If you work in the public sector and are working toward Public Service Loan Forgiveness (PSLF), the main action to stay the course is submitting the Public Service Loan Forgiveness Employment Certification Form. In this post, we’ll cover what the PSLF Employment Certification Form is along with how to complete and submit it.

Note: This form just became extremely important for millions more people thanks to the Biden administration's PSLF order, which is effectively extended until June 30, 2024 thanks to the IDR waiver. You need to submit your PSLF ECF form by the end of 2023 to qualify. Unfortunately, you need to be proactive in submitting this ECF document as it's a requirement to gain additional relief from this executive action.

Public Service Loan Forgiveness Employment Certification Form

The Public Service Loan Forgiveness Employment Certification Form is an official form from the Department of Education. It’s used to help borrowers stay on track with their employment under the PSLF program.

Under PSLF, borrowers must work for a nonprofit or government agency for 10 years and make 120 qualifying loan payments in order to receive student loan forgiveness. Once you submit the PSLF Employment Certification Form, your loans are transferred to MOHELA, the student loan servicer that manages the program.

MOHELA will review your PSLF Employment Certification Form and your employer information to let you know how many qualifying payments toward forgiveness you’ve made.

How to complete the PSLF Employment Certification Form?

As you can see, the Public Service Loan Forgiveness Employment Certification Form is important for you to fill out to know where you stand in the program. Here’s how to complete the form in four steps:

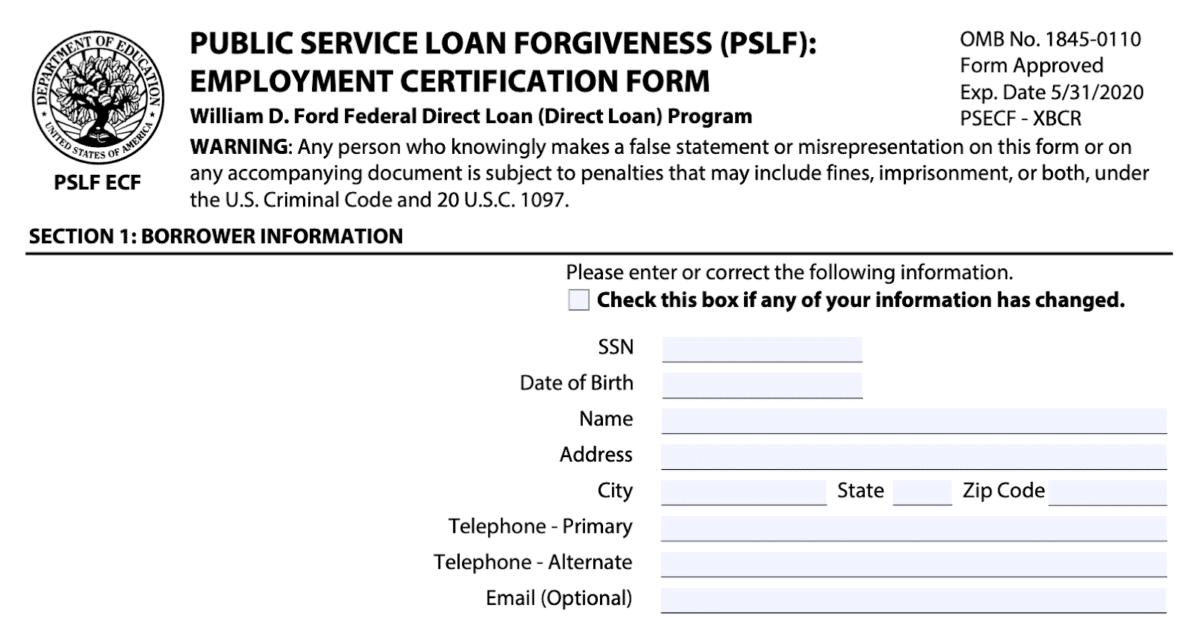

Step 1: Fill out personal information

After downloading and printing the PSLF Employment Certification Form, fill in your personal information. This includes your name, address, Social Security number, etc.

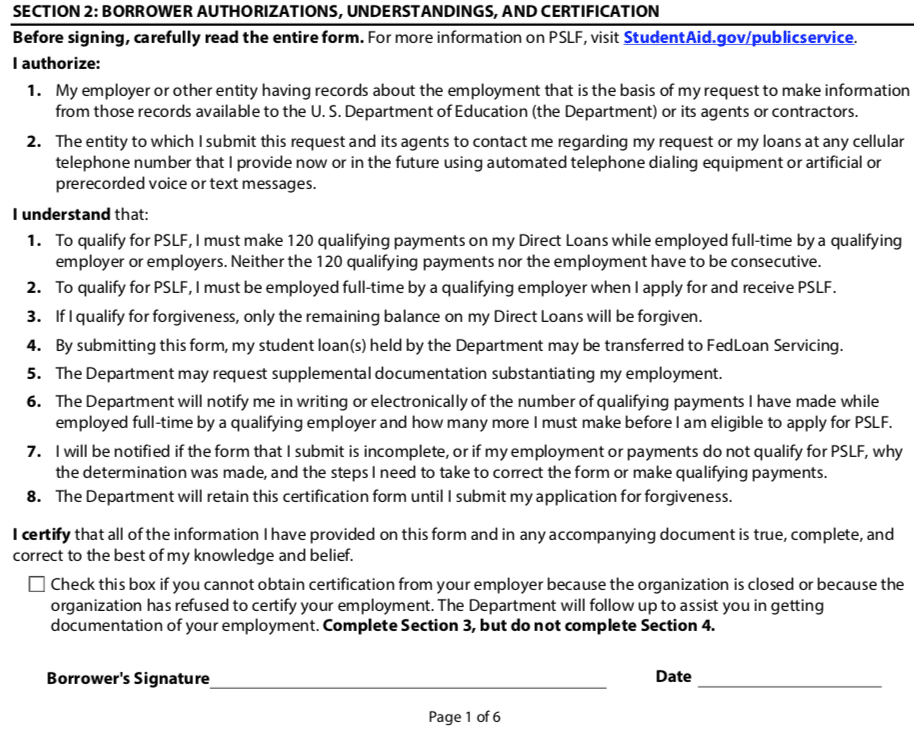

Step 2: Sign the terms and conditions

The second part of the form is the fine print. You’ll authorize that you understand how the program works, the eligibility requirements and how to qualify. Note that you must be on a qualifying repayment plan. These include income-driven repayment programs such as Pay As You Earn (PAYE), Saving on a Valuable Education (SAVE), Income-Contingent Repayment (ICR) and Income-Based Repayment (IBR).

Step 3: Give the form to your employer to fill out Sections 3 and 4

Section 3 of the PSLF Employment Certification Form can be filled out by you or your qualifying employer. Since your employer will have all the necessary information and will need to certify the form, you can also have them fill out this section.

Once you’ve filled out the first two sections, bring the form to your employer and ask them to fill out the third and fourth parts of the form. Your employer will provide basic information about your start date, employment status, hours and the type of organization they are. Your work must be considered full-time — not part-time — for your monthly payments to count toward PSLF and get your remaining balance forgiven.

Once they complete Section 3, an authorized official from your organization must sign, date and certify your employment in Section 4.

Step 4: Send in the completed form

Once you’ve completed the PSLF Employment Certification Form, you’ll need to send it to MOHELA. You can do this by mail, fax or through MOHELA website:

Mail:

U.S. Department of Education, MOHELA

633 Spirit Drive

Chesterfield, MO 63005-1243

Fax:

866-222-7060

Online:

You can upload the form online by visiting MOHELA.com, if MOHELA is currently your loan servicer.

After certifying the first time, you should complete this form once a year and each time you change jobs.

Related: How to Get an Electronic Signature for Public Service Loan Forgiveness

Why recertification is important

Certifying your employment the first time is important because you can make sure your employment qualifies and get your loans transferred to MOHELA, which manages the PSLF program. Note that if MOHELA fails to get back to you about your certification status, you can ask for a manual recount of your payments.

But recertifying each year is important, too, for several reasons. First, it can help you track your student loan repayment, so you know you’re on your way to making 120 payments. On top of that, if you change jobs, you can ensure that your new employment still qualifies for the Public Service Loan Forgiveness Program, so there are no surprises.

And as your loans will be serviced by MOHELA during this process, you’ll have to practice filling out forms for when it’s time to officially submit the full PSLF application.

If you don’t recertify, there are no hard consequences — but you’ll have to submit the PSLF Employment Certification Form for the previous 10 years of work. Might as well stay on top of it as you go through the process.

Mistakes to avoid with the PSLF Employment Certification Form

There’s been press about borrowers not receiving student loan forgiveness through PSLF, but some of that is user error. To ward off any issues, here are some common mistakes to avoid:

- Not filling out the form completely. Any blank space should be filled in.

- Forgetting to sign and date the form.

- Not turning in the form every year of employment.

- Not recertifying when changing jobs.

- Not having an official from your employer fill the form out.

- Not following up with your employer about filling out their part.

- Not submitting the form to the right place.

- Not keeping copies for your own records.

Opting for student loan forgiveness under PSLF can be great for the right borrower. You can get your loans wiped away after 10 years and won’t have to pay taxes on the amount forgiven — but you must stick to the process to have this happen.

If you avoid these common mistakes, you can stay on track with your student loan forgiveness under PSLF. Submitting your form each year can make the process easier and prevent issues down the line. If you have any additional questions, contact MOHELA about the process or your status.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.