Did you know you can appeal your financial aid award? Most people don’t realize there’s a fairly simple process to negotiate more financial help from your school.

Although it isn’t a guarantee, requesting a professional judgment could increase the amount of financial aid you receive. To be eligible, you'll need to have special circumstances that weren’t reflected on your Free Application for Federal Student Aid (FAFSA).

Decisions are made on a case-by-case basis through your school’s financial aid office, so you’ll have to initiate the process directly with your college. And don’t worry — asking for a professional judgment won’t affect your admission status or convey any negative message to your school.

It’s simply a way to notify your institution that you’d like a more accurate assessment of your family’s current financial situation. Here’s what to know about asking for a professional judgment for your FAFSA.

What is a professional judgment for financial aid?

A professional judgment gives your school’s financial aid administrator the ability to make adjustments to data elements included on your FAFSA. This review process is used to account for any unusual situations or circumstances that weren’t included when filling out your financial aid application.

Here’s several scenarios where a professional judgment might be successful:

- Your family’s income is now significantly less than the tax filing year used on the application.

- Your family is incurred extraordinary medical or dental expenses beyond what was claimed on your federal taxes.

- Your parent no longer receives child support, or other untaxed sources of income, that were originally included on your FAFSA.

- You’ve experienced the death of a parent or spouse.

Any significant change in your financial situation could result in an increase in financial aid. But ultimately, the decision lies with your school’s financial aid administrator.

The Higher Education Act of 1965 provides a school’s financial aid administrator the authority to conduct professional judgment reviews. And their decision is final, meaning you can’t appeal it — nor can it be overridden by your school’s president or the Department of Education.

Professional judgment process: What to expect

Once you’ve been admitted to a college, you’ll receive a financial aid award letter that details the different types of financial aid the school is offering. This might include aid in the form of grants, scholarships, work-study opportunities or student loans.

If the financial information you provided on your FAFSA no longer reflects your current ability to afford college, contact your school’s financial aid office directly to start the professional judgment process.

Each college is responsible for evaluating professional judgment requests from their students. Therefore, you’ll need to contact each prospective college’s financial aid office if you haven’t decided where you’ll be attending.

Supporting documentation for professional judgment request

Your school might have formal professional judgment policies and procedures available to review online. You might also have to call or make an in-person request to receive detailed information about the process.

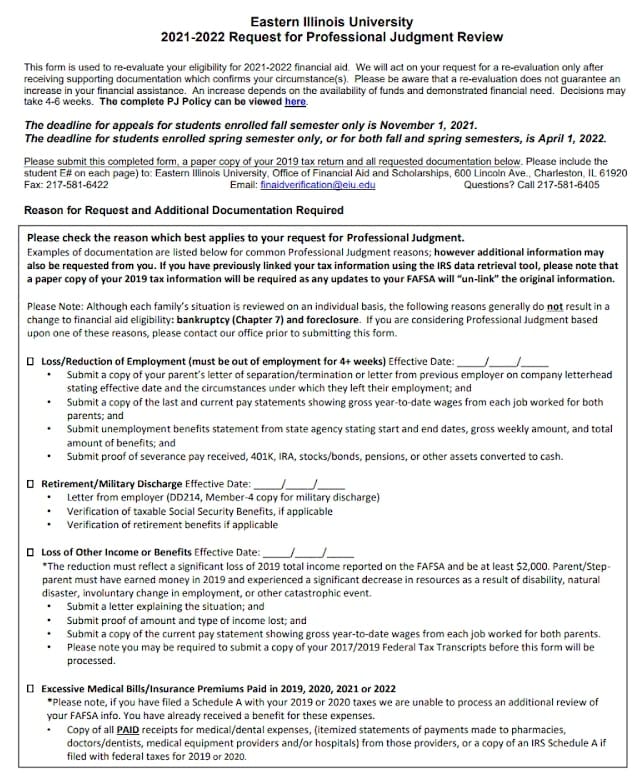

Here’s an example of a request for professional judgment review from Eastern Illinois University.

Photo credit: Eastern Illinois University

Keep in mind that each school’s professional judgment process and required documentation will be different, but this can give you an idea of what a request might look like.

Be prepared to submit additional information to support your request for a professional judgment review. Supporting documentation might include:

- Tax documentation from your original FAFSA data (e.g. tax return, 1040 tax forms, etc.)

- Unemployment information (e.g. copy of termination letter, unemployment benefits statement, proof of severance pay received, etc.)

- Proof of excessive medical bills not reimbursed by insurance (e.g. copy of paid receipts for medical or dental expenses)

- Copy of a parent or spouse death certificate

Check with your school to determine what supporting documentation is acceptable based on the special circumstance you’re claiming.

Filing a financial aid appeal during a pandemic

The FAFSA uses information from the prior-prior tax year, meaning financial data from two years ago. And due to the COVID-19 pandemic, many families have lost jobs or seen significant reductions in income. This means the information included on their most recent FAFSA likely won’t match up to their current financial situation.

So, current and prospective students who’ve been impacted by the pandemic shouldn’t hesitate to request a professional judgment to receive more financial aid. Just be sure to include as much documentation as possible, and request your appeal as early as you can.

Other ways to pay for college

If your professional judgment isn’t accepted — or if you still need additional money to pay for college — consider these alternative forms of aid.

- Tuition discounts. Some colleges provide a tuition discount in the form of a tuition waiver for certain hardships or out-of-state residency qualifications. In some cases, your family member’s employment (e.g. university or federal employee) could qualify you for a tuition discount.

- Scholarships. Many state, local and private organizations provide need-based and merit-based scholarships. You can find scholarship opportunities by using databases like the Department of Labor’s Scholarship Search Tool. Also, reach out to community organizations in your area. Student Loan Planner® even offers an annual scholarship to our readers (more details to come later).

- Federal student loans. Federal loans have low interest rates and borrower protections that can come in handy after graduation. They also give you access to flexible income-driven repayment plans and forgiveness programs, like Public Service Loan Forgiveness (PSLF).

- Private student loans. If financial aid and federal student loans aren’t enough to cover the cost of college, you might need to explore private student loans. But only as a last resort. We recommend shopping around with at least three private lenders to find the best interest rate and loan terms to fit your needs.

If student debt is in your future, our team of experts can give you unbiased advice about your financial future. We also recommend exploring our many resources to learn as much as you can about managing student debt before you head off to school.

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

| Sallie Mae |

Competitive interest rates.

|

Fixed 3.49 - 15.99% APR

Variable 4.54 - 14.71% APR

|

|

| Earnest |

Check eligibility in two minutes.

|

Fixed 3.47 - 16.49% APR

Variable 4.99 - 16.85% APR

|

|

| Ascent |

Large autopay discounts.

|

Fixed 3.39 - 15.71% APR

Variable 5.01 - 15.27% APR

|

|

| College Ave |

Flexible repayment options.

|

Fixed 3.47 - 17.99% APR (1)

Variable 4.44 - 17.99% APR (1)

|