dollars would be about $480,000.

Authors Assume These Ideal Workers Never Take Time Off

Compare a Bachelor’s degree holder to a Professional degree holder. The paper looks at a career lasting from 25-64 for workers who do not take time away from the labor force. They admit that this is not very typical, as the majority of women take some time away and half of the men do.

A Bachelor’s degree holder is going to have more years of earnings potential. When they take time away from the workforce, they are shortening their earnings years by a smaller percentage than a professional degree holder who by necessity has a shorter career because of their longer years of training.

Earnings in Real Life Are Taxed. It’s not the Money You Earn, It’s the Money You Keep

It would be great if you could keep the lifetime difference in earnings without paying taxes, but that’s not how the world works.

Hence, the difference in earnings between degrees would be reduced by taxes. What’s a reasonable rate to use? The difference in earnings is taxed at a higher marginal tax bracket because we have a progressive income tax, so assuming 25% for federal taxes, 5% for state and local, and 7.5% for Social Security and Medicare would leave us with a 37.5% tax rate.

If we apply that tax to our present value assumption, then the difference between Bachelor’s and Professional degree holders shrinks from my estimate of a $480,000 premium to $300,000.

Why Do Media and Academia Never Focus on Today’s Cost of Education?

In one of the most egregious mistakes the paper makes, the authors do not look at the cost of the educational programs, which is front-loaded, not tax-deductible, and carries interest costs.

If it wasn’t for income-driven repayment, loan forgiveness programs, and student loan refinancing opportunities, the cost of many professional programs would eliminate a premium for many of the top earning professional programs.

US News puts out rankings of the top 100 jobs in America, and many professional school level occupations are on there. However, they never once mention that to obtain many of these jobs, you have to borrow $200,000 to $500,000.

Our business is finding every loophole and optimization for borrowers with six figures of grad school debt to save them money on student loan repayment.

Thanks to the many tricks and options embedded in the complex student loan system, we can help borrowers reduce the projected cost of their education and help them get a better ROI for their educational investment.

I just want to point out that left to traditional payback methods of student debt, the idea that more education pays off would be in deep trouble.

Where the Study Has Merit

I think it’s hard to argue against the value of a Bachelor’s degree versus a high school education. The authors attack James Altucher, who is a prominent critic of college. Asserting that instead, prospective students should direct their efforts to entrepreneurial activities and forgo college.

Altucher says that high school grads could invest their money and earn a higher return than if they invested in their education. The authors of this Georgetown paper question how a high school grad could ever make good long-term investments.

Given that many professional school graduates are in the dark about investing, I agree with the Georgetown paper in this regard.

The only college dropouts that seem to have real success are those who attend elite institutions. They have already proven they have potential and already have the contacts that come with being attached to one of these universities.

I would suspect that a college dropout from a community college who wanted venture capital funding would be taken much less seriously.

Where I am suspect about the paper’s conclusions mainly centers on the value proposition of some graduate programs. After all, since the paper was published in 2011, the cost of grad school has risen at an astonishingly fast rate.

Think About the Cost of the Degree at the School Where You Want to Go

You should think about the cost of the educational degree you’re getting as well. A flagship public university’s four-year degree has a much better payout than most expensive private colleges or liberal arts schools.

Yes, I’m a little biased because I went to the University of Florida, but I got a full tuition scholarship there while other schools like Vanderbilt and Tulane would’ve asked me to pay tens of thousands a year. I don’t think the value of the education would’ve been significantly different, but the cost sure would have been.

We should look at grad school cost differentials as well. A medical school education from an in-state school will prove a much better investment than a private medical school in a high cost of living area.

I see this all the time with my clients. A dentist graduating from Texas A&M uses my refinancing links to get a lower interest rate without even talking to me.

Meanwhile, the dentists from NYU need to craft custom plans with the government repayment programs to afford to pay back their $550,000 in student loans while still having a life.

My Advice For Students Considering Graduate School

If you have the grades and scores to attend grad school, you are not like the median bachelor’s degree holder. The comparison in your mind should be “What is my potential if I go to grad school versus just sticking with my Bachelor’s degree?”

If you are very risk averse and don’t like taking chances, then the return on a professional degree program is likely to be higher. However, if you are like me and didn’t know what to do with your life but you enjoy learning, then the dynamic economy we live in will always present new challenges.

I’ve worked with individuals who own their own businesses and offer Digital Marketing, Facebook Ad help, Google search engine optimization, and WordPress development. None of these jobs existing at the scale they do now when I was a freshman in college less than 10 years ago.

Any motivated self-taught person could learn these skills and drastically increase their earnings.

If you are going to a professional school program, ask yourself “would this degree allow me to do the only job I’ve ever wanted to do?” Also, think about what you’d do if you never went to grad school and if you could have a fulfilling life without an advanced education.

Of course, if you already have a bunch of debt, we’d love to help you figure out how to get the highest return on your educational investment with our student loan consults.

The thinking present in this Georgetown “The College Payoff” paper is the same kind of bias present when financial aid officers and college administrators say clichés like:

- “Student debt is good debt”

- “You’ll pay these loans off in no time”

- “Our average pay off period is seven years (or promising any specific payoff period)”

- “You’re gonna be fine because you can always pay based on your income”

Watch Out For Conflicts of Interest Wherever They Appear When in Comes to College

I think you as the reader should always evaluate the obvious conflicts of interest present when someone writes something. When a student loan consultant like me says student loans are complicated and you need a clear plan, obviously I have something to gain monetarily by you believing that and hiring me.

I believe that it’s true that 90% or more of borrowers are overlooking tricks that I’ve learned from advising over 1,000 clients on a quarter billion dollars, but still, you should always evaluate things critically.

Likewise, when Georgetown authors say that ever-increasing levels of postsecondary education pay off, there could be some truth in it given the professional degree vs bachelor degree debate.

That said, the assumptions they used in the paper are ridiculously rosy, and these assumptions bake the math strongly in favor of getting as much advanced education as possible. Perhaps one reason is that the careers of the authors and their colleagues strongly depend on prospective students believing in a very high ROI on college education.

Don’t ask the realtor how much house you should buy. Don’t ask the insurance agent how much coverage you need, and don’t ask someone who’s worked at a university all their lives how much education you should get.

Make that decision for yourself. After all, if you’re thinking about this issue, you’re clearly an intelligent person who can think for themselves.

As always, if you have student loan debt or are considering taking some loans out to fund your education and you need help coming up with a plan that puts your best interests first, feel free to contact me at your leisure.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

Bonus for eligible users who refinance $100k or more (bonus from SLP, not SoFi)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 3.99 - 10:49% APR

Variable 5.88 - 10.49% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.99 - 11.09% APR

Variable 4.31 - 12.05% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).