You wanted to be a clinical psychologist. The problem is that funded PhD programs want folks interested in research. To top it off, funded positions are really hard to get. Hence, PsyD programs sprung up in earnest after the Vail conference.

Unfortunately, the high cost of PsyD programs grew even faster than enrollments. The untold story of the PsyD degree is astronomical debt.

First, you're not alone and there are many others struggling with six figure debt loads.

Second, you can come up with a strategy that will save you money on your PsyD loans that will allow you to practice without worrying.

Third, if you want professional help figuring out your plans, Student Loan Planner® has counseled many PsyD grads looking for student loan answers.

PsyD reality: Graduates often owe $100,000+

The first step in confronting the terrible treatment PsyD students receive at the hands of student loan policy is calling out the cost. The range of debt loads my PsyD clients have had is between $100,000 to $450,000.

The average PsyD program cost of the clients contacting me is around $270,000. No doubt, a disproportionate number of students from for profit schools like Argosy University reach out, but so do graduates of lower cost programs. Even if you leave school with $100,000, that's still a lot given that most psychologists make less than that.

Why do PsyD programs cost so much?

Here's my theory. There's a strong demand for psychologist jobs from students. All you have to do to see the interest in the field is the huge enrollment numbers at undergraduate institutions. When I was at UF, I think there were more than 1,000 Psychology undergrads.

The law of large numbers states that a number of these folks will want to continue in the field professionally, but the only way to do that is through advanced education. Hence, we have the proliferation of PsyD programs that's happened around the country.

Huge profits to be made from PsyD education

PhD programs by their nature are small. In the face of high demand from students, universities realized that professional psychology programs could be very profitable. In contrast to dental school and medical schools, the capital investment is lower, yet schools charge similar tuition.

Argosy University and Alliant International University were among the most expensive PsyD programs

Lending support to this idea is the large concentration of for profit institutions in the PsyD world. Alliant switched to a for profit benefit corporation. Argosy University had campuses all over the place and books major profits for shareholders.

The private ‘non-profit' universities out there make a lot of money too. If you look at a list of APA accredited programs, you sure don't see very many public institutions on the list.

Why is this? The PsyD at the scale it's at today is a newer program. Hence, more profit oriented schools are quicker to react to the demand. That's one of the big reasons for the super high cost.

The majority of the psychologists that I work with coming out of Argosy University and Alliant International University have had over $250,000 in debt. There's totally still hope if you owe this much. That said, if at all possible I'd try to avoid these schools unless they were my only option.

PsyD loan repayment options

Fundamentally, I think there are three paths that make sense to repay PsyD student loans. I encounter all three paths in my consulting business.

Hopefully, you'll identify which one looks the most like you. If you had any questions at all, you could of course reach out to me directly by email.

To illustrate each of these paths, we'll use hypothetical psychologists and include some examples of their situations to show you how I'd analyze it. If you wanted your own copy of the calculator that I'm going to use to model these situations, you could click on that link and get it.

The PsyD with a modest amount of debt looking to pay it back

Anna has been practicing for about 7 years and has $120,000 of debt at a 6.5% interest rate (which she's been paying on IBR for 6 years). She's married to a a spouse with $80,000 in income and no student debt (lucky!) She makes $90,000 and works in a private practice setting.

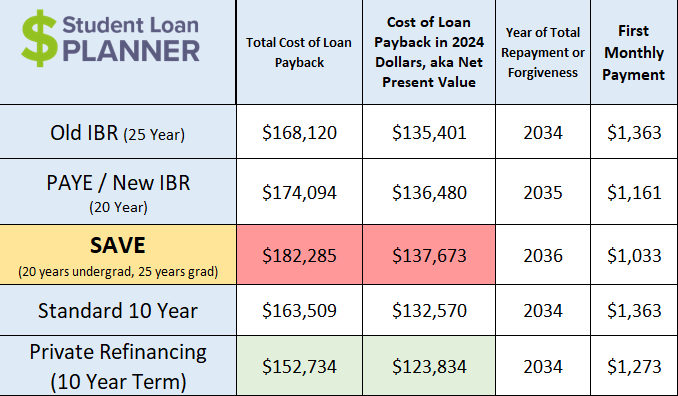

We'll assume she and her spouse get inflation level raises and they could refinance her loans at a 5% with a 10-year term. Here's what the projected costs look like:

I like to compare the actual dollars out of your pocket cost as well as convert the cost to today's dollars since the repayment plans are over different periods. Both measures show refinancing as the cheapest option for Anna.

Public or nonprofit sector psychologist with a lot of debt

Kristina is a PsyD counselor at a local school. Here's a quick look at her debt portfolio and employment situation:

- Earns $65,000 with excellent benefits and a reasonable working schedule.

- Expects a 3% salary increase each year.

- Has $250,000 student debt with an average interest rate of 6%.

- Is interested in the Public Service Loan Forgiveness program.

- Has a partner of several years, but considers marriage optional.

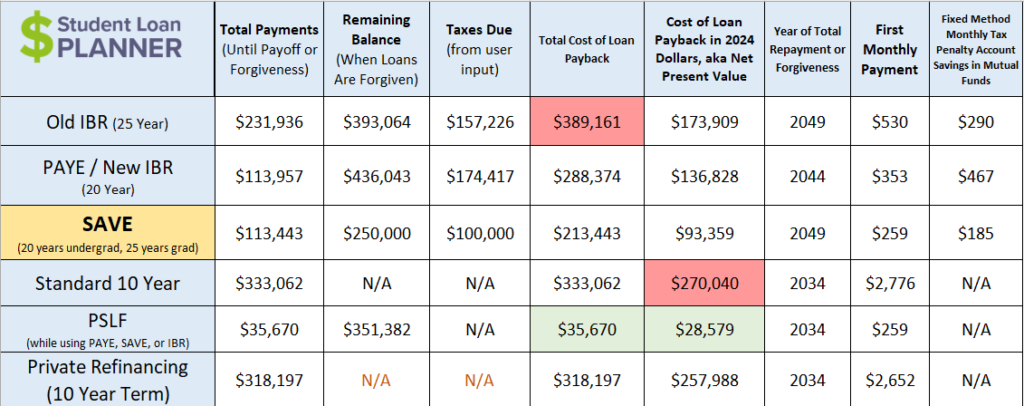

We'll assume that Kristina is just starting work at the school this year and that there aren't any family size considerations to look at. Here's the projected cost:

Clearly Public Service Loan Forgiveness (PSLF) is the way to go. By enrolling in the SAVE plan, Kristina will only pay a total of $35,670 over 10 years. At which point, her remaining balance will be forgiven tax-free thanks to the PSLF program.

Using PSLF to her advantage will literally save her $175,000 to $300,000 compared to pursuing 25-year forgiveness with SAVE or sticking with the standard 10-year repayment plan.

When comparing PSLF to refinancing at a 5% rate to aggressively pay down her debt in 10 years, we're talking about a savings of over $282,000. That's like an after tax bonus of $28,000+ every year she works at the school.

There are still other tips to optimize this repayment cost, like saving in pretax 403b plans and health savings accounts. If you're going for PSLF, you're going to want to minimize payments because the forgiveness is tax free.

If you want more tips on this program, click on the link in this section above because I've written extensively how to maximize your benefit under this program.

Note that public sector psychologists could save a TON of money under the IDR Waiver program.

Private sector psychologist with a lot of psychology school debt

Tim's dream was to have a private psychologist practice. He makes decent money at about $110,000, but his debt is a staggering $350,000 at a 7% interest rate. His wife makes $50,000 a year (with no debt), and they have 2 young children.

Tim's monthly payment would be around $4,000 a month if he tried to pay it back in 10 years. That's clearly not feasible if he wants to have a nice standard of living.

A private sector PsyD grad is very likely going to need to optimize their situation for loan forgiveness. That's particularly true if they went to a high cost school like Argosy University or Alliant International University.

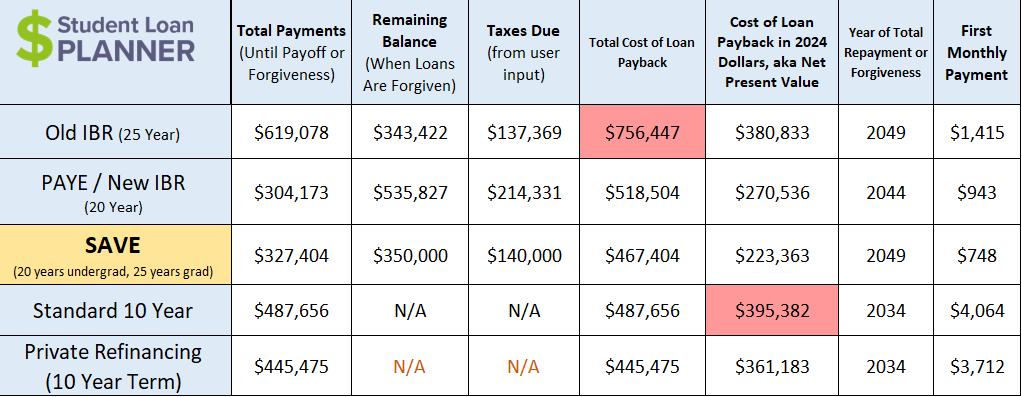

Here's the cost of the various repayment options. It's important to know that Tim will have to save for a tax penalty when his loans are forgiven.

Tim should clearly go for either the SAVE or PAYE programs if he wants to avoid a huge monthly payment. He would need to weigh whether he prefers getting loan forgiveness after 20 years with PAYE, requiring a higher monthly payment. Or stick with 25-year forgiveness with SAVE to lower payments and save the most overall in terms of total cost of loan payback and when comparing costs in today's dollars.

I'd probably suggest SAVE in this case. He could put away about $750 or so a month in a side investment account to prepare for the $140,000 tax penalty he'll owe when his remaining $350,000 in loans is forgiven in 25 years.

There are other things he can do too like saving for retirement. If loan forgiveness ever went away, he could use that tax side account to make a big prepayment then refinance. If the tax penalty went away, he would get to keep those savings. Either way, paying back the loans brute force style would be a mistake under current rules.

Help for figuring out what to do with loans from PsyD programs

Most financial advisors don't have a clue how to find the optimal loan repayment strategy. They'll give you generic advice or leave out the nitty gritty details.

There are a lot of situations and examples that I left out in this article, and your story is unique.

All I do is consult on huge student loan balances from professional programs. I've worked with a bunch of PsyD grads before, and I'd love to work with you.

If you're tired of watching the balance grow, we can get a comprehensive plan in place so you can remove student loans from your worry list with a confident plan.