Student loan debt has reached record levels, and the totals are increasing significantly. We don't want you to get to the point when you have to think ‘can social security be garnished to pay student loans?' You have other options out there to avoid having this became a reality. Recent data indicates that about 45 million Americans owe a total of $1.4 trillion in student loan debt; this is more than all the credit card debt, auto loan debt, and every other type of debt Americans hold with the exception of mortgages.

Student loan debt is a new problem

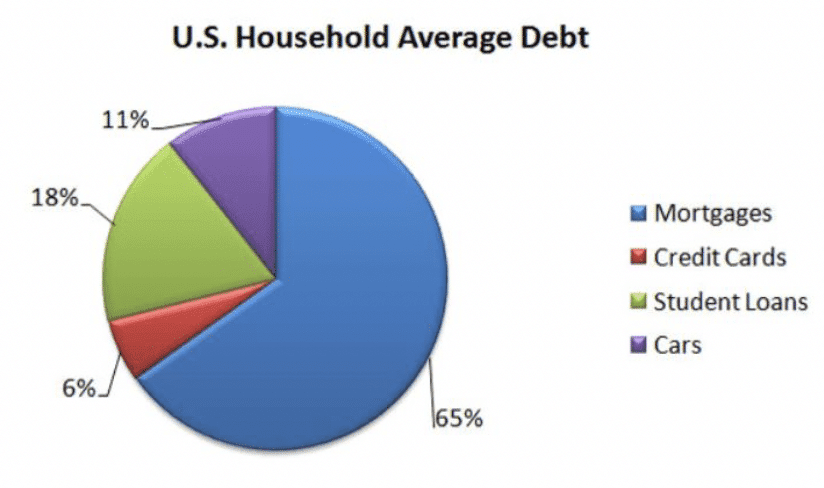

As a financial planner in the 1980s, I observed that student loan debt was not a significant part of household debt (typically less than 5%). Since then, the debt breakdown has changed such that student loan debt now comprises a far more significant portion of average household debt:

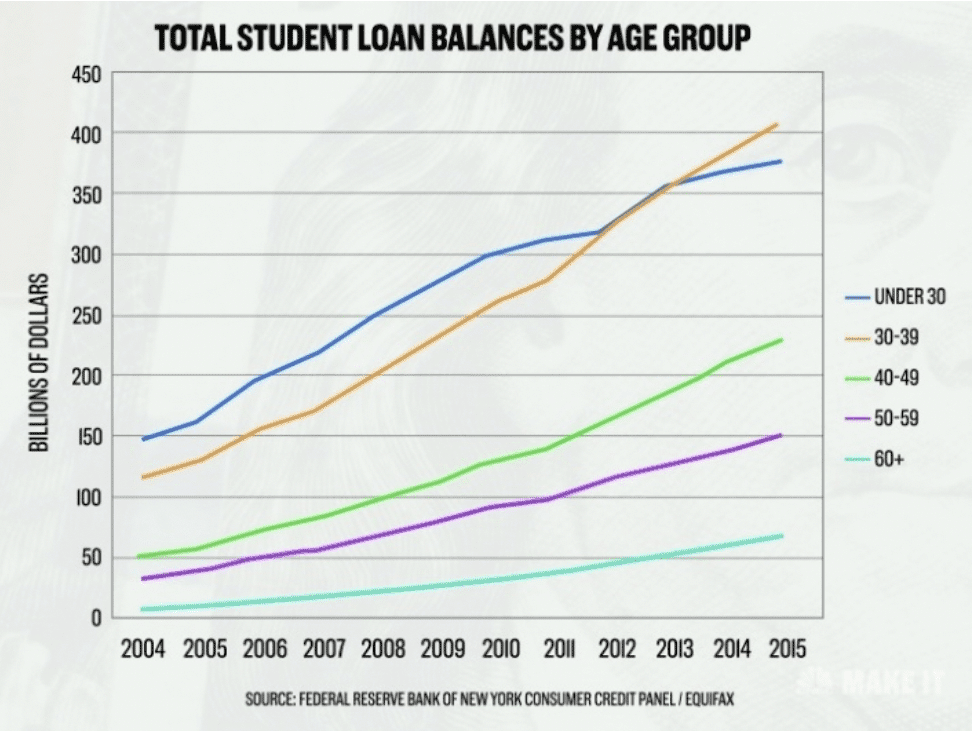

The chart below illustrates total student loan balances by age group; note the steady rise in loan balances by borrowers age 50 and older (the bottom two lines):

In fact, two of the biggest long-term financial problems facing the United States are Social Security funding and the growing level of student loan debt. Furthermore, people age 50 and older now hold record levels of student debt. Recent data from the General Accounting Office (GAO) and the Consumer Financial Protection Bureau (CFPB) report the following:

- Nearly 7 million Americans over age 50 have student loan debt.

- From 2005 to 2015, the number of people age 60 and older with student loan debt quadrupled to nearly 2.8 million, and the average amount owed is approximately $23,500. Data that I will be showing later in this article will show that the average loan portfolio is also growing at an alarming rate.

- There has been a 10-fold increase in the amount of student debt held by people age 65 and older, from $2 billion in 2005 to $22 billion in 2015.

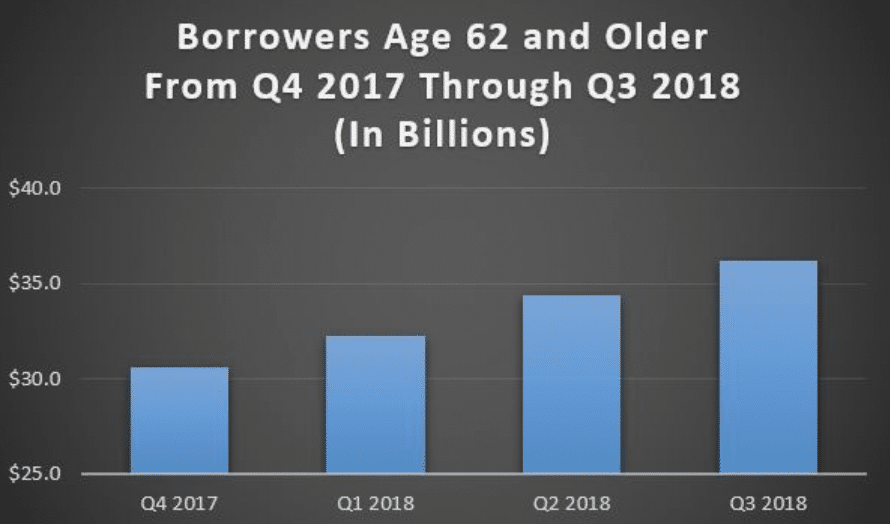

- Borrowers age 62 and older now owe more than $36 billion in direct loans as of the 3rd quarter of 2018.

- Nearly 40 percent of people over age 65 with student loan debt are in default.

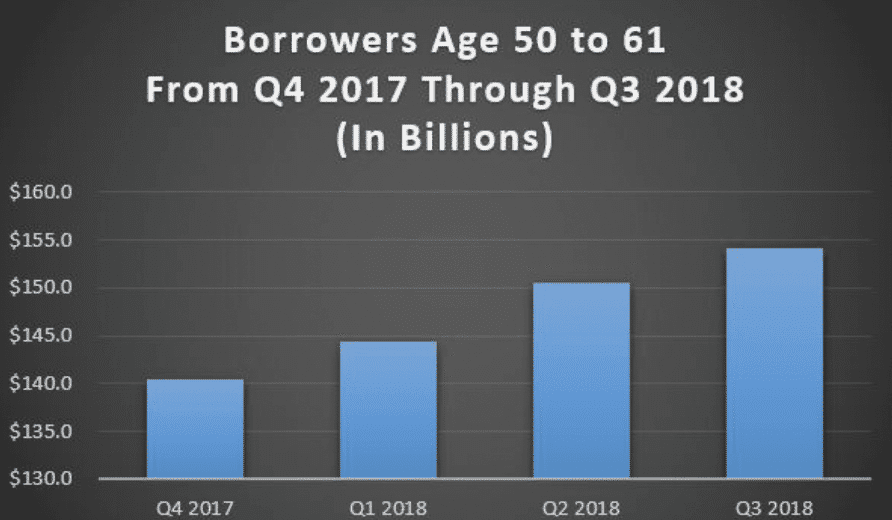

Recent data reported by the Enterprise Data Warehouse shows rising trends in student loan portfolios for persons age 50 and over. The first chart illustrates direct loan portfolios by borrowers age 50 to 61, from the 4th quarter of 2017 through the 3rd quarter of 2018 (in billions):

The next chart illustrates the same data over the same period for borrowers age 62 and over:

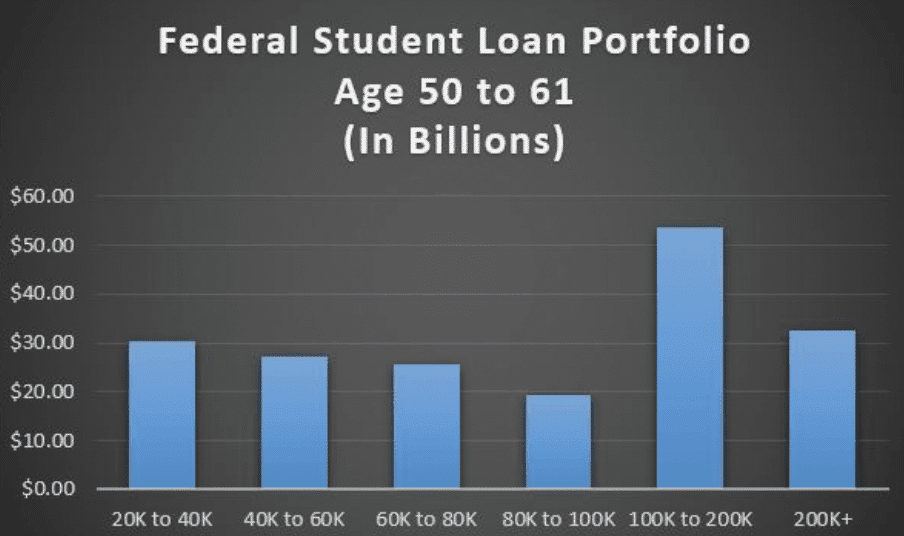

Furthermore, average federal loan portfolios are growing dramatically, with an alarming number of portfolios over $100K. The chart below illustrates federal student loan portfolio amounts for borrowers age 50 to 61 (in billions). Note the section showing portfolios between $100K and $200K in both charts:

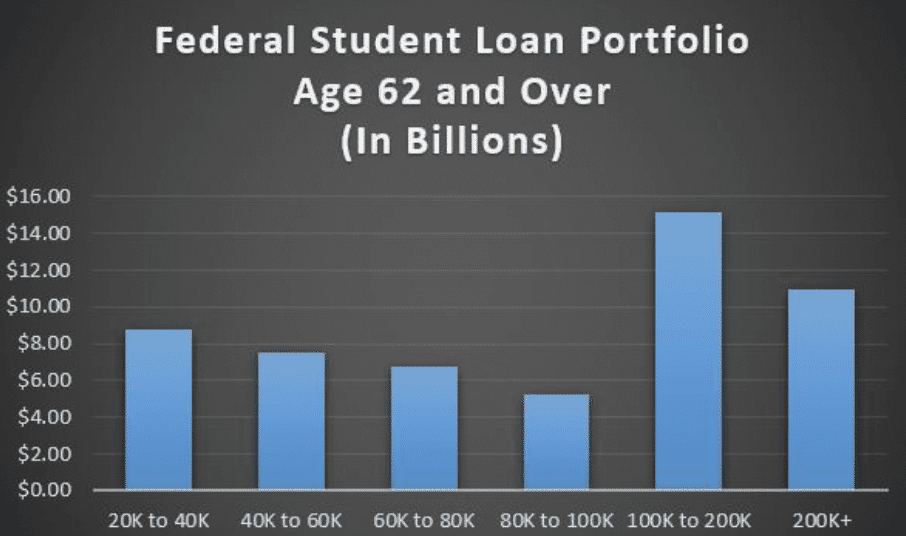

The next chart illustrates the same figures for borrowers age 62 and older:

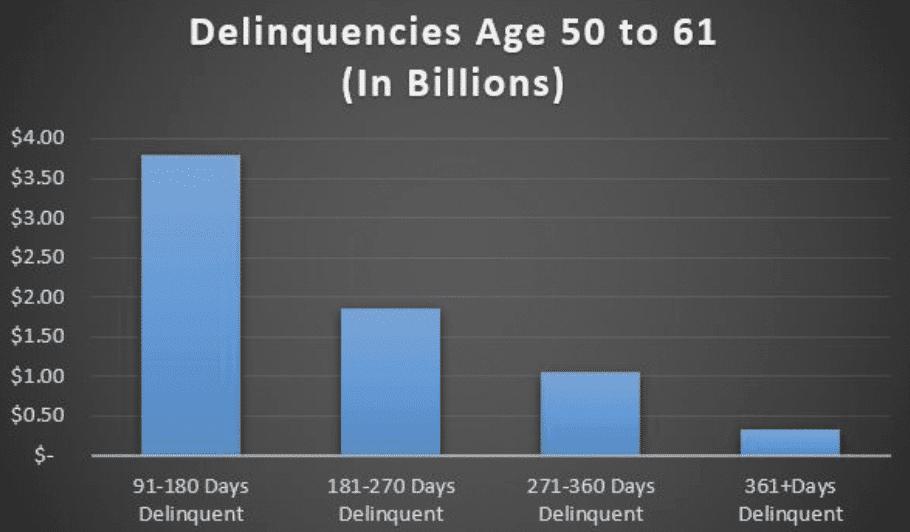

Alarmingly, a significant number of borrowers age 50 and older and now in delinquency. The chart below illustrates delinquencies by borrowers age 50 to 61 (in billions):

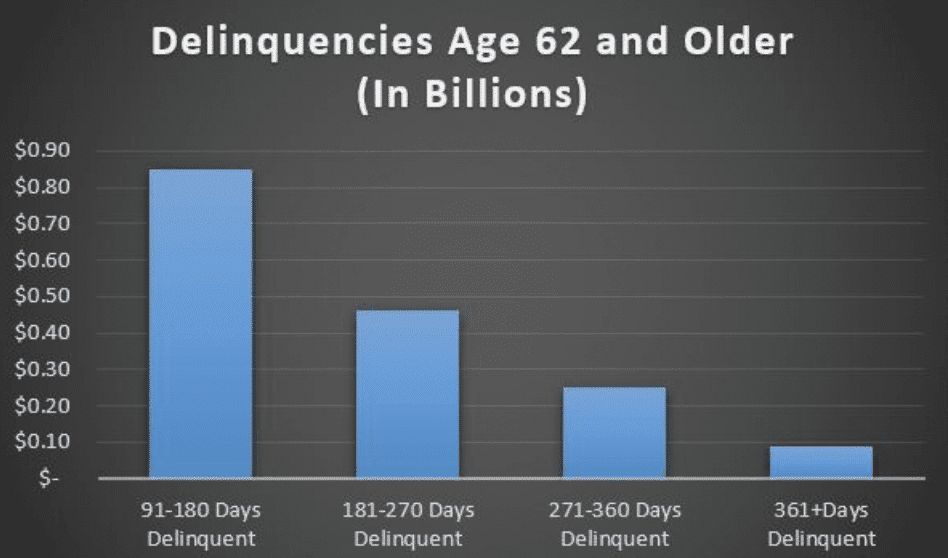

The next chart shows the same delinquency figures for borrowers age 62 and over:

If these trends continue, the amounts owed by borrowers age 50 and over will continue to grow, as will the delinquencies. I wouldn’t be surprised to see future trends showing many of these same borrowers becoming delinquent by more than 270 days, which is when loans are considered to be in default.

These are sobering figures, and demonstrate a significant problem for older persons, many of whom are now living on fixed incomes. This is especially alarming given the fact that people over age 60 have fewer options for finding new sources of revenue.

Can social security be garnished for student loans?

When you fail to make a student loan payment for 270 days, then your loan is considered to be in default. When an agency decides to garnish your Social Security benefits, the first $750 of your monthly Social Security payment ($9,000 annually) is off-limits to garnishment. But the government can garnish up to 15% of your total Social Security income, which can result in a significant loss of income for those who depend solely upon Social Security.

To make matters worse, outdated policies set the Social Security garnishment limit below the poverty limit. The last time it was adjusted was in 1998; obviously, the cost of living has increased since then, and the poverty line has gone up. Today, the poverty threshold for one adult is $990 per month. Since the government can garnish Social Security benefits all the way down to $750, this can force people with no other revenue streams to subsist on an income that is $240 below the national poverty line.

And it doesn’t matter how long ago you were in school: a 2005 U.S. Supreme Court case (Lockhart v. U.S.) determined that there is no statute of limitations on Social Security offsets to repay student loans.

The amount being seized is relatively small: less than 10 percent of the $4.5 billion collected annually on defaulted loans is taken from Social Security income. However, the number of people it affects has risen sharply:

- In 2015, approximately 173,000 Social Security recipients had their benefits garnished to pay down defaulted student loan debt, which includes 114,000 borrowers aged 50 and older. Of that number, 67,300 are living below the poverty line.

- The population of people aged 50 to 64 in this situation has increased by 407 percent since 2002.

- The population of borrowers aged 65 and older facing Social Security garnishment has increased by 540 percent, and this figure is expected to rise in the years to come.

Supplemental security income is untouchable

Supplemental Security Income (SSI) is a Federal income supplement program funded by general tax revenues (not Social Security taxes). It is designed to help aged, blind, and disabled people, who have little or no income, and provides cash to meet basic needs for food, clothing, and shelter.

SSI benefits also are payable to people 65 and older without disabilities who meet the financial limits. The reason I mention it in this article is that Supplemental Security Income cannot be garnished under any circumstance, including student loans in default.

Social Security garnished for student loans is an inefficient solution

Data suggests that the garnishments are not successfully collecting an outstanding debt: more than one-third of older Americans were still in default after two years of reduced Social Security payments. One reason for this is that only a small portion of garnished payments go toward paying off the loan principal.

Instead, of the $1.1 billion garnished from benefits, nearly 71 percent were allocated to pay fees ($15 per month) and interest, as opposed to paying down the principal. This is an inefficient solution, and some lawmakers are proposing legislation that is designed to reduce the burden on Americans owing student debt.

Possible new legislation regarding student debt

A recent quote by Sen. Claire McCaskill (MO), the ranking Democrat on the Senate Special Committee on Aging, puts it bluntly: “We can’t be garnishing people’s Social Security in a way that puts them into poverty. We need to make sure that we have adjusted the ability of the government to recover those loan amounts in a way that is not spiraling people into poverty.”

Rep. Tom Garrett, a freshman Republican congressman from Virginia, has introduced new legislation known as the Student Security Act. Under this act, student loan borrowers would be allowed the option to have some of their student loan debt forgiven in exchange for a higher Social Security full retirement age.

For every month a borrower agreed to raise his or her own Social Security full retirement age, he or she would receive $550 in student loan forgiveness. In other words, the borrower is postponing retirement age to offset the loan amount. The plan would set a maximum amount of loan forgiveness of $40,150, which would result in a delay of six years and one month for the recipient's Social Security retirement age.

President Trump, along with Education Secretary Betsy DeVos, is proposing a different solution. The proposed changes are comprehensive in nature and a full discussion is beyond the scope of this article, but some of the key points are addressed below:

- Under the current federal student loan laws, borrowers who choose to utilize Income-Driven Repayment Plans have their monthly payments capped at 10% of their discretionary income, and are then eligible to receive forgiveness after making payments for 20 years. President Trump’s plan seeks to increase the monthly payments to 12.5% of discretionary income, while reducing the length of time it takes to receive forgiveness, from 20 years to 15. This would result in higher monthly payments, but borrowers would receive forgiveness sooner. It should be noted that this only applies to undergraduate loans; graduate students will need to make payments on their loans for 30 years before being offered forgiveness.

- Trump’s plan would end the Public Service Loan Forgiveness (PSLF) program altogether. The way PSLF currently works is that you’re able to receive complete student loan forgiveness for any Federal loan if you agree to work full-time in a qualifying public service position (e.g., a government employee at the federal, state, or local level, or any role at a 501(c)(3) Non-Profit Organization) and make payments toward your loans for 10 years. President Trump’s Administration claims that eliminating the program would save taxpayers $203 Billion over the next decade. However, the Congressional Budget Office disagrees with this number and claims that it’s closer to $100 Billion.

- The plan would end federally subsidized student loans. Currently, most people who borrow money from the federal government for undergraduate degrees get some of their loans subsidized, which means that their loans won’t accrue interest while the borrowers are still in school. President Trump’s proposal seeks to end this program entirely, which means that borrowers would start accruing interest on their loans as soon as they are granted. Proponents of this change say that borrowers would pay less over the lifetime of their loans due to an earlier forgiveness timeframe (15 versus 20 years). I disagree because it also means that when students graduate, they could owe much more than when they took out the loan. It should be noted that interest is the biggest issue with student loans, especially when people have trouble paying them back in the early years. This could, therefore, result in the borrower owing more money in the long run.

How do you spell relief?

While you cannot appeal to reduce the amount of the debt, you can go to the agency that levied the garnishment and seek relief. Your best bet to avoid the threat of garnishment is to act as soon as you realize you’re having trouble paying your debt.

This way, you will have a wider range of options available if you haven’t already defaulted. Below are some of the more important methods for reducing or preventing Social Security garnishments.

Make a payment arrangement

Once you make an arrangement with the appropriate agency to repay your debt, the Social Security garnishment is released. In some cases, you may be able to negotiate a settlement.

Apply for a disability waiver

Older Americans on permanent disability may be eligible for a full discharge of their student loans. Borrowers with a long-term medical condition can also qualify for full Social Security payments. Though the process can be tedious (you will need to document it annually), statistics have shown that more than one-third of people in default were able to pay off or cancel their debt with this option. One caveat: The amount forgiven is considered income and you will likely owe taxes.

Apply for financial hardship

You may request a reduction or suspension of the garnishment of your Social Security because of financial hardship. It is up to the Department of Education whether they will grant it. You can call the Department of Education to request a suspension, then follow up with the documentation needed for them to review.

Consolidate your loan

You could get out of default by converting your defaulted federal loan into a federal consolidation loan. You then have the option of doing an income-based repayment plan, which can make the payments more manageable and could reduce them to less than what is taken from Social Security.

Rehab your loan

People in default can “rehabilitate” loans by working out a payment plan with the Department of Education. This also doesn’t erase your debt, but depending on your income, your monthly payment under a loan rehabilitation agreement could be as low as $5.

Bankruptcy: A Last Resort

Can social security be garnished? Absent relief from the federal government or your ability to withstand garnishment, the main solution left is bankruptcy. This should be considered as a last resort and only after all other options have been considered. It should be noted that it can be more difficult to wipe out student debt with bankruptcy than it is to absolve other kinds of debt, because it is a federal loan.

Hopefully, this article has provided some useful information to help prevent you from having your Social Security benefits garnished. And don’t count on future legislation to come to the rescue. Instead, your best bet is to plan ahead and manage your money wisely.

Have you thought about what may happen with your social security because of your student loans? Which one of these options prompt you to take action?

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, IDR, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.