So, you’ve finished the long and difficult process of earning your Doctor of Optometry (OD) degree. Now you can finally begin the optometry career that you’ve been dreaming about for so many years!

But then you realize that your graduation also brings with it the start of something else — the repayment of your student loans. And student loans are something that most optometry grads have a lot of:

- According to the American Optometry Association, the mean student debt for 2018 optometry grads was nearly $180,000.

- As of October 2019, the ODs that our Student Loan Planner® consultants have worked with have had an average debt load of $267,000.

If you’re dealing with a ton of optometry school debt, you may be wondering if refinancing your student loans would be a smart move. Let’s take a look at when student loan refinancing for optometrists makes sense and when optometrists should choose a different strategy.

Pros and cons of student loan refinancing for optometrists

Like other forms of refinancing, the goal of student loan refinancing for optometrists is to limit your interest costs. But despite the savings potential of refinancing, it isn’t the right move for everyone.

Let’s take a look at why. Here are the main advantages and disadvantages of student loan refinancing for optometrists.

Pros of refinancing optometry school student loans

Refinancing can save you a lot of money

If you used mostly Grad PLUS loans to pay for optometry school, your average interest rate could be over 7%. And if you have some private loans, you could have student loans with even higher rates.

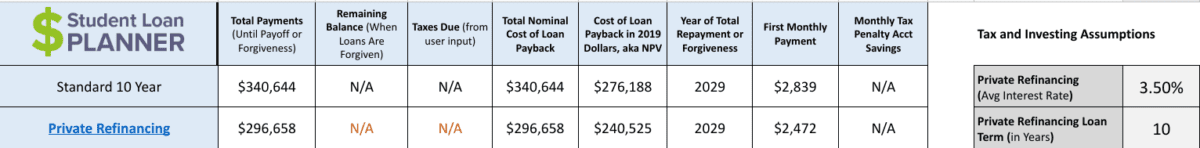

With optometry student loan refinancing, a private lender will pay off your student loans and give you a new loan at a different — hopefully lower — rate. And a lower interest rate could make a big difference in how much you pay over time.

For example, let’s say that you have $250,000 of student loans at an average interest rate of 6.5%. If you were able to refinance to 3.5%, it could save you nearly $44,000 throughout your entire repayment plan.

That’s a ton of money you can put toward retirement, a down payment on a home or any other financial goals.

You get one payment with the lender of your choice

After seven or more years of education, there’s a good chance that you’ve taken out several student loans. Trying to keep track of all the different servicers, payment methods and dates for each loan can be overwhelming.

Plus, some federal loan servicers have a bad reputation for making mistakes or offering poor customer service.

One of the benefits of refinancing is that it can simplify your life. Instead of dealing with multiple payment plans and lenders, your loans and payments are reduced to one. If you pick one of the best refinancing lenders, you should get a customer service upgrade as well.

Cons of student loan refinancing for OD graduates

Student loan refinancing isn’t the best choice for everyone, however. Compare your financial circumstances with the criteria below to see if you should skip refinancing.

You’ll need to meet eligibility requirements

One of the difficult things about refinancing is lenders’ lofty eligibility requirements. For instance, Travis Hornsby, founder of Student Loan Planner®, says that a credit score of 700 or better is typically needed to qualify for the best refinancing rates.

You’ll also need to have a reasonable debt-to-income (DTI) ratio even if you have a high credit score.

Generally, you’ll want to owe less than 1.5 times your income. We’ll see later that keeping a DTI ratio within that range can be one of the most difficult eligibility requirements for many optometrists to meet.

You’ll lose out on federal benefits

When you refinance federal student loans, you lose eligibility for federal programs like income-driven repayment (IDR) and Public Service Loan Forgiveness (PSLF).

If you weren’t planning to work in the public sector, losing out on PSLF might be a non-issue. If your income is high, IDR may not benefit you as much either. But, for others who are going to work in the public sector or who have a lower income, these benefits may be too valuable to pass up.

Factors for optometrists to consider when refinancing

Optometrists should ask themselves these three questions before pursuing optometry student loan refinancing:

1. What is your DTI ratio?

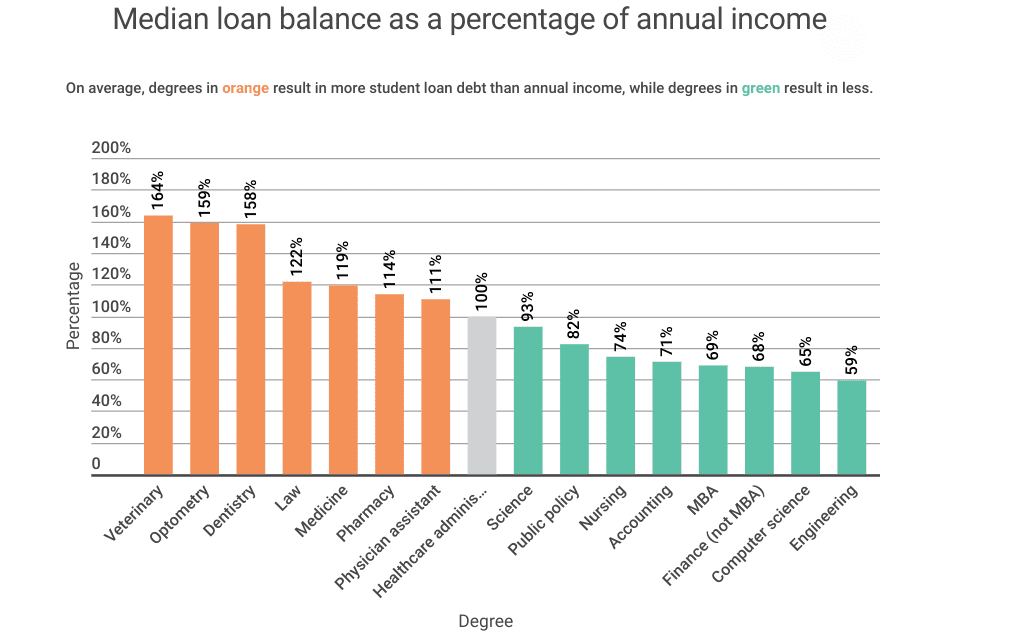

The biggest problem most optometrists face in regards to student loan refinancing is their DTI ratios. According to a 2019 study by Credible, optometrists had the highest DTI ratio of all borrowers with advanced degrees.

Image credit: Credible

As mentioned earlier, you generally want to owe less than 1.5 times your income in order to qualify for the best refinancing rates. But according to Credible’s data, the average optometrist is dealing with debt totals that are just over that benchmark.

Related: Optometrist salary: Is it worth the debt?

2. What are your business and lifestyle goals?

Do you plan to work in the public sector … like for the Department of Veterans Affairs? If so, your best bet is probably to stick with federal loans and pursue Public Service Loan Forgiveness (PSLF).

Keep in mind, however, that government optometrist jobs pay about $15,000 less per year than private-sector optometry jobs, according to the BLS.

If you feel like public service is your calling, PSLF could relieve your student loan burden. But you probably shouldn’t pick public sector work strictly for financial reasons, even with the potential of student loan forgiveness.

3. Do you plan to buy a home soon?

Refinancing lenders aren’t the only ones who care about your DTI. Mortgage lenders care about your annual DTI and your monthly DTI.

In other words, mortgage banks will check to see how much of your monthly income is going toward debt repayment. Typically, you’ll want to keep your DTI below 36%. But you may be able to qualify for a mortgage with a DTI as high as 50%.

So what does this have to do with refinancing? Let’s say that you’re currently on an IDR plan. By refinancing your student loans, your payment could jump significantly, possibly even double.

Student loans can affect your ability to get a mortgage, and that higher payment could make a difference on whether or not you’re able to qualify for a home purchase.

How much could you save by refinancing your optometry school loans?

If refinancing sounds like a good fit for you, you’ll want to get quotes from several top lenders. You’ll also want to compare any extra benefits that lenders offer. For instance, some of the best private lenders may offer financial hardship forbearance periods.

Finally, you’ll want to see if you could save even more money by earning a cash bonus. Here at Student Loan Planner®, we’ve negotiated deals with many of the top lenders to put more money in our readers’ pockets.

By using our referral links, you may be able to qualify for $350 to $750 cashback. Check out the top lenders and their current cash bonus offers!

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

For refinancing 100k or more (bonus from Student Loan Planner®, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 10:49% APR

Variable 5.88 - 10.49% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.38% APR

Variable 4.33 - 12.35% APR with autopay with autopay |