What is the worst-case scenario for the SAVE plan lawsuits now that President Trump has won a second term in the 2024 election? How can you protect yourself from that worst-case outcome using a tax filing strategy?

To answer that question, you must first know that the Saving on a Valuable Education (SAVE) plan was created from the Income Contingent Repayment (ICR) statute, which says that the ‘Secretary of Education can make IDR plans no more than 20% of income and no more than 25 years until forgiveness.’

That ICR law is how President Obama released the Pay As You Earn (PAYE) and Revised Pay As You Earn (REPAYE) income driven repayment (IDR) plans without needing Congress during the 2010s.

To stop the SAVE plan, plaintiffs bringing the legal challenge are throwing the kitchen sink of arguments at it. One argument that would stop SAVE is that the ICR statute itself has been illegally applied for years. That could have wide-ranging consequences.

We’ll show what this potential worst-case scenario would look like and why tax filing strategy could make all the difference.

What happens if SAVE was ruled to be unconstitutional along with the ICR statute?

If that occurred, the courts would say that SAVE is illegal because the ICR statute has been used illegally in the past.

This is the worst-case scenario because it would also bring down the REPAYE and PAYE plans, leaving the only remaining option for loan forgiveness as the Income Based Repayment (IBR) plan.

Recall the version of IBR you would be on depends on if you had at least one loan on July 1, 2014. If you did, then you would be on the “Old IBR” plan, and if you borrowed your first loan after that date, you’d be on “New IBR,” which effectively has the same definitions as the PAYE plan.

The IBR plan cannot be touched legally because it is written into law with precise language that a conservative-leaning court could not overturn.

In contrast to the ICR statute, which says “no more than 20% of income,” the IBR statute simply says “10% of income or 15% of income depending on when you first borrowed.”

The huge problem, though, is IBR requires a partial financial hardship to qualify.

A partial financial hardship, PFH for short in this article, is not what it sounds like. You have a PFH if and only if your required payment on IBR (based on your most recent income tax return) is less than the Standard 10-year plan for the loan amount you have.

How filing your 2024 tax return the wrong way could make loan forgiveness impossible

If the worst-case SAVE scenario came to pass, many households could become ineligible for forgiveness simply by filing their taxes incorrectly.

These mistakes could include:

- Filing jointly instead of separately

- Failing to include form 8958 in a community property state

- Forgetting to file an extension to use a lower income

- Filing your return too early based on when your recertification date is

- Failing to switch plans before you would no longer be eligible

Here’s an example of the stakes of your tax filing status in 2024 and how making the right decision could protect against this worst-case SAVE plan scenario.

Physician pursuing PSLF who could lose it if they file joint

Pretend that Christy is an OBGYN in California who started med school in 2012 and residency in 2016. She finished her training in the summer of 2020, and she’s since been earning $275,000 a year at a non-profit hospital for several years. She has $200,000 of student debt.

She had nearly 8 years of PSLF credit going into spring 2024 when the SAVE plan forbearance put a hold on her credit for PSLF.

She appreciated the $200 a month payments she had due to multiple extensions of the student loan pause and IDR recertification dates, but she’s ready to pay based on her attending income when she has to in anticipation of finally being done with her student loans.

Christy has a spouse who stays at home and one child. So a family size of 3.

If the SAVE plan's worst-case scenario were to occur, she would be forced to use her most recent taxable income from 2024 under the old version of the IBR plan.

Her IBR payment in this scenario would be $2,953 a month. Since that number is higher than the Standard 10-year payment of $2,220 a month, she would not be able to sign up for ANY qualifying repayment plan for PSLF (if the other IDR plans were repealed or blocked)

Despite being two years away from forgiveness, she would not be able to qualify for PSLF unless she filed her taxes separately and used form 8958 to split the income.

How filing taxes separately could keep borrowers eligible for forgiveness in this worst case scenario

If she filed her taxes separately in California, her $275,000 income would be split equally between her and her spouse, and she would pay on half that amount.

Note: Rules regarding married filing separately depend on the state where you live, as community property and common law states have different rules.

In this case, her IBR payment would be $1,336 a month, which is comfortably below the Standard 10-year plan. By filing her taxes strategically and separately, she would be able to qualify for PSLF in this worst-case scenario.

So if the worst-case SAVE scenario occurred, but she strategized the right way with her loans and taxes, she would save:

Standard 10-year plan principal and interest MINUS 2 years left of IBR PSLF payments

Christy, the physician, would save approximately $230,000 (Standard 10-year principal + interest minus 2 years left on PSLF).

IBR + PSLF is a good replacement for SAVE + PSLF if you qualify

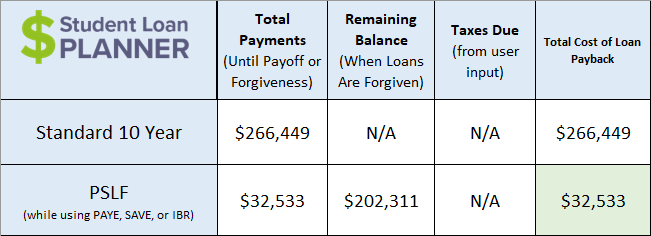

The image above shows two years left on PSLF under the IBR plan.

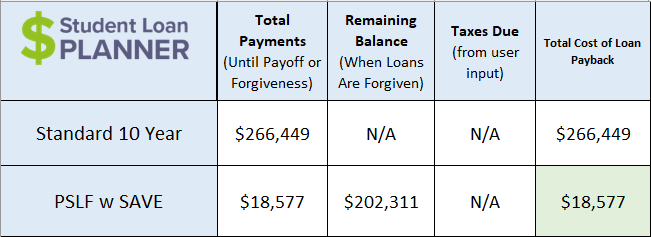

Take a look at the same numbers below if Christy, the physician, had two years left on the SAVE plan under PSLF.

SAVE is cheaper by about $15,000 in this case.

That's a significant difference, but it pales in comparison to the difference between getting PSLF vs. not getting it at all.

The extra payments a borrower would make under IBR instead of SAVE are an expensive nuisance. However, not getting forgiveness at all could be life-altering and delay major financial goals.

That's why planning your next tax return is so important starting now. It could potentially save you five or six figures.

How likely is the worst case SAVE scenario?

Unfortunately for borrowers, the worst-case scenario is quite likely with President Trump's victory in the 2024 election. There's still a chance of SAVE getting repealed and the old pre-pandemic plans coming back occurs instead.

However, if we see a very anti-SAVE plan ruling in a lower court in late 2024, we will very likely not see a Trump administration appeal that decision.

That means a ruling that strikes down the ICR statute and all IDR plans that were created from it could very easily occur, leaving IBR as the only option.

How can borrowers be prepared for the worst-case SAVE plan scenario?

You can use our IBR calculator to see your payment depending on what taxable income you use. To qualify for IBR, you need that IBR payment to be lower than the Standard 10-year plan.

If you haven’t already, you can get a student loan consult to go over the specifics of your situation.

If you want the most individualized level of attention and help, we hope to have 100-150 spots available for student loan-aware tax planning and prep for the 2024 tax year. We'll announce that opportunity in mid-November via our email list.

To hire us for tax services, you must first be a financial planning client of SLP Wealth. If you're interested in learning more about financial and tax planning with SLP Wealth, you can book a free intro call here.

Disclosure: SLP Wealth is a SEC Registered Investment Advisor with headquarters in Durham, NC.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).