Savannah College of Art and Design (SCAD) prepares talented minds for creative professions around the globe. It has more than 40 majors and 70 minors with opportunities to study in Georgia, Europe and online.

But earning a SCAD degree can be expensive, as it offers limited merit-based financial aid and has a high-ticket cost. Many families end up taking on a large debt load that includes a mixture of federal, private and Parent PLUS Loans.

Whether you’re considering attending this art and design university or you already have loans for a SCAD program as a student or a parent, it’s important to understand how quickly student debt can add up. Keep reading for smart strategies to pay off Savannah College of Art and Design student loans.

Key data for Savannah College of Art and Design student loans

The Department of Education’s College Scorecard provides reliable information on college costs, graduation metrics and post-college earnings. Based on its most current data, here are some important statistics related to the debt that students and parents carry in order to attend this expensive university.

| Debt stat | Student borrowers | Parent PLUS borrowers |

|---|---|---|

| Median federal debt | $24,500 to $27,000 | $91,960 |

| Borrowing rate | 47% of students | 15% to 25% of parents |

| Typical monthly payment* | $234 to $258 | $989 |

Although borrowers with Savannah College of Art and Design student loans graduated with a median federal debt of roughly $25,000, it’s likely that many of these students carry a much larger private debt balance.

College Scorecard reports that the average annual cost for tuition, living costs, books and supplies and fees is $42,355 (after receiving Savannah College of Art and Design financial aid). If we use this data point for a four-year student, that’s $169,420 that a student must come up with outside of grants and scholarships.

Federal student loans would only cover a portion of this cost because there are annual and aggregate student loan limits. For example, dependent first-year students can borrow up to $5,500 for federal subsidized and unsubsidized loans combined. This number jumps to $9,500 for independent students (and for dependent students whose parents are unable to obtain a Parent PLUS Loan).

So, this large financial gap is likely covered by private student loans or by relying on a parent to take on additional debt to fund their child’s education.

What’s the deal with Savannah College of Art and Design Parent PLUS Loans?

Savannah College of Art and Design Parent PLUS borrowers have an average $91,960 of debt. Think this high debt burden for parents is normal? It’s not.

The Wall Street Journal determined that parents of recent graduates of four-year colleges took out a median $25,000 or more in Parent PLUS Loans.

SCAD has one of the highest Parent PLUS Loan balances in the country — landing itself in the top five schools for the largest parent debt burden. Why is this?

Considering many private lenders won’t approve undergraduates for a large loan, SCAD parents are shouldering a huge financial burden. Although this decision is done with best intentions to benefit their children, it could affect parents long into retirement years.

If you’re a parent considering taking out Savannah College of Art and Design Parent PLUS Loans, think about this: the average loan payment for SCAD parents is $989. That’s almost a grand per month that could be used to set yourself up for retirement by investing it or paying down existing debt.

After all, you can’t take out a loan to pay for retirement. It’s best to look for alternative ways to support your child during college.

How to manage SCAD student loans

With various repayment options and loan forgiveness opportunities (e.g. federal, state and profession-based), you need a solid strategy for paying off your Savannah College of Art and Design student loans.

The best repayment strategy will depend on whether you have federal or private student loans. But it should also include other important factors related to your career and personal life.

Here are some repayment strategies to consider when paying off your SCAD student loans.

Choose an income-driven repayment plan to cap your monthly payments

Students with federal student loans have access to flexible income-driven repayment (IDR) plans. If you’re struggling to make payments, an IDR plan will cap your monthly payment at 10% to 20% of your discretionary income. Then, after 20 to 25 years you’ll have an open door for loan forgiveness on the remaining balance.

IDR plans include:

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Based Repayment (IBR)

- Income-Contingent Repayment (ICR)

Each plan has its own payment calculation and forgiveness guidelines. But here’s how an IDR plan could benefit SCAD students.

Let’s say Dusty has $40,000 in federal student debt with an average interest rate of 6%. He’s married with two children and has an adjusted gross income of $50,000.

By enrolling in PAYE, Dusty can keep his monthly payment as low as possible and use loan forgiveness to his advantage if desired.

As the Student Loan Planner® Calculator shows, Dusty’s monthly payment would start out at $85 and adjust each year based on his discretionary income and family size. This is several hundred dollars less than the $444 he’d pay on the 10-year Standard Repayment Plan.

Note that his payment under REPAYE would be the same, but he’d end up paying more since it takes five additional years to become eligible for forgiveness.

Additionally, if Dusty chose to work in the public sector — say for a city or nonprofit organization — he could pursue Public Service Loan Forgiveness (PSLF). His PAYE payment would stay the same, but his remaining balance would be wiped away tax-free after 10 years of qualifying payments. In this scenario, Dusty would only have to pay back a total of $11,750.

Parent PLUS borrowers can access IDR plans by consolidating

Unfortunately, Parent PLUS borrowers aren’t eligible for these federal IDR plans. But a Direct Consolidation Loan can give you access to the ICR plan which limits your payment to 20% of your discretionary income.

Parents can further reduce their monthly payment by using the Parent PLUS double consolidation loophole to become eligible for the remaining IDR plans, including loan forgiveness eligibility.

Refinancing can lower your interest rate or monthly payment

Refinancing is a great way to lower your interest rate, reduce your monthly payment or get better loan terms. But it isn’t always the best route, depending on what type of loans you have and what your overall financial goals are.

Keep in mind that refinancing with a private lender causes you to lose the benefits and protections that come with having federal student loans, such as loan forgiveness or cancelation.

Although loan cancelation isn’t a guarantee, there’s a decent chance that many SCAD student loan borrowers could qualify for the $10,000 forgiveness that’s currently being proposed. So, you might want to keep some of your federal student loans to reap any loan cancelation benefits.

But if you’re making good money and plan to pay back your student or parent debt in full, refinancing can help you fast-track repayment and save you a lot of money.

Let’s say Isaiah took out $50,000 in Savannah College of Art and Design Parent PLUS Loans with an average interest rate of 7%. He could possibly transfer his debt into his daughter’s name, but because he’s in a financially stable place, he’d prefer to pay off the loans without burdening his child.

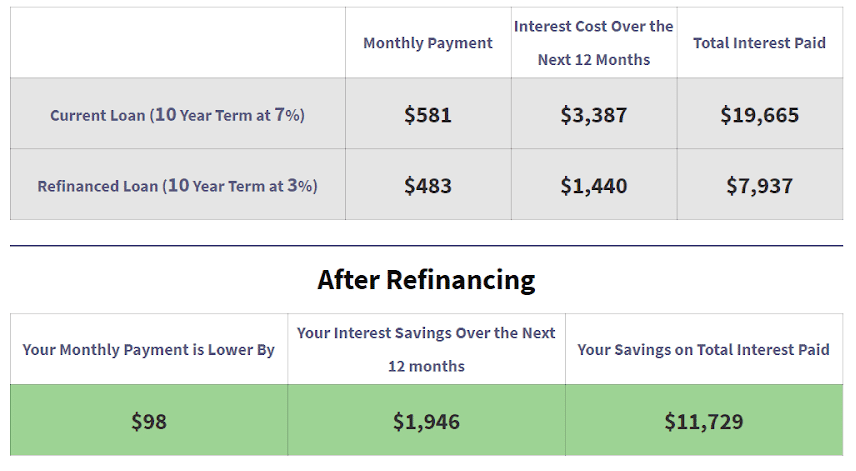

Depending on Isaiah’s goals, he could choose to refinance at 3% with a 10-year term.

This would save him roughly $100 per month and $11,729 in interest over the life of the loan.

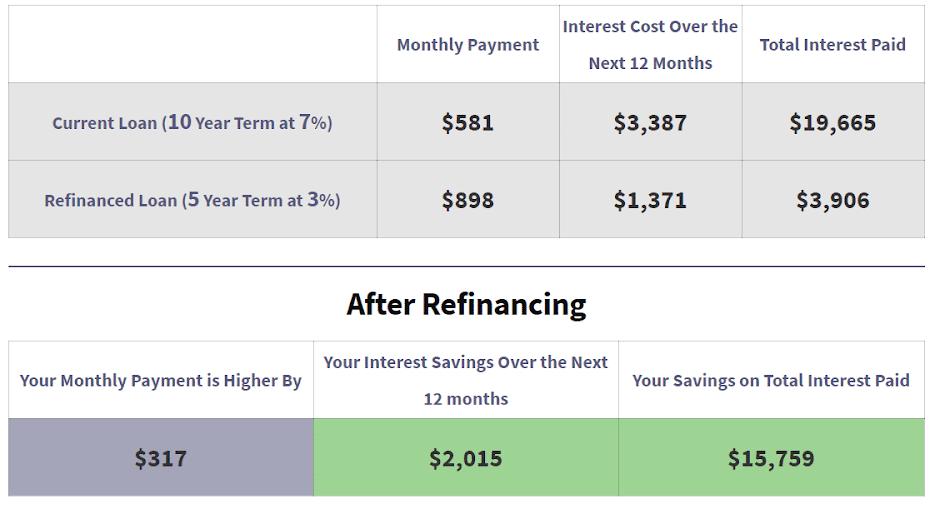

But if Isaiah’s goal is to pay off his loans as quickly as possible, he could refinance to a shorter 5-year term.

His monthly payment would be $317 higher than his current Parent PLUS Loan payment, but he’d be able to pay off his full balance within only five years — saving him $15,759 in interest.

Use our Refinance Calculator to see how much you could save. And check out the huge refinancing cash-back bonuses you can score when you use offers from our partner lenders.

Biggest piece of advice: Get a custom plan for your student debt

Many SCAD students and parents end up with a hefty student loan balance between federal and private student loans. It can leave many families struggling to figure out the best way to pay off their debt without making insane sacrifices.

Loan servicers will provide basic information and guidance for paying back your Savannah College of Art and Design student loans. But many times, it isn’t the best advice or entirely accurate. It certainly doesn’t factor in any of your other financial or career goals, all of which should also drive your repayment strategy.

Schedule a consult and let our team of student debt experts create a custom plan for you or your parents.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, IDR, or refinancing (including the one lender we think could give you the best rate).