I love writing year in review posts because it lets you behind the curtain as to what's going on inside Student Loan Planner®. My wife says I sound like a broken record whenever I say, “we had a record month helping borrowers,” but it's a fun refrain.

There's nothing fun about student loan debt though. That's why our team is passionate about helping folks like you get out of it.

So how did we do with that goal in 2019? If you want to read how we did in 2018, I'll be pulling comparisons from that post.

Consulting Stats for Student Loan Planner® in 2019

Here's how many clients we've had in each year

- 2016: 125

- 2017: 607

- 2018: 876

- 2019: 1,608

We advised about 1,600 clients in 2019. That's about the total from 2016, 2017, and 2018 combined.

The total debt for our clients this year? Just over $387 million.

We're actually closing in on having made 1 on 1 plans for borrowers with a collective $1 billion of student debt since we launched SLP in September 2016.

For 2020, I'd like to get to the point where we've advised $1 of every $1,000 dollars of student debt in America. That would mean we hit $1.6 billion of student debt advised. We're at about $825 million currently.

So that means our 2020 goal for consulting is to advise about 3,000 to 3,500 clients. We're off to a good start in January so far.

We Help More People Than Just Clients Who Hire Us Directly

If you include all the humans that interact with our free blog content, the podcast, social media efforts, and calculator tools, my goal is that Student Loan Planner® will change the lives of 10% of all student loan borrowers in America.

We're probably at about 2% so far based on the number of borrowers who've interacted with us in some way.

That's the power of the internet and a passionate team that put borrowers first.

Refinancing Stats for 2019

It's more difficult to tell how we did here, since we partner with lenders who readers use to refinance their student loans.

I have a good idea of how many loans we refinanced in 2019, but it's not exact.

In 2018, I think we refinanced around $75 million in student debt and in 2019 I think we were closer to $150 million.

We were also able to increase referral bonuses with Laurel Road, Earnest and Credible, among other lenders with some of the leverage we got from sending over more business.

We are one of 3 major sites that I know of that offer refinancing bonuses at all. Most prefer to keep the extra money for themselves.

Refinancing is perhaps our biggest conflict of interest. When someone uses our links, it's a lot easier way to make money than hop on the phone for an hour and try to find the best solution regardless of what it is for your student loans.

But if we do the right thing, we can minimize the conflict of interest. That's one reason I wanted cash bonuses for readers in the first place, is so no one has too big a temptation to tell someone to refinance when it's not in their best interest.

Consultants that work for Student Loan Planner® have no economic incentive to recommend refinancing. They're paid solely from the consulting revenue, which is intentional.

I've also gotten more conservative in who I tell to refinance in 2019 compared with 2018. Now I saw 1.5 times your income instead of 2 times your income.

Thank you to all of you who used our refinancing links in 2019. It allows us to continue providing the best bonuses and best deals on the web when you choose to use our site.

How Many People Checked Out Our Blog Posts in 2019?

I got my start blogging randomly about personal finance and never getting more than a couple hundred page views a day.

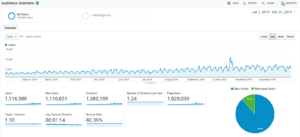

Having more than 1 million readers in 2019 is humbling, but I didn't have as much to do with it as our team did.

Our traffic more than tripled from 2018 (a little over 500,000 page views to 1.8 million), in large part because we professionalized the content team and brought on personal finance writers.

Our direct and search traffic dwarfed our social media traffic. I'm curious if we'll ever be able to gain traction there. Maybe I need to figure out how to fuse funny cat videos with student loans.

I expect in 2020 we'll focus on making our articles even higher quality rather than drastically increasing the total number of published posts.

If you ever have ideas about what we should write about, I always love hearing them. After all, the whole point of this site is to help you live your best financial life.

Most Viewed Posts of 2019

Here's our top 10 most viewed posts from 2019.

- Top 40 Tips to Use PSLF – 48,280 views

- Are You Eligible for Closed School Discharge? – 42,616 views

- What You Should Know About the Navient Lawsuit – 38,452 views

- 13 Best Banks to Refinance Student Loans – 38,169 views

- FedLoan Cost Us $20,000 – 37,629 views

- Get a Student Loan Plan – 37,002 views

- It's Now Dangerously Easy to Get into Pharmacy School – 33,795 views

- Here's the Top 11 Grants to Avoid Student Loans – 33,753 views

- The Best Free Student Loan Calculator Anywhere – 30,944 views

- Student Loan Forgiveness Guide for Nurses – 27,960 views

This shows the social mission of Student Loan Planner®.

Our clients primarily have six figures of student debt, but they also have enough income to get help to figure out what to do.

A lot of people aren't that lucky. That's why it's nice to see the closed school discharge and servicer struggles articles doing well.

Of course our core articles about how to get help with PSLF, student loan planning, and refinancing all did well too.

From what I've heard about pharmacy school in 2019, I would short the PharmD degree if it was a stock. It seems like the next recession we have could cause an implosion that labor market.

It also makes sense that readers were looking for ways to avoid student loan debt with our top 11 grants article. We're certainly in support of that.

How Did We Do with 2019 Goals?

Here's the marks I set below for 2019.

- Hit 100k users from Google each month

- Growing the podcast to 5,000 downloads per episode

- Get 20k users from social media each month, 2k of which are from Pinterest

- Hit 20,000 email subscribers

- Hit 2,000 of YouTube subscribers

- Advise $500 million of student loan debt

- Refinance over $200 million of student loans

- Hit $1 million of revenue and $400,000 of profit

- Save at least one life through our suicide prevention and mental health efforts

We hit 4 of the 9 goals, and some of these were very ambitious, so I'm happy with that.

You can probably put 2 and 2 together and figure out which ones we achieved.

Without going into details, I'm thrilled to say I think we might have saved a life last year, so that's something that makes everything else worth it alone.

Our survey that found 1 in 15 borrowers had considered suicide due to their student loans started a national conversation.

Some of our content on mental health caused some people in very desperate situations to contact us and we were able to refer them to the appropriate crisis hotlines and resources and to explain why their debt was not a death sentence.

Revenue and Expenses for 2019

I never expected quitting my job as a bond trader and being a twenty something “early retiree” would lead to me to doing something I love while also earning more than I did back in the day.

The lesson here is that if you have a dream of taking a risk with your career, you should jump at the chance.

I won't disclose our revenue and expenses like I have the previous two years. They were significant and if you think about the number of clients we served and how it increased along with the amount of loans we refinanced, you can figure out that we have nothing to complain about.

Our margin was about 44%, which is low for a blog.

But it's high for a service business.

Truth be told, we are somewhere in between those 2.

I made substantial investments in growing the SLP message in 2019.

The scary thing is that if student loans change significantly in 2020 or 2021, those investments could all be for naught.

That's also one of the reasons bigger competitors are terrified of this space. Student loan rules change rapidly and suddenly years of work could evaporate, so you have to be extremely nimble to survive.

My friends like to joke that it's very unlikely that Bernie wins, but if he did forgive student loans we'd obviously need to write about something else.

That's kind of like how ethical accountants must think about the unnecessarily complicated tax code though. It would be a good thing if taxes were far easier to do and if there were no loopholes so everyone would know what they were supposed to pay.

Yet that's not the world we live in because of politics. So as long as taxes are complicated, accountants will be needed.

Time will tell if that analogy carries to the student loan world. My goal is to exist for as long as student loans cause virtually everyone severe anxiety.

How Did I Do on My 2019 Predictions?

Here's what I said we'd do in 2019 last year:

- We'll add more faces on the site – We added two new consultants and half a dozen new writers, so we definitely met this mark.

- I'd like to answer fewer emails – I'm still not doing great here because I like talking to you and email is one of the easiest ways to do that. We do have some assistant help now and it's made a big difference.

- Take another stab at an online course – Our Student Loan Planner® Investing Course was unexpectedly one of the most successful things we did in 2019.

A Lot of Other Student Loan Sites Faltered in 2019

2019 was not a good year for big student loan sites overall.

Some were acquired and lost some traction from the loss of talent that resulted.

Others might have been hit with penalties from aggressive strategies to build up authority in the niche.

My theory is that as long as we keep you the borrower at the center of what we do, we'll be ok.

I think it's fair to say that Student Loan Planner® is now one of the top 5 student loan websites on the internet in terms of where people get their information.

That's happening because of you telling your friends about us, leaving comments, and trusting our advice, so thank you.

Our Goals for 2020

Now I can set some goals for 2020

- Get to 500,000 monthly visitors from search traffic

- Hit 5,000 downloads per podcast episode

- Reach 120,000 annual users from social, including 2x the Pinterest and 10x the YouTube traffic

- Create content where you are the hero

- Hit 50,000 email subscribers

- Hit 10,000 YouTube subscribers

- Reach the point where we've advised 0.1% of all student debt in America by the end of 2020 (need to advise about $800 million more to get there in 2020)

- Refinance $400 million of student loans

- Triple our 2019 revenue while continuing to invest in the business

- Host an in person meetup with all of our team (as a virtual workplace, our ~ two dozen folks live all over the country and it'd be great to have everyone together at some point in 2020)

- Save at least 5 lives this year

Bonus: Help You Achieve Your Goals for 2020

I got this email from a reader a couple weeks ago and I think it perfectly highlights why we exist as a business.

Thanks to Student Loan Planner®, we did the following in 2019:

- Sold an expensive house

- Paid off one car

- Paid off $16,000 in consumer debt

- Saved about $60,000 in retirement accounts

- Bought a new house

- Paid substantially less in taxes, which beyond pays for the $600 fee I paid to consult and the course fee

- Have plans to buy real estate investment property

- Saved an additional $10,000 in a post tax brokerage account

- Have an emergency fund (and had the down payment for our new home)

- Gained PEACE OF MIND with objective data to keep me grounded

- Hacked travel rewards to get 4 future trips for free

- Paid for a couple emergencies with cash

This is what we need to do more of.

I want to help you achieve what you want in 2020. If we do, then I think all our goals will take care of themselves.

Thank you for trusting us! I don't take it lightly.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

For refinancing 100k or more (bonus from Student Loan Planner®, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 9.89% APR

Variable 5.88 - 9.99% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.69% APR

Variable 4.35 - 12.68% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.