Prosthodontics is a dental specialty that focuses on restoring or replacing lost or damaged teeth — and sometimes other oral structures — with artificial devices. This cosmetic specialty requires three to four years of residency training after graduating from dental school.

These additional years of specialized training prepare prosthodontists for more complex dental cases. But dental school debt can quickly balloon while in residency and throughout the early years of practice.

If you’re a prosthodontist with a hefty student loan balance, there are several student loan repayment strategies that can help you pay down your debt. One strategy in particular — refinancing — can lower your interest rate and help you pay off your loans faster.

The strategy you choose needs to be right for your circumstances, though. Here’s what you need to know about prosthodontist student loan refinancing.

Average debt vs. salary for prosthodontists

Dental school is among the most expensive graduate programs. The American Dental Education Association (ADEA) reports the average educational debt for dental school graduates in 2023 was $296,500.

However, dental debt can grow much higher. Two recent Student Loan Planner® prosthodontist clients reported student loan balances ranging from $625,000 to $800,000.

The good news is that the high cost of dental school — and costs associated with additional specialty training — are often matched with high-income potential.

According to the Bureau of Labor Statistics, the average salary for prosthodontists is $240,750. General dentists, however, can expect an average annual salary of $191,750. This significant bump in prosthodontist earning potential can offset the high cost of education, particularly when maximizing your student loan repayment strategy.

Related: How to Protect Your Prosthodontist Salary with Disability Insurance

Student loan refinancing for prosthodontists

Dental professionals who want to rid themselves of student debt may benefit from refinancing their dental school loans. Prosthodontist student loan refinancing can consolidate multiple loans or release a cosigner from an existing loan. But, more importantly, it can reduce your interest rate and lower your monthly payment. Here’s how.

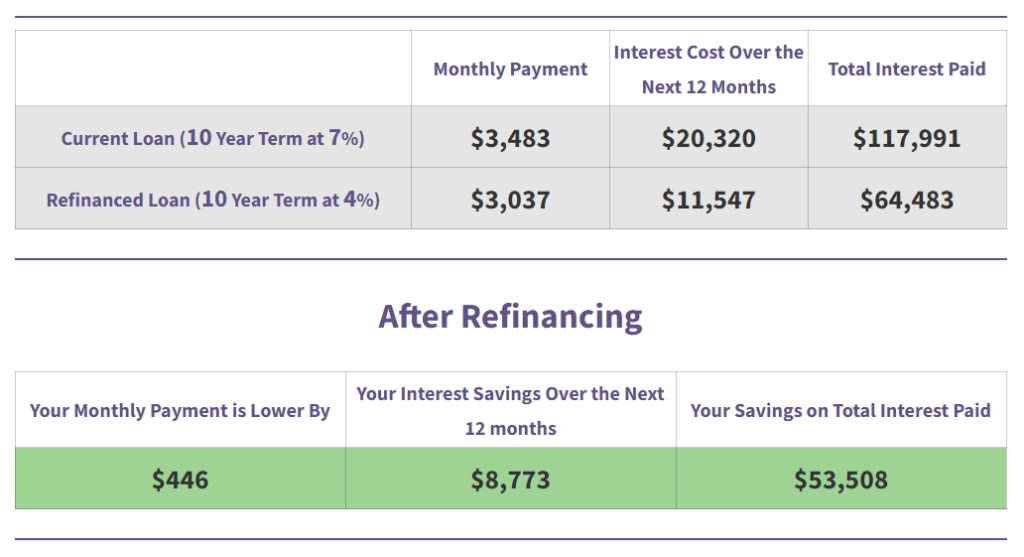

Let’s say Lori has $300,000 in student loans at a 7% interest rate. Her current monthly payment is $3,483. If she refinanced with a private lender at 4% with a 10-year term, her monthly payment would be lowered by $446.

If she continued to make the new monthly payment of $3,037, she would save over $53,500 in interest over the life of the loan. She would save even more if she chose to aggressively pay off her balance by dedicating extra funds toward her monthly payments.

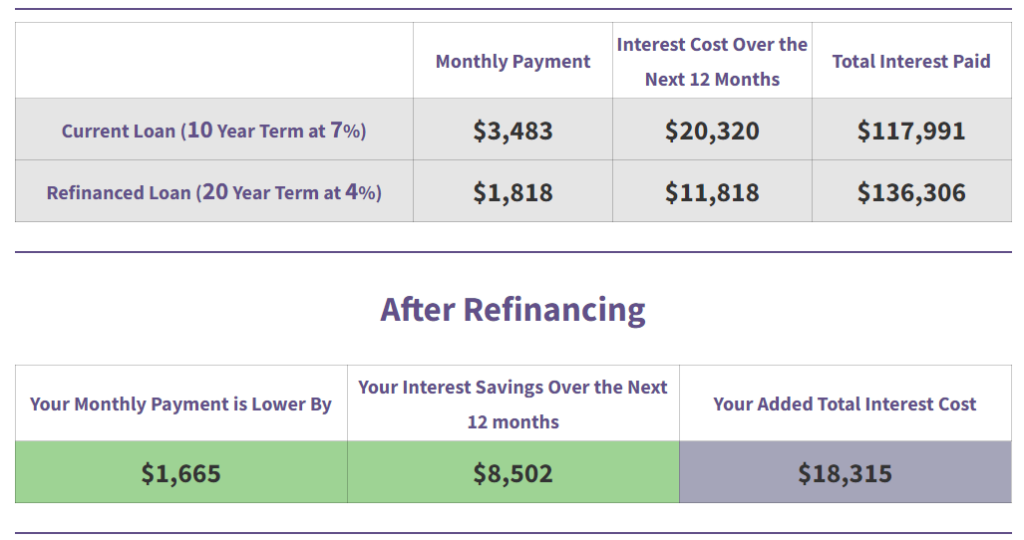

Now, a $3,000 payment isn’t ideal for most people. To significantly lower her monthly payment, Lori could choose to refinance at 4% with a 20-year term instead. She would then cut her monthly payment almost in half.

In this example, Lori would have a more manageable monthly payment of $1,818. But she would also pay $18,315 more in interest over the loan due to the extended term length. So, the choice to refinance with a 10- or 20-year term would depend on her overall goal.

Use Student Loan Planner®’s Refinance Calculator to see how much you could save by refinancing your prosthodontist school loans.

Drawbacks of prosthodontist student loan refinancing

Refinancing can help you pay your loans off faster. It’s not necessarily the best repayment strategy for all prosthodontists, however, especially if you have federal student loans.

When refinancing with a private lender, you’ll lose certain federal benefits and protections, such as access to flexible income-driven repayment (IDR) plans and options for forbearance or deferment if you experience financial hardship.

You’ll also miss out on opportunities for federal loan forgiveness programs. Federal repayment programs are designed to keep your monthly payment low. But they can also guard against having to pay back massive amounts of debt, letting you pursue other financial and professional goals.

When student loan forgiveness might be a better route

If you have federal student loans, you might be able to take advantage of various loan forgiveness programs, including Public Service Loan Forgiveness if you work in the public or nonprofit sector. Another option is an IDR plan that includes loan forgiveness after 20 to 25 years of qualifying payments.

Loan forgiveness is worth pursuing for most prosthodontists, especially if your residency program had additional high costs or if you attended a private dental school.

Here’s a good way to evaluate the benefits of IDR forgiveness programs: If your debt-to-income ratio is above 2:1, an IDR plan might be a better option than refinancing.

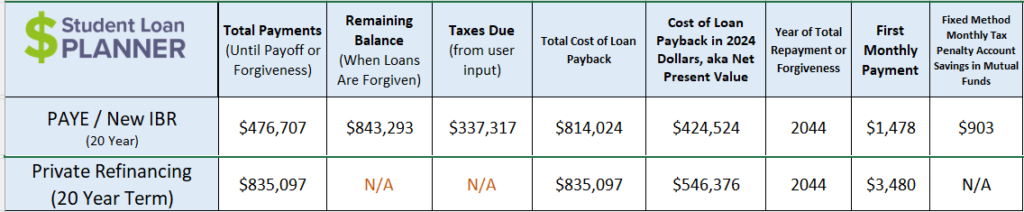

For example, let’s say you’re a prosthodontist who earns $200,000 annually and carries $550,000 of student debt at a 7% interest rate. To lower your monthly payment, you could refinance them at 4.5% for 20 years or sign up for Pay As You Earn (PAYE) and still make payments for 20 years. Here’s what that would look like using our free Student Loan Repayment Calculator.

In this example, you’d pay less money monthly and overall with PAYE than you would with refinancing.

Note that a large chunk of the total cost is incurred with PAYE when it’s time for the loan balance to be forgiven. This tax bomb should be planned for by setting aside money each month into a nonretirement savings account.

Prosthodontists can use a combination of repayment strategies

In some cases, it may make sense for prosthodontists to leverage multiple repayment strategies over time.

For instance, you can take advantage of payments as low as $0 while in dental residency under the new Saving on a Valuable Education (SAVE) plan. This strategy prevents your loan balance from growing during residency and gives you some added monthly financial relief.

Depending on your goals, you could then refinance your student loans once you complete residency and secure a much higher salary.

When you’re ready to refinance, look into lenders like Laurel Road (if you’re a member of the American Dental Association). They offer special rates for dental professionals. Plus, you may be eligible for cash-back bonuses by using our provided referral link.

Get expert help for prosthodontist student debt

With so many repayment strategies to choose from, it can be challenging to figure out which path is right for you. Especially when weighing important career decisions that can affect all aspects of your finances.

For example, prosthodontists who own their own private practice often benefit more from refinancing than other repayment strategies because they typically earn a much higher salary than a prosthodontist who is working for someone else as an employee.

Our team of student loan experts can help you work through your options and craft a repayment plan that fits your unique situation. Schedule a one-hour consultation today.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

For refinancing 100k or more (bonus from Student Loan Planner®, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 9.89% APR

Variable 5.88 - 9.99% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.69% APR

Variable 4.35 - 12.68% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).