Through the PSLF program, eligible borrowers with Direct Loans can get the remainder of their loans forgiven after 120 payments and 10 years of service at an approved employer. Plus, borrowers don’t have to worry about tax repercussions of forgiven loans under PSLF.

Below we cover the major PSLF statistics around applicants, the PSLF acceptance rate, reasons behind denied applications and more.

Top PSLF Statistics

PSLF Discharge Totals

- Total Amount Discharged Through PSLF, TEPSLF & PSLF Waiver: $42 billion

- Average Loan Balance Forgiven Through PSLF, TEPSLF & PSLF Waiver: $63,242

- Total Borrowers with Loans Discharged Through PSLF, TEPSLF & PSLF Waiver: 615,000

PSLF Forms

- Total forms submitted (through March 31, 2023): 5,462,098

- Forms processed that met eligibility requirements (under the original program): 2.2%

- Forms processed that did NOT meet eligibility requirements (under the original program): 97.8%

Borrowers on Track for PSLF

- Outstanding loan balance for borrowers with student loan debt that have qualifying employment: $125.66 billion

- Number of borrowers who qualify for PSLF based on employment: 1,330,968

- Average outstanding loan balance: $94,411

History of the Public Service Loan Forgiveness Program (PSLF)

The Public Service Loan Forgiveness Program (PSLF) was launched in 2007 as part of the College Cost Reduction and Access Act of 2007. This landmark student loan forgiveness program gave public service workers a form of debt relief in exchange for 10 years of service. PSLF helps attract federal student loan borrowers to fields like nonprofit work or government that are generally not as well compensated.

Given the program’s 10-year, full-time commitment, the first borrowers eligible for loan forgiveness applied in 2017. During that time, many PSLF applicants were rejected for a variety of reasons. As of March 2019, the U.S. Government Accountability Office (GAO) found that 99% of PSLF applications were denied.

As of 2018, eligibility requirements for PSLF were expanded to previously consider borrowers who made monthly payments via repayment plans that didn’t qualify. This program’s referred to as Temporary Expanded Public Service Loan Forgiveness (TEPSLF).

More borrowers are applying for PSLF, and now with Temporary Expanded Public Service Loan Forgiveness (TEPSLF) and the PSLF waiver, that number is growing. The PSLF waiver is a time-sensitive opportunity with a deadline of October 31, 2022.

The major changes with the PSLF waiver include counting previous student loan repayment — as well as some forbearance and deferment — toward PSLF, essentially expediting the forgiveness process.

Below are current PSLF statistics. These figures offer insight into how many borrowers are benefiting from the program, including forgiveness amounts and reasons for some application denials.

About PSLF statistics

Federal Student Aid publishes data that includes PSLF statistics relevant to borrowers. The information below is from its most recent report as of July 2022, unless stated otherwise. The data illustrated is ever-changing and will be updated on a regular basis.

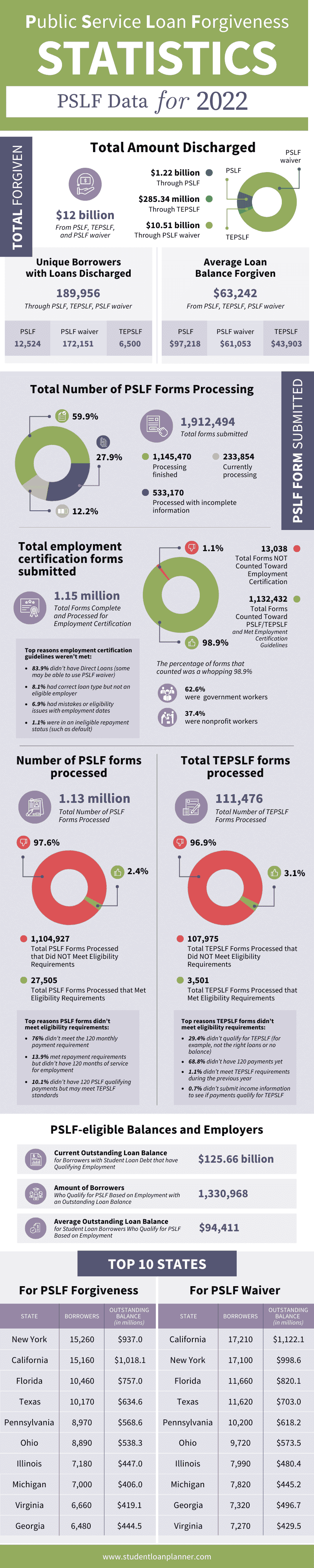

Total forgiven from PSLF, TEPSLF, and PSLF waiver

The PSLF statistics below illustrate the total amount of student loans and borrowers that have taken part in the various PSLF-related programs.

| Total amount discharged through PSLF, TEPSLF & PSLF Waiver | Total unique borrowers with loans discharged through PSLF, TEPSLF & PSLF Waiver | Average loan balance forgiven through PSLF, TEPSLF & PSLF Waiver |

|---|---|---|

| $42 billion | approx. 615,000 | $68,547 |

Total PSLF forgiveness – Formal program only

When applications rolled in for PSLF forgiveness, the acceptance rate drew scrutiny about the number of applications that weren’t accepted. Though there have been some hiccups along the way, the data shows that student loan borrowers are getting forgiveness through the program.

| Total amount discharged through PSLF | Total unique borrowers with loans discharged through PSLF | Average loan balance forgiven through PSLF |

|---|---|---|

| $1.22 billion | 12,524 | $97,218 |

Total TEPSLF forgiveness

The TEPSLF program loosened some eligibility requirements, making forgiveness possible for more borrowers who might otherwise not qualify for traditional PSLF. For example, one of the requirements for PSLF is to be on the right repayment plan.

PSLF borrowers need to repay student loans through an income-driven repayment (IDR) plan (Revised Pay As You Earn, Pay As You Earn, Income-Based Repayment, Income-Contingent Repayment). Through TEPSLF, borrowers who made payments on a different payment plan might be eligible for forgiveness.

| Total amount discharged through TEPSLF | Total unique borrowers with loans discharged through TEPSLF | Average loan balance forgiven through TEPSLF |

|---|---|---|

| $285.34 million | 6,500 | $43,903 |

Total forgiven from the PSLF waiver

The PSLF waiver is a unique opportunity for borrowers that has an end date of October 31, 2022. Given the time-sensitive nature, it’s important for borrowers to get information about qualifying and adding qualified payments that can count toward forgiveness, where they may not have counted before.

| Total amount discharged through PSLF waiver | Total unique borrowers with loans discharged through PSLF waiver | Average loan balance forgiven through PSLF waiver |

|---|---|---|

| $10.51 billion | 172,151 | $61,053 |

Number of PSLF forms submitted

The PSLF and TEPSLF applications are now in just one form for borrowers to fill out. Based on this change, PSLF data and reports after April 2021 are a bit different. Before this time period, PSLF statistics included whether an Employment Certification Form (ECF) or forgiveness application was submitted.

Additionally, there has been an influx of applications for PSLF waivers that aren’t included but reflected in discharges as part of the PSLF portfolio.

The total number of borrowers who've submitted PSLF forms is 1,274,322. The numbers reflected below include PSLF forms from borrowers starting November 9, 2020, to July 31, 2022.

Let's consider this data from another point of view. Here is the total number of PSLF forms processed, broken down by percentage.

Total employment certification forms submitted

PSLF, unlike income-driven repayment forgiveness, has an employment requirement that borrowers must meet to qualify. The organization a borrower works for must meet specific criteria.

| Total forms complete and processed for employment certification | Total forms counted toward PSLF/TEPSLF and met employment certification guidelines | Total forms NOT counted toward employment certification |

|---|---|---|

| 1.15 million | 1,132,432 | 13,038 |

The percentage of forms that counted was a whopping 98.9%. Of those, 62.6% were government workers and 37.4% were 501(c)(3), nonprofit workers.

Top reasons employment certification guidelines weren’t met:

- 83.9% didn’t have Direct Loans (some may be able to use PSLF waiver)

- 8.1% had correct loan type but not an eligible employer

- 6.9% had mistakes or eligibility issues with employment dates

- 1.1% were in an ineligible repayment status (such as default)

Number of PSLF forms processed

The numbers above show a large number of employment certification forms that meet eligibility requirements, with a very small percentage not. The data is nearly flipped when you look at the data of total processed PSLF forms. Note these forms were under the original PSLF rules and met the qualifying employer guidelines and were processed.

| Number of PSLF forms processed | Total PSLF forms processed that met eligibility requirements | Total PSLF forms processed that did NOT meet eligibility requirements |

|---|---|---|

| 1.13 million | 27,505 | 1,104,927 |

Out of the total number of PSLF forms processed, only 2.4% met eligibility requirements, while 97.6% did not. Most of the processed forms (67.9%) were from government workers, while a smaller number were from nonprofit employees.

Top reasons PSLF forms didn’t meet eligibility requirements:

- 76% didn’t meet the 120 monthly payment requirement

- 13.9% met repayment requirements but didn’t have 120 months of service for employment

- 10.1% didn’t have 120 PSLF qualifying payments but may meet TEPSLF standards

Total TEPSLF forms processed

The TEPSLF gave borrowers shut out from traditional PSLF forgiveness more opportunities thanks to expanded eligibility requirements. Below covers TEPSLF forms processed that met employment and TEPSLF guidelines, those that didn’t meet the requirements, employment type, and reasons for not qualifying.

| Number of TEPSLF forms processed | Total TEPSLF forms processed that met eligibility requirements | Total TEPSLF forms processed that did NOT meet eligibility requirements |

|---|---|---|

| 111,476 | 3,501 | 107,975 |

Of the total forms processed, 96.9% did NOT meet eligibility requirements, while 3.1% did. Most of the forms processed (70.3%) were government workers, while 29.7% were 501(c)(3), nonprofit workers.

Top reasons TEPSLF forms didn’t meet eligibility requirements:

- 29.4% didn’t qualify for TEPSLF (for example, not the right loans or no balance)

- 68.8% didn’t have 120 payments yet

- 1.1% didn’t meet TEPSLF requirements during the previous year

- 0.7% didn’t submit income information to see if payments qualify for TEPSLF

PSLF-eligible balances and employers

The major thing borrowers need to qualify for PSLF is to work at an employer that qualifies for the program. Generally, this can include a nonprofit or government organization. Borrowers working toward PSLF can submit an Employment Certification Form.

| Current outstanding loan balance for borrowers with student loan debt that have qualifying employment | Amount of borrowers who qualify for PSLF based on employment with an outstanding balance | Average outstanding loan balance for student loan borrowers who qualify for PSLF based on employment |

|---|---|---|

| $125.66 billion | 1,330,968 | $94,411 |

Top 10 states for PSLF forgiveness

As you can see from the PSLF statistics outlined above, millions of student loan balances have been discharged under PSLF for thousands of borrowers. Some states have a higher number of borrowers receiving PSLF forgiveness. Below are the top 10 states for PSLF forgiveness, which include forgiveness applications that have been processed under all three programs: PSLF, TEPSLF and the PSLF waiver.

| State | Borrowers | Outstanding balance (in millions) |

|---|---|---|

| New York | 15,260 | $937.0 |

| California | 15,160 | $1,018.1 |

| Florida | 10,460 | $757.0 |

| Texas | 10,170 | $634.6 |

| Pennsylvania | 8,970 | $568.6 |

| Ohio | 8,890 | $538.3 |

| Illinois | 7,180 | $447.0 |

| Michigan | 7,000 | $406.0 |

| Virginia | 6,660 | $419.1 |

| Georgia | 6,480 | $444.5 |

Top 10 states for PSLF waiver

The PSLF waiver has increased eligibility and is a huge benefit for borrowers that qualify. As of mid-August 2022, here are the top 10 states that have borrowers who have been identified for PSLF waiver forgiveness.

Note that the outstanding balance below refers to both loans that have been forgiven under the PSLF waiver, as well as the loans that haven’t been processed for forgiveness yet. Of course, there’s a correlation between the size of the state and population density and the corresponding borrowers who are eligible.

| State | Borrowers | Outstanding balance (in millions) |

|---|---|---|

| California | 17,210 | $1,122.1 |

| New York | 17,100 | $998.6 |

| Florida | 11,660 | $820.1 |

| Texas | 11,620 | $703.0 |

| Pennsylvania | 10,200 | $618.2 |

| Ohio | 9,720 | $573.5 |

| Illinois | 7,990 | $480.4 |

| Michigan | 7,820 | $445.2 |

| Georgia | 7,320 | $496.7 |

| Virginia | 7,270 | $429.5 |

Use the PSLF Help Tool to apply today

Borrowers who wonder where they stand regarding PSLF can use the PSLF Help Tool. It lets you see if you qualify for PSLF, TEPSLF, or how you might gain more qualifying payments under the PSLF waiver. Borrowers are also advised to submit their Employer Certification Form each year to track payments and eligibility.

Private student loans from private financial institutions — not the U.S. Department of Education — don’t qualify for student loan forgiveness programs.

If you’re working toward PSLF, keep good records of payments and employment, evaluate expanded eligibility with the waiver, and contact your loan servicer if you need more information.

Have questions regarding PSLF? Get in touch with a Student Loan Planner team member or book a consultation.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).