There is a high need for public servants who play an essential part in the day-to-day operations of our society. These include jobs like public school teachers, police officers, public works employees and so many more vital roles. But the pay for public and nonprofit jobs is generally much lower than its private sector counterpart — which can make paying back student loans even more challenging.

That brings us to one solution for federal student loans: the Public Service Loan Forgiveness (PSLF) program.

PSLF can help ease the student loan debt burden of public service workers. But it also serves as an incentive to encourage more student loan borrowers to pursue careers in the public and nonprofit sectors.

Here’s how to determine if you've worked for public service loan forgiveness jobs, as well as a PSLF-qualifying employers list.

PSLF eligibility requirements

The PSLF program requires that you make 10 years of student loan payments while working as a public servant to have your remaining student loan balance forgiven, tax-free.

To qualify for PSLF, you must:

- Work full-time for a qualifying employer.

- Have federal Direct Loans.

- Repay your loans under an income-driven repayment plan.

- Make 120 qualifying payments.

StudentAid.gov states that qualifying employers include “government organizations at any level (U.S. federal, state, local or tribal)” and “not-for-profit organizations that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code”.

Additionally, time spent as a full-time AmeriCorps or Peace Corps volunteer also counts as qualifying employment toward PSLF.

PSLF qualifying employers list

If you work for a government agency or a tax-exempt 501(c)(3) organization, it’s pretty clear cut — you work for a PSLF employer.

But if you work for a nonprofit that isn’t tax-exempt, you can still qualify for PSLF as long as the organization provides public services that fall into certain categories.

Public service loan forgiveness jobs generally include public services such as:

- Emergency management. This diverse field includes professions that specialize in disaster relief, local and national preparedness, and many more emergency response services.

- Military service. This includes members of the U.S. Armed Forces or the National Guard.

- Public safety. Among this group are professions like firefighters, EMTs and paramedics, correctional officers and 911 dispatchers.

- Law enforcement. Personnel involved in crime prevention, control or reduction of crime or the enforcement of criminal law may qualify.

- Public interest legal services. This includes those who provide legal services that are funded in whole or part by a local, state, federal or tribal government.

- Early childhood education. Licensed or regulated childcare, Head Start and state-funded pre-kindergarten employers.

- Public service for individuals with disabilities and the elderly.

- Public health. This includes nurses, nurse practitioners, nurses in a clinical setting and full-time professionals engaged in healthcare practitioner occupations and health support occupations. It also includes counselors, social workers and other community and social service specialists.

- Public education. This includes teachers, administrators and support staff of all grade levels, regardless of position.

- Public and school library services.

- Other school-based services.

Additionally, legislation was passed in August 2020 to allow faith-based leaders to apply for PSLF.

Employers that don’t qualify as public service loan forgiveness jobs

Although the PSLF program includes a large number of public service loan forgiveness jobs, there are several types of employers that are specifically excluded from student loan forgiveness.

Non-qualifying employers include:

- Labor unions.

- Partisan political organizations.

- For-profit businesses and organizations.

The PSLF program also draws a hard line when it comes to eligibility for contractors. You must work directly for the qualifying employer, not as a contractor.

So, let’s say you work as an independent contractor providing IT services to a local government agency. You won’t qualify for PSLF because you’re not directly employed by the government, even though you provide services to them.

If you’re a contractor and aren’t sure whether you’re technically an employee of a qualifying employer, look at who sends you an IRS Form W-2 at the end of each tax year. The Department of Education uses the employer on your W-2 to determine your eligibility for PSLF.

The PSLF qualifying employer list can change over time

Keep in mind the definition of “public service organization” can always be changed in the future, as was the case with a recent PSLF lawsuit involving the American Bar Association (ABA).

In this case, several borrowers were incorrectly issued approval letters saying they qualified for the PSLF program — even though they technically didn’t because the ABA isn’t a 501(c)(3) organization, nor does it provide a qualifying public service. But in the end, the government settled the lawsuit and agreed to include the ABA as a public service organization for PSLF.

How to determine if your employer meets PSLF requirements

You can determine if your employer meets PSLF requirements by using the new PSLF Help Tool. This simplified process allows you to search for a qualifying employer, learn what action you need to take to be eligible and generate the PSLF form you’ll need to submit.

To complete the process, you’ll need your most recent W-2. Or you can use your employer’s Federal Employer Identification Number (EIN) to complete the process.

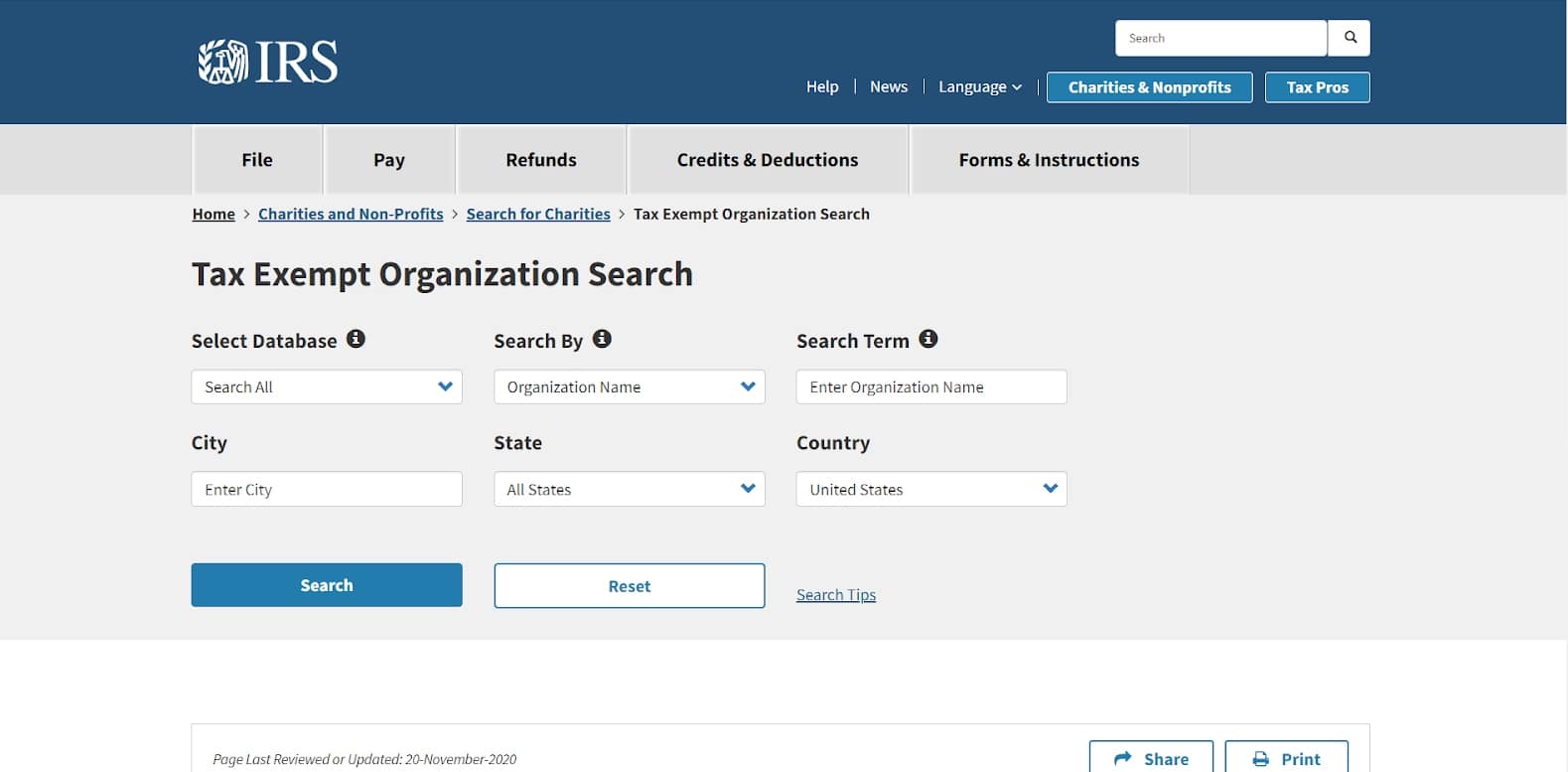

If you work for a nonprofit organization, you can use the IRS Tax Exempt Organization Search to look up your employer’s EIN number.

Search for your organization’s name, or search by city if you can’t locate your employer, as its name might be different with the IRS.

You can complete the PSLF Help Tool process in less than 30 minutes. But you’ll need to provide detailed information related to your employment and student loans.

Once you’ve entered the necessary information, you can generate and print your Employment Certification Form (ECF). This form needs to be signed by both you and your employer. Then, forward it to MOHELA, the only loan servicer currently overseeing PSLF.

The ECF form helps verify that you work for a public service employer and make monthly payments under a qualifying repayment plan. Once submitted, MOHELA will confirm how many qualifying payments you’ve made.

We recommend submitting an updated ECF once a year to ensure you’re on track for PSLF. After all, loan servicers often drop the ball, so it’s best to create a thorough paperwork trail.

Other occupations that qualify for federal loan forgiveness

PSLF isn’t the only road to erasing your remaining balance. Other federal loan forgiveness options include:

- Teacher Loan Forgiveness. This program is for teachers who have taught full-time for five consecutive years in elementary or secondary schools or educational services that serve low-income families.

- Perkins Loan Cancellation. This program is open to a variety of professionals who have remaining federal Perkins loans. Eligible occupations include teachers, nurses, firefighters, college faculty members, speech pathologists, librarians, law enforcement officers, public attorneys, childcare providers and more.

- Income-driven repayment (IDR) forgiveness. This option is available to federal borrowers, regardless of occupation.

It can be confusing to navigate PSLF and other student debt relief programs. But our team of student debt experts can review your financial situation and provide you with a customized loan repayment plan that factors in your financial and career goals.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).