You’ve given me the opportunity to serve you in the super niche area of huge student debt, and for that I’m very grateful. As of the end of 2017, I’ve consulted on more than $200 million in student debt. That by default makes me the most experienced student loan consultant in the country. What’s also scary is that big number still just represents a little over 0.01 percent of student debt in the United States.

At the same time, we’ve helped clients save over $40 million on their loans (projected over 20-25 years). That’s freakin’ awesome. I bet we’ve saved even more money for readers who downloaded our student loan calculator and never paid us. We probably slashed unnecessary interest by millions more with all the readers who used the site to refinance their student loans with some of the best cashback bonuses in existence.

This post is going to show past, present, and future of my business. I hope we accomplish 2 things:

- Inspire you to entrepreneurial activity in your own life

- Show you revenue, expenses, site stats, and other key metrics and explain how we're seeking to align everything with our core mission of serving you

How Student Loan Planner® Began

I “retired” from my old gig as a bond trader for one of the world’s largest investment companies in 2015. I had these big dreams after learning about financial independence from the blogosphere of traveling the world and never working for corporate America ever again.

Once I got to the point of about 60% of what I thought I needed in investments and savings to not have to work anymore, I quit. That happened mostly because of my extremely low spending rather than having a bunch of money.

During the first year of my “retirement”, I focused on growing a personal finance blog called Millennial Moola. It was never super successful, averaging about 5,000 in monthly page views and bringing in little to no revenue. I even wrote 2 books that you can find by searching Travis Hornsby on Amazon. I just wrote about whatever and hoped people would read it.

At the same time, my relationship with my girlfriend Christine grew more serious. After hoping back and forth between the US, Europe, and Latin America, it was time to put up or shut up with my relationship.

She was totally worth it, so I decided I needed to relocate with her to St. Louis for her job as a professor of surgery when she finished her training.

Desperation that Created Focus

This is where things get interesting. I had been doing some one-off student loan consulting for Christine’s friends after she told me I should start coaching people on student debt after I helped her figure out hers. Christine is far smarter than me (she started med school at age 18), but she doesn't like thinking about money. What I learned about loans allowed her to focus on what she does medicine, heal people. While doing the occasional consult for friends was a nice side hustle, it didn’t bring in much money either.

Unrelated to the business, I decided that Christine was the person I wanted to spend the rest of my life with, so I asked her father for permission to marry her. Her parents are from Hong Kong and didn’t like my non-traditional lifestyle of writing and earning a small amount of money as a semi-early retiree.

To my shock, they denied their blessing until I could prove that I loved their daughter enough to be a provider in case something happened to her. They wanted me to get a “real job.”

Suddenly, my options were to go work for a local St. Louis corporation or be successful at running my own business. I was determined NEVER to go back to a world of pointless meetings, wasted time, and staring at the clock ever again. Maybe that's unfair, but corporate America just wasn't for me. That meant I had to make this student loan gig a winner, or else.

Student Loan Planner® in 2016

We had a good year and brought in about $18,000 in revenue from the beginning of October to the end of the year. Our expenses were about $8,000, for a net profit of about $10,000.

While that was pretty good, the annualized number would’ve been about $40,000 of profit. I didn’t think that would fly as a full-time gig to win the future in-law’s approval. Only one path forward, save people more money and do more consults.

Student Loan Planner® in 2017

Our clients now number over 700. Almost all of them I’ve helped personally navigate our software and show them their options under the ridiculously complex student loan system.

Here’s the problem though, if you’re doing that many calls with people, you don’t have much time for anything else. There’s a reason that other big student loan sites do not do 1 on 1 consulting. It takes a ton of time.

I love it though, so I was bound and determined to keep consulting as our core function even as folks suggested I focus more on driving traffic to refinancing links or to our self-directed student loan course.

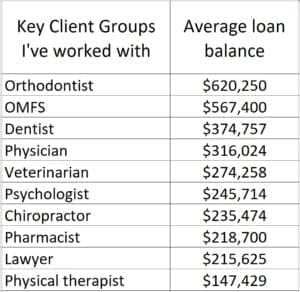

Here’s the average debt of the professions I’ve worked with in 2017:

Clearly my post about dentists and dental specialists having the number 1 job for debt is true. Physicians have a lot of debt but luckily have the PSLF out in most cases since the majority work at 501c3 hospitals. Alternatively, physicians make enough money to be able to refinance if they’re in the private sector for the most part.

Veterinarians, psychologists, and chiropractors really get a raw deal with the cost of their education, which is not justified with the incomes that most practitioners earn. Based on some of the more extreme cases I’ve seen, there are schools that need to be shut down in these professions, mostly in the for-profit sphere. However, many supposedly not-for-profit institutions educating DVMs, DCs, and PsyDs are not acting that way. One need only look at the half billion-dollar expansion of UC Davis vet school to see that.

Pharmacists make a lot of loan repayment mistakes because they either refinance without searching around enough for the best rate, or they are eligible for forgiveness but aren’t optimizing it correctly. I’d say the same of physical therapists.

Lawyers fall into one of three camps that I’ve seen. There are the Big Law associates making big money that should refinance, the public interest attorneys that need PSLF optimization, and the small to mid-size firm lawyers who need to use PAYE and REPAYE better through use of private sector loan forgiveness.

I worked with many more occupational groups than the ones above. These just represent the ones with the largest sample size.

Revenue for 2017

I’m not going to break down the details line by line, but the total revenue for Student Loan Planner® in 2017 was about $183,000. Most of this came in the form of consult revenue, but a sizable chunk came from affiliate earnings. Those affiliate earnings would be much higher if I didn’t opt to give most of the referral bonus back to you in the form of industry leading cashback bonuses.

That’s cool, because I think it’s the right thing to do. It’s your money, not mine. I’d like to earn enough to keep me incentivized to keep doing this and have some left over to keep growing the business.

For expenses, we spent about $48,000. If you told me when I retired from the bond trading world that I’d be spending over $1,000 a month on Facebook ads, I would’ve laughed in your face.

Yet spending we are. A chunk of my expense budget now goes to the excellent team of professionals I’m working with to help me grow the site. If anyone needs fantastic help with SEO, FB ads, podcast representation, PR, virtual assistant services, site development, or marketing, let me know by emailing me. I’d be happy to share their names with you if you’re thinking about giving them some business.

Hence, net profit before taxes for the year was about $135,000.

Site Stats

Here’s where I think Student Loan Planner® punches above its weight class. We had about 190,000 page views for the year. That means we generated roughly 96 cents in revenue for every page view.

What we lack in absolute numbers of eyeballs on the site, we make up for in delivering enough value to hopefully justify the revenue we generate. I’m still stoked about the success we’ve had, as over 2,300 folks are now on the email list. If you haven’t already picked up the free student loan calculator, you should join them here.

Here’s this nice graphical representation from Google Analytics. I'd like to do work to increase the time spent on page and increase the number of pages visited. Those stats are a good proxy for engagement. If people are engaged, that means I'm creating value.

Is Student Loan Planner® the Vanguard of Student Loans?

I want to be known that way.

Attentive readers will have noticed that while we consulted on over $200 million of loans, we only generated $183,000 of revenue. That’s equivalent to a 0.09% “expense ratio” if you will. While we're not financial advisors for regulatory reasons, many of them charge 1% EVERY YEAR for their services. I've been told over and over that I'm vastly undercharging for our services, and that's intentional. If you give away more than you get back in value, my belief is that good things happen.

For those of you who don’t know what an expense ratio means, a mutual fund firm earns money by charging a percentage of your investments each year. Most charge 1%, but the not for profit investment firm Vanguard (that I used to work at) charges about 90% less than the standard industry fee at about 0.10% a year.

Hence, from a profit hungry standpoint, I’m failing because I’m not charging my clients “enough money.” Even highly ethical fiduciary financial planners are looking to lock in $2,000-$10,000 a year annual retainer fees, not bother with one off $200-$600 consulting arrangements.

We'll probably have to charge some sort of subscription based model in the future to stay in business. I don't particularly like recurring fees though, which is why I've resisted charging them. That said, being able to follow up whenever you want for $29 a month with an annual 30 min check in call is probably a steal, so it might be something we offer one day.

Many advisors who charge thousands or even tens of thousands are totally worth that fee. However, my goal with Student Loan Planner® is by focusing relentlessly on student loans, we can deliver amazing help at a great value that you’re going to want to tell everyone in the world about.

We might add additional products or services in the future. Our super low revenue per million dollars of loans advised might change too. Most of the 5 price increases we did this year were truly because my calendar was getting overwhelmed rather than just because we felt like charging more.

Big Changes for 2018

I had a choice to make near the end of 2017 because of how many people wanted help. One option was to continue to raise my consulting price until it hit uncomfortably high levels. The other option was to hire help and offer different price points for varying levels of debt. I decided to go with the latter.

I want that not for profit government employee with $100,000 of loans to still find our service affordable. At the same time, I want to maintain my calendar availability for the dentists and physicians with monster balances.

Those of you on my email list already know this, but I brought in a second consultant, Rob Bertman, CFA, CFP. He is helping me handle all the increase in volume so I have more time to create content for you.

If you’re looking for a plan on less than $300,000 in debt, Rob can help you, and he’s a steal right now since we’re charging less for his consult service. He also had a trading background on Wall Street with a top money manager in New York before moving to St. Louis for family reasons. I can't wait to get him firing on all cylinders with a packed calendar, and it seems like he's already well on the way there from intitial reception.

Our “Student Loans 101” course is an area for growth that didn’t contribute hugely to 2017 revenue. That makes sense, as why pay $199 for something you’d learn yourself when you could pay a few hundred more for and have someone who’s consulted for other professionals hundreds of times figure it out for you in only 1 hour.

I think the most compelling part of the course is the guarantee that you’ll save $10,000 on your loans projected over 20 to 25 years or your money back. I decided I wanted a guaranteed product and it couldn’t be the consult.

The only thing I need to do if you don’t like the course is press the refund button after you send me an email. And hardly anyone has done that, so it must mean that it's very good. Click that link above and check it out.

Goals for 2018

- Hit $500 million of debt consulted on over 1 calendar year

- Earn $500,000 in revenue from exceptional results for our community

- Save our clients a projected $100 million in 2018 (a ton of people are on the wrong repayment plans)

- Guide 2,000 clients on their options

- Help readers refinance $100 million of student loans and save millions in unnecessary interest payments

- End the year with 20,000 readers on our email list and make the messages we send fun, important, or hilarious (hopefully a combination of all 3)

I would love your feedback, comments, insults, encouragement, and whatever thoughts you have as I try to work my tail off to help you in 2018. The student loan world is sketchy, complicated, and ridiculous. Student Loan Planner® is here so you don’t have to go it alone.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

For refinancing 100k or more (bonus from Student Loan Planner®, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 9.89% APR

Variable 5.88 - 9.99% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.69% APR

Variable 4.35 - 12.68% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.