Putting it lightly, this pandemic has sucked for most and has been truly devastating for some. Fortunately, federal borrowers pursuing Public Service Loan Forgiveness (PSLF) recently received great news that makes loan forgiveness easier — on top of already scoring almost two years’ worth of PSLF qualifying payments without spending a dime.

Most borrowers shouldn’t worry about getting PSLF credit during the payment freeze if they meet all other PSLF eligibility requirements. That said, federal loan servicers absolutely make paperwork mistakes.

Here are some proactive steps that PSLF borrowers can take to make sure all administrative forbearance months count toward loan forgiveness.

Preparing your PSLF status for the administrative forbearance aftermath

According to the Department of Education, suspended monthly payments will count toward PSLF (and TEPSLF) as long as you certify your qualifying employment for the same period as the administrative forbearance: March 13, 2020 to August 29, 2023.

Note that many borrowers lost their jobs or saw a reduction of hours during the pandemic. So, you’ll only receive PSLF qualifying payments for the months that you meet the full-time requirement, which is either 30 hours per week or however much your employer considers to be full-time (whichever is greater). You can also meet this requirement by being employed part-time with multiple PSLF-qualifying employers.

If you meet this public service requirement (or could possibly meet it), then here’s what we suggest doing to ensure you receive credit for PSLF qualifying payments.

1. Submit your PSLF certification form once a year

You aren’t required to submit a PSLF Employment Certification Form (ECF) specifically for the administrative forbearance period. But you can if you want to. Otherwise, just keep doing what you’re already doing and submit your PSLF form annually when it’s time to recertify your income with your loan servicer.

Use the PSLF Help Tool to search for a qualifying employer and to generate a pre-filled ECF. Have your employer sign the form, and then submit the signed copy to your loan servicer.

If you’re already on track for PSLF, and therefore assigned to FedLoan Servicing, simply upload an image of the signed form to FedLoan’s PSLF Payment Tracking tool.

Keep in mind that FedLoan will be ending its loan servicing contract at the end of this year. Therefore, MOHELA or another loan servicer will handle your PSLF progress once your account is transferred.

2. Download your payment history from FedLoan

Since FedLoan is getting fired in December, it wouldn’t hurt to retrieve your payment history from FedLoan’s website before it hits the road.

You can download or take a screenshot of your payment history as an additional paper trail in case any issues arise in the future. Drop it into your Google Drive or Dropbox account for easy access going forward.

3. Download your NSLDS file

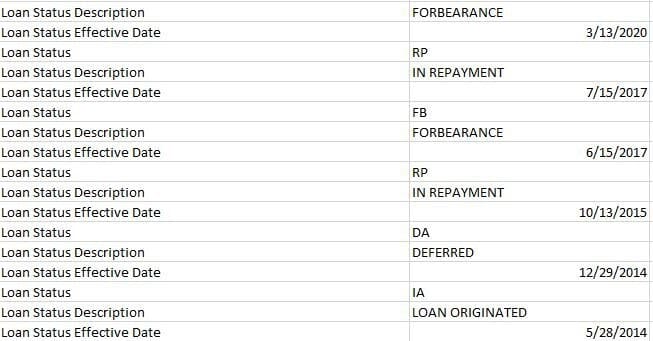

The Department of Education uses the National Student Loan Data System (NSLDS) to record and track student loan activity. Since this is an unprecedented payment freeze (who knows what hiccups might come up), we recommend downloading your NSLDS file showing the forbearance dates.

Double-check the information that’s listed. You want to make sure you were in repayment on a qualifying repayment plan and that forbearance started on March 13, 2020. You’ll also want to confirm the remaining PSLF program qualifications.

Note that this is a precautionary step and likely won’t be needed. Your NSLDS file will follow you regardless of how many times your federal student loans change servicer hands.

But you never know — so, take a quick glance, drop it in a designated folder and then go about your life.

4. Submit a complaint if problems arise

If you ever run into an issue with your PSLF qualifying payment count, you can submit a complaint with the Consumer Financial Protection Bureau (CFPB).

This is typically an efficient route to resolve payment concerns. But if your complaint isn’t properly resolved or if you need a faster solution, you can reach out to your Congressperson’s constituent services office.

Going forward with PSLF

The PSLF student loan program requires 120 qualifying payments, meaning at least 10 years of repayment. But due to COVID-19 relief efforts, PSLF borrowers will receive almost two years’ worth of credit for PSLF qualifying payments (even though they were a $0 monthly payment amount).

If you’re worried about receiving credit for PSLF qualifying payments during the administrative forbearance, trust that it’s not something to stress over. In all likelihood, you won’t need to do anything other than submit your annual ECF detailing that you met PSLF employment requirements during the administrative forbearance.

But these additional action steps can give you a safety net and allow you to feel a little more in control during a time that has felt completely out of our control.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).