This post is supposed to be about the business impact of Student Loan Planner® in 2021, but it's hard to separate business from personal life after the year we all had.

In 2020, I thought I hit my breaking point. But then Pfizer announced a vaccine! My wife got it early in 2021 as a healthcare provider, and I was excited at the prospect of getting everything back to normal after a simple jab.

From a business perspective, I thought the student loan pause would end September 30, 2021, and maybe we’d see some targeted student loan cancellation. But a bunch of new Greek letters came out of nowhere and COVID punched us all in the face.

I’m not sure where you fall on the interpersonal spectrum, but I’m an extreme extrovert. I love people, and I love helping them. Needless to say, two years of social distancing have taken their toll on me, mentally. You’ve probably been through a lot, too, despite the past two years being quite decent financially for most people.

So, how did we handle 2021? You can compare this year to how we did in 2020, 2019 and 2018. I'll be pulling comparisons from those posts.

First, we tried to prepare for the onslaught of clients needing a plan

Early in 2021, Student Loan Planner® added two new consultants. I worried about messing with the team dynamic at the time because our other consultants had been so fantastic. But both of our two new team members exceeded my expectations.

The stressful part of running Student Loan Planner in 2021 was that I had no idea how to plan from a staffing perspective. Do I add four consultants because of the expectations that we’ll be busy in the future? Or do I not add any, thinking that student loan pause extensions will cause demand to decrease?

Luckily, we had an uptick in demand compared to 2020, but nothing so extreme that we were completely unable to meet it. The only failure here is our wait time to get an appointment on average is about three to four weeks now compared to almost no wait in 2020.

We expect to see many clients who procrastinated on getting help until payments restart. On top of this, we know that many borrowers will also wait until the last second to get help managing the PSLF waiver, which expires October 31, 2022.

So, we’re adding one to three new consultants to the team to help as many borrowers as we can. We’ve also increasingly been asked to speak for hospital systems interested in maximizing the PSLF waiver’s benefits for their employees.

Editor’s note: The PSLF waiver expired on October 31, 2022. However, the IDR Adjustment has many of the same benefits and can positively impact many borrowers. The IDR Waiver, or IDR Adjustment, is a one-time account adjustment to give credit for qualifying payments to borrowers on income-driven repayment plans and under PSLF.

Hence, we started 2021 with six consultants, and we’ll likely have nine consultants shortly after the start of 2022.

Then, we refinanced more debt than ever before

The last time we refinanced a ton of student debt was March 2020.

Interest rates were falling like a rock, and refinancing student debt seemed to be the rational thing to do to lock in a low-interest rate for the long term.

Of course, no one expected the President to pause all federal student loan interest.

In 2020, we had a monster first quarter, followed by a steep decline, and then a strong recovery.

In 2021, more readers refinanced their loans through Student Loan Planner® than ever before. The total sum is somewhere in the nine figures of loans borrowers have been able to refinance.

The majority of this is probably private student debt, as almost any borrower with private loans has been able to find a better rate in 2021 because of rock bottom interest rates combined with rock bottom credit risk.

We even saw many borrowers refinance federal loans in late 2021, as they became worried that interest rates would soon begin a steep rise.

As the pandemic eventually recedes, I could easily see refinancing interest rates increasing significantly — 2022 could be a big year for borrowers looking to lock in record-low rates for the long term.

After 27 extensions of the student loan pause, we added new ways to save readers money

Student loan borrowers have been through five extensions of the student loan pause. I joke because, while it’s been good for our readers, it has been very difficult to plan anything from a business perspective.

So, we asked ourselves, “Why not help out our readers in other areas of their lives while we have some extra time on our hands?”

In 2021, we added doctor mortgages, private student loans for school, and practice loans to our suite of products we help readers get better deals on.

Another way we’ve made a difference is getting the best cash bonuses anywhere on the web for student loan refinancing.

We are trying to take similar actions in other spheres of the financial world, although sometimes regulations prevent us from doing so (such as in the case of doctor mortgages).

I think these regulations are ridiculous because I view them as an anti-competitive way to prevent competition on price. Hence, my goal is to figure out ways to get unique and special deals for readers that they would have missed otherwise.

To that end, we’ve connected readers with 0% down mortgages and promo rates on practices as low as 1%.

We’ve also connected readers with seven figures of loans to fund school.

Expect another huge category of financial service to come in 2022.

Consulting stats for Student Loan Planner® in 2021

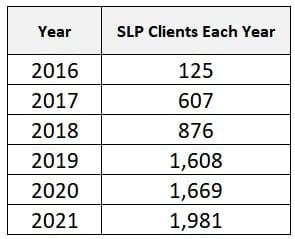

We advised over 300 more first-time clients than last year. Although our repeat client business is relatively low, I view that as a good thing — it means we put together great plans the first time and most clients do not need our services again.

That’s one differentiator for our business compared to others. I’m not trying to maximize revenue by signing up everyone for a recurring monthly membership for a service they don’t need.

Financial planners and others in the financial industry thought I was a little crazy charging a few hundred for a student loan plan when you can earn $10,000 simply by investing $1 million for a client every year.

But it’s really exciting to make a difference. I didn’t quit bond trading to switch to another area of financial planning that would allow me to make a lot of money off clients who had already made it.

The ‘marginal benefit’ of an hour spent with our clients is life-changing. It can get them on a completely different trajectory than what they would have been otherwise.

And our consultants can work as little or as much as they want. Some of them earn six figures by doing a lot of consults, and all of them do so many plans that watching them deliver a customized plan to a client is like watching an experienced cellist nail a concerto.

Financial planners might do five student loan plans a year. Our consultants sometimes do 50 by themselves in a month. It makes us highly specialized and allows us to deliver expert advice that changes lives even more.

Refinancing cash bonuses to readers

We have now delivered millions of dollars in cash bonuses to readers that we could have otherwise pocketed — that’s because the bonuses we pay come out of the advertising fees we would normally earn.

That’s one way we’ve tried to be different. It’s a lot more fun to sell 100 widgets at a steep discount than three widgets marked up a ton, so that’s the way we’ve run our refinancing business.

We frequently receive pressure from businesses and websites all over the internet that wants us to stop doing this because the deal is TOO good, and it eats into their margins.

We could not do that without readers like you telling your friends about the bonuses we’ve got. So, thanks for telling your friends about our refinancing deals and for taking advantage of them yourself if you have.

How many people checked out our blog posts in 2021?

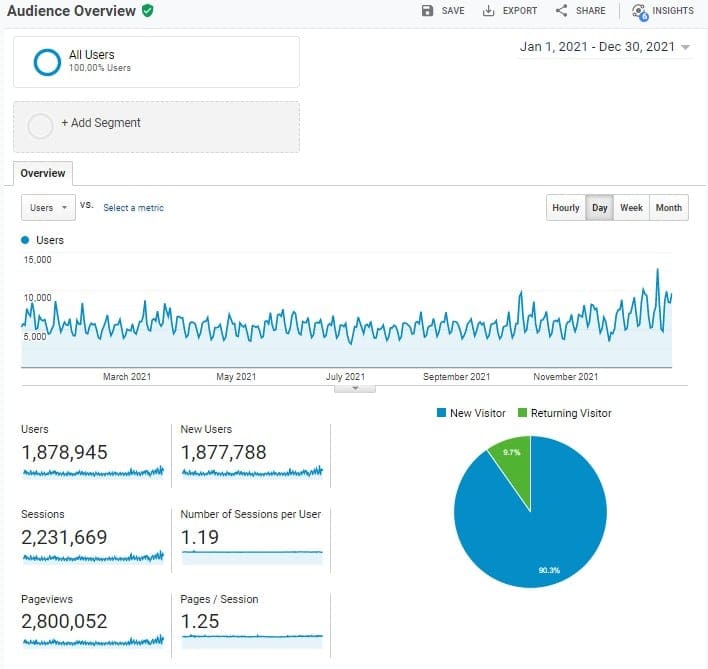

Traffic declined in 2021 compared to 2020 by about 28%, but we still helped 1.87 million readers who visited the site. That makes a lot of sense that our traffic declined! How many different ways can you say “student loan interest and payments are paused again.”

In all seriousness, it’s not how much traffic you have, but how well you help the people who show up.

A lot of the additional traffic from 2020 was “public service traffic.” In other words, it was people looking for steps to reclaim a seized tax refund or how to ask for money back from their servicer for overpayments they made during the first couple months of the payment pause.

These folks generally did not become paying clients, and that’s totally okay. We operate as a mission-driven company, so I hope we’re able to provide a lot of free help to folks like that in 2022 (if payments do start again in early May as expected).

Sometimes I get emails from people that say something like “you guys are jerks! Everyone just wants to take advantage of me and y’all want to charge me hundreds of dollars for just an hour on the phone!”

If all we did was talk for an hour on the phone, no one would hire us, and our reviews would be awful.

I love to point folks like that to our free resources that they can use if they can’t afford our help.

And most people are really grateful that someone out there is trying to show them a path out of student debt that doesn’t involve living in a cardboard box like many personal finance personalities preach.

Most viewed posts of 2021

Here were our top posts of 2021:

- Highest Paid Types of Lawyers (129,487 views)

- Biweekly Student Loan Payments Get You Out of Debt Faster (72,921 views)

- Student Loan Forgiveness Scams (65,586 views)

- How is the Pharmacist Job Outlook? (56,772 views)

- How to Get Navient Forgiveness (40,644 views)

- Refinance Student Loans with These 9 Companies (38,793 views)

- Top 10 Cheapest Medical Schools (35,370 views)

- Hire a Student Loan Consultant for Your Plan (33,238 views)

- Guide to Public Service Loan Forgiveness (30,530 views)

- Top 10 Cheapest Dental Schools (29,683 views)

That list is always unpredictable to me. Clearly, people want to know about cheaper options for professional schools, and the main pages on our site about refinancing and loan forgiveness also tend to perform strongly.

Podcast downloads in 2021

If our blog post traffic in 2021 was explained by “how many ways can you write, “student loans are still paused,” then our podcast downloads would be explained by asking, “how many different ways can you speak “student loans are still paused”?

I’m kidding about both. If you told me in 2018 that someday we would have almost 2 million people visit our blog and hundreds of thousands of podcast downloads, I would have fallen out of my chair.

It’s stunning to me that podcast downloads grew in 2021 despite borrowers technically not needing to know anything for the entire year of paused payments and interest.

More charitably toward what we do, borrowers want clarity, and this pause has bought people time to think about how they want to approach their debt.

And just because the debt is paused does not mean the anxiety goes away. It’s still very much there for clients who, in some cases, have had more money to invest in advice due to paused payments.

The podcast continues to attract a very niche audience, and remember my earlier point, it’s about how you serve the folks who show up, not how big the listenership is.

I think a niche podcast with 100 downloads an episode about a highly technical topic probably has more business value than a true-crime podcast with 30,000 downloads an episode.

Even though there’s a lot of podcasts out there, you don’t see enough podcasts about niche topics.

Here are our top 5 most downloaded podcast episodes in 2021 (subscribe by searching for “Student Loan Planner” on Spotify or Apple Podcasts):

- Fired Servicers and PSLF Changes (published 10/05/21)

- Six Student Loan Loopholes Borrowers Haven’t Heard (published 09/08/21)

- How to Invest Even If You’ve Never Done it Before (published 07/20/21)

- The Future of PSLF (published 09/02/21)

- My Thoughts on Biden’s Student Loan Extension (published 01/27/21)

How did we do with 2021 goals?

Every year I set goals for our business, and we hit some and miss others.

Here are our 2021 goals and how we did the past year:

- Get to 300,000 monthly visitors from search traffic (missed it by about half)

- Hit 5,000 downloads per podcast episode (we were stuck around 2,000 to 3,000)

- Reach 10,000 subscribers on our YouTube Channel (We’re about half that, subscribe here)

- Hit 50,000 email subscribers (we did it!)

- Reach the point where we've advised 0.1% of all student debt in America (basically hit that!)

- Refinance $200 million of student loans (we probably hit that, although it’s hard to tell exactly)

- Equal or surpass our 2020 revenue while continuing to invest in the business (revenue was up nearly 50% despite student loans being paused the whole year)

- Host an in person meetup with all of our team (We did it! We sent a lot of our team to a financial blogger conference in between the worst of delta and omicron)

- Save at least 10 lives this year through our content that promotes mental health wellbeing (we had thousands of visits on our mental health content, so I bet we saved at least one life!!!)

Revenue and expenses for 2021

Our margin was very similar this year compared to last, at around 57%. That’s well above the target margin of 30% that my wife and I agreed on when I started Student Loan Planner.

I hope this example will help at least one other business owner out there. The eternal battle of a business owner without outside investor bosses is how much cash you should take out of the business versus investing back in it.

We’re investing a lot back into growing the company because I think it will help us achieve our mission to help as many borrowers as possible. That said, I’m not going to throw money away if I can’t think up smart ways to spend it, so that’s how we ended up with a margin that was “too high” relative to our target.

I think 2022 might be the year we make a lot more investments to reach a lot more borrowers.

Part of this is time-limited urgency with programs like the PSLF waiver that have a limited window to take action. With millions of borrowers potentially being eligible, I’d like to reach as many of them as possible.

From what we know about how effective servicers and the government is at helping borrowers, there are likely at least 1 million borrowers who will miss out on getting extra credit for PSLF this year. That’s extremely motivating and is a good reason to go after our mission hard in 2022.

On the refinancing side, millions of borrowers have private student loans and are paying too much in interest because they haven’t checked refinancing deals in the past six months. We want to help them save money, too.

Hopefully, my experience growing a business might inspire you to take a big risk in your career. It doesn’t have to be being a fellow business owner though (although it might be).

Whether it’s asking for a big raise, taking a chance on a new job, renegotiating for more vacation days, or launching a new venture, I hope all the instability of the workplace in 2021 inspires you to take a big risk in 2022 — it will probably work out better than you think it will.

Embracing an uncertain future instead of worrying about it

I joked to our team last week, “only 126 days until President Biden extends the student loan pause again.”

We exist to help you. If student loans are all canceled tomorrow, then I’ll find something else to do.

But Washington is dysfunctional. It’s unlikely we’ll see big changes on student loans because both parties have helped to break the system, and they don’t know how to fix it.

Democrats’ solution is a cancellation, which doesn’t fix the high cost of school. Republicans’ solution is capping borrowing limits and involving the private sector more, which would demolish access to higher education for many communities.

Sometimes people on Twitter get mad at me and call me names like “loan shark” or “profiteering a**hole” because of being involved in the student loan industry.

I liken working on student loans to the job of a cancer doctor. If cancer was abolished tomorrow, that would be great! The cancer doctors would be out of job, but you shouldn’t cry for them because they’ll figure out something else to spend their time on.

But until that happens, people really need good cancer doctors.

In early 2020, I literally thought we were going bankrupt. Our advertising revenue fell 95% in some categories, although our consulting business grew during that time as people rushed to get advice on how to maximize the student loan pause benefits.

Our 2021 revenue was triple that of our 2019 revenue and 50% more than 2020 revenue. That is shocking to me. A year in which no payments or interest happened on federal student loans was somehow three times as good as a year in which loans were normal.

That’s why they say past performance is no guarantee of future results, because nobody really knows anything about what the future holds. But uncertainty shouldn’t stop us from making goals and dreaming about the future. So now, let’s talk about those goals for the future.

Our goals for 2022

- Hit 300,000 monthly visitors from search traffic as borrowers seek out help (I’m repeating the goal from last year assuming loans actually restart this time.)

- Hit 5,000 downloads per podcast episode (I’ll have to tell a lot of dad jokes to attract that kind of download milestone 😊)

- Publish content on YouTube that changes lives (measured by our watch time doubling in 2022)

- Hit 100,000 email subscribers (the best content happens in our weekly newsletter, so hopefully we can share that with more people)

- Help 3,000 clients in 2022 with their first student loan plan

- Refinance $300 million of student loans (this goal is pretty aggressive given that interest rates are near record lows)

- Hit a 30% profit margin but invest more than we did in 2021 to reach a bigger audience because of the limited opportunities available in 2022 to borrowers like the PSLF waiver

- Increase revenue 50% by being laser focused on our mission of helping student loan borrowers eliminate debt anxiety from their lives and grow wealth

- Connect at least 500 readers each to our new product lines in private loans, practice loans, doctor mortgages, and a surprise service in 2022 that we will announce at a later date

- Promote mental health for borrowers as student loans make a return at some point in 2022

- Help 1,000 public servants get closer to forgiveness under PSLF

- Continue to retain and attract our awesome team members at Student Loan Planner®, allowing us to delight readers and clients with the best service

Be kind to yourself in 2022

My last goal is to simply survive 2022. To be vulnerable for a second, 2021 was the first year in my life that I decided to try counseling, thanks to the many new online services out there.

I even had panic attacks at times. I do not recommend being an extreme extrovert to anyone these past two years. Social distancing, not being able to see people’s faces because of masking, and not being able to gather in person have been devastating to me.

And that’s not minimizing other people’s experiences of the greater devastation of losing people. It’s just acknowledging all the awfulness of this virus.

Maybe you had a good 2021 and didn’t have too many obstacles. If so, I’m glad.

But if you struggled in 2021, know that I struggled too. It stinks not living in a normal time. I believe 2022 is going to be a lot more normal than 2021 because it must be.

I struggled immensely with anxiety in 2021, with each new virus wave sending me to a bad place mentally.

I’m a lot more aware now of the kind of emotions our clients go through with student loans. I don’t think I fully appreciated the mental strain student loans can take on a person until battling anxiety issues myself this year.

At some point, the student loan pause that has been so good for so many is going to end. And if virus cases are anything south of 200,000 a day in early April, this current pause will be the final one.

That means a lot of people will need the help of a business like ours.

I’m grateful for all the lessons I’ve learned this year. They’ll help me do a better job of empathizing with borrowers in 2022 as we help even more folks fight back against student debt. And thank you so much for telling your friends about Student Loan Planner®. It’s the best compliment we get for our efforts at helping borrowers.

May 2022 be filled with happiness for you, and if you’re a fellow extrovert I hope we get to have a socially undistanced year.

Travis

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

For refinancing 100k or more (bonus from Student Loan Planner®, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 9.89% APR

Variable 5.88 - 9.99% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.69% APR

Variable 4.35 - 12.68% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).