The world has collectively shut down due to the coronavirus pandemic, leading to isolation and economic uncertainty. Now moving beyond the two-month mark of quarantine, the pandemic is more than just a threat to our physical health, but also our mental health.

In our survey of high-debt and high-income student loan borrowers, we found that nearly 80% of respondents fear the pandemic will affect them or a family member, while 74% of respondents are dealing with anxiety related to the pandemic. Another 38% are experiencing depression because of the pandemic and 2.46% are even dealing with suicidal ideation.

Though the pandemic is causing pervasive mental health struggles for nearly everyone, we found that student loans are the source of more mental health challenges than the novel COVID-19.

In fact, we found that among 20 and 30 something student loan borrowers, 1 in 16 had considered suicide due to student loans while 1 in 40 had considered suicide because of stress from the pandemic.

That's a rate of suicidal ideation 2.5x more than from coronavirus stress, despite the fact that the majority of our respondents are health care professionals.

Key findings

- Student loans led to suicidal ideation 2.5x more than coronavirus among younger individuals with large student debt balances, 55% of whom worked in healthcare fields with high exposure to COVID-19.

- Seventy-four (74%) percent of respondents experienced anxiety due to coronavirus. Seventy-nine (79%) percent of respondents experienced anxiety due to student loans.

- Thirty-eight (38%) percent of respondents experienced depression due to coronavirus. Forty-five (45%) percent of respondents experienced depression due to student loans.

- Veterinarians were 10x more likely to have suicidal ideation from student loans than coronavirus.

- Veterinarians are also most likely to experience depression (61.8%).

- Private loan borrowers experienced suicidal ideation at a slightly higher rate than federal loan borrowers at 7.2% compared to 6.2%.

- Income level affected depression levels, with 42% of borrowers who earn below 100k experiencing depression because of coronavirus, compared to 31% for respondents who earn more than 100k.

- Respondents making below 100k experienced depression at higher rates about student loans (48%) compared to those making above 100k (41%).

Please note: The following may contain triggering or sensitive information about depression, anxiety and suicide. If you need help text HOME to 741741 to connect with a crisis counselor.

Mental health vs. COVID-19

The mental health toll of coronavirus is nearly ubiquitous. Our survey found that 79% of respondents were scared that coronavirus would affect them or a family member. So nearly eight of 10 student loan borrowers are living with that fear on top of their crushing debt.

On top of general fear, there’s its cousin, anxiety — which 73% of respondents said they had in relation to the pandemic. Anxiety is the top feeling student loan borrowers are experiencing because of the pandemic, nearly twice as much as they are experiencing depression (38%).

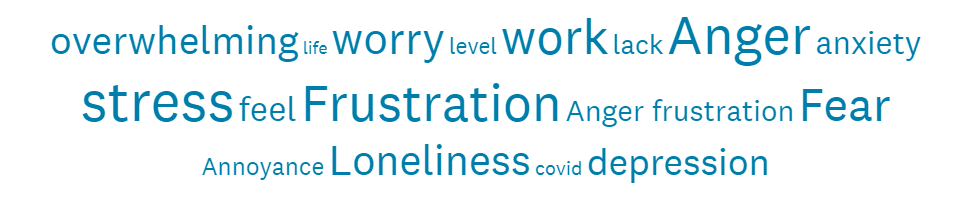

There’s a wide range of emotions people are feeling. In addition to depression and anxiety, those who marked “other” when asked what feelings they’re experiencing during coronavirus said they feel:

- Fear

- Stress from working as an essential worker

- Frustration

- PTSD

- Hopeless

- Scared

- Uncertain

- Confused

- Insomnia

Here’s a word cloud of the common feelings that came up:

Having so many negative emotions related to the pandemic is a recipe for mental health struggles. For some, the feelings are so intense that it's led to suicidal ideation for 2.46% of borrowers.

Suicidal ideation can be a range of ruminative thoughts that consider taking one’s own life. In a pandemic, it’s more likely that people are experiencing situational depression, which is leading to these unpleasant and life-altering thoughts.

Situational depression compared to clinical depression is usually triggered by a traumatic event rather than an imbalance of chemicals in the brain. There’s no doubt we are living through a collective trauma as the world has shifted overnight with health scares, travel restrictions, quarantine orders, a scarcity of goods and economic uncertainty rivaling the great depression.

Mental health vs. student loan debt

As we found in our mental health survey last year, student loan debt has a great impact on borrowers’ mental health. We found that 90% of borrowers experienced significant anxiety related to their student loans, with 1 in 15 considering suicide over their debt.

This year, we found that 79% of borrowers experienced anxiety related to their student loan debt, while 45% experienced depression.

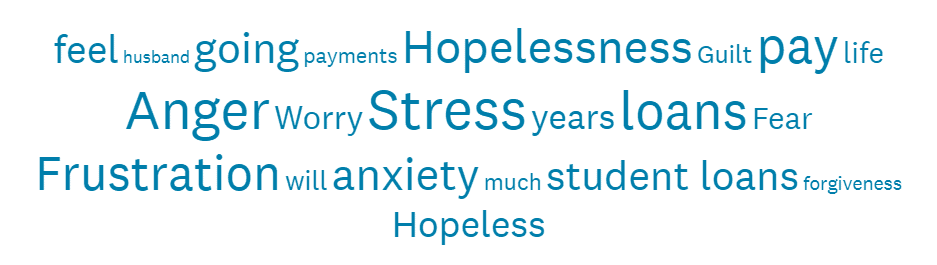

Some of the answers for people who responded “other” to the question, “Have you ever felt the following because of your student loans?”, include:

- Feeling nauseous

- Feeling stressed

- Feelings of regret

- Feelings of frustration

- Feelings of fear

- Feelings of hopelessness

- Feeling angry

- Feeling defeated

Here’s a word cloud of the common feelings that came up:

Aside from this myriad of feelings, 6.17% of student loan borrowers experienced suicidal ideation because of their debt.

Student loans cause more mental health challenges than coronavirus

Everyone’s adjusting to the new reality of living through a pandemic and all that comes with that. The toll on mental health is great. There’s fear about getting the virus or having a family member or loved one get it — and not even be able to see them if they get sick. There’s an effect on employment and income, physical isolation and more.

Though the globe is experiencing all of this at a large scale, we found in our survey that student loans were a bigger source of depression, anxiety and suicidal ideation than coronavirus.

Despite efforts to support borrowers during this difficult time — such as postponing federal student loan payments until September 30, 2020 due to the CARES Act and then a further extension until August 30, 2023, unless the lawsuits are settled earlier than that. — it seems that student loan debt is causing more intense feelings for borrowers.

When we look at depression and anxiety due to coronavirus and student loan debt, the numbers are fairly similar but student loan debt still scores higher.

| Feeling | Coronavirus | Student loan debt |

|---|---|---|

| Depression | 38% | 45% |

| Anxiety | 74% | 79% |

Though close in number, you can see there are still higher rates of both depression and anxiety related to student loan debt. There’s a 7% increase in depression and a 5% increase in anxiety.

What’s more interesting is that student loan debt caused suicidal ideation 2.5x more than the coronavirus pandemic.

| Feeling | Coronavirus | Student loan debt |

|---|---|---|

| Suicidal ideation | 2.46% | 6.17% |

Though the percentages on their own are fairly low, considering the grave implications of suicidal ideation they shouldn’t be ignored. It’s clear that student loan debt is having sweeping effects on borrowers’ mental health, even more so than the current pandemic.

Student loan debt is a source of intense pain, leading to suicidal ideation, even for frontline workers battling coronavirus. Many of our respondents are working in medicine.

For example, the majority of the respondents are physicians (14%). On top of that, 10% of respondents are dentists, 5% of veterinarians, 4% pharmacists, and 4% physical therapists in addition to other professions.

From our data, which is comprised of high debt and high-income borrowers with professional jobs, student loan debt has a greater impact on mental health than coronavirus. But why would student loan debt cause suicidal ideation 2.5x more than coronavirus?

The reason for this may be that 62% of our respondents said coronavirus hasn’t impacted their income. Twenty-six (26%) percent said their income fell but they were still earning money, and only 12% said they lost their income completely.

Also, 40% of respondents said coronavirus hasn’t affected them, a family member or friend.

What could also be adding to the mental health distress is the lack of benefits for private student loan borrowers. Private student loan borrowers typically don’t get the same protections that federal student loan borrowers receive.

There’s also worry about being able to make payments in the coming year with 1 in 3 respondents expressing this concern.

Additionally, respondents who are getting unemployment benefits have higher instances of suicidal ideation — almost double, related to the pandemic. We found that 4.4% of unemployed respondents experienced suicidal ideation — compared to 2.3% of respondents who weren’t unemployed.

There was a 2.5% difference in suicidal ideation related to student loans among people who are employed versus unemployed: 6.0% of respondents who are employed experienced suicidal ideation due to student loans, whereas 8.5% of respondents who are unemployed experienced suicidal ideation due to student loans.

One survey respondent said:

“If Covid-19 results in an economic recession, or a depression, that lasts over the next several years, then something is going to have to be done about the student loan debt issue, such as either canceling all student loan debt or, canceling a portion of the borrower's debt amount.”

It’s clear that student loan debt is still taking up a lot of mental space even in the midst of a global pandemic. Borrowers may feel like coronavirus is a temporary concern while student loan debt still feels like a life sentence.

Mental health resources

Whether you’re experiencing mental health issues like depression, anxiety or suicidal ideation due to coronavirus or student loans, there’s help out there.

If you’re in crisis — whatever crisis means to you (you don’t have to be suicidal), you can contact the Crisis Text Line by texting HOME at 741741. If you’re feeling suicidal please call the National Suicide Prevention Lifeline at 988.

If student loans are the issue, talk to your loan servicer about options and take advantage of the current pause and look into an income-driven repayment plan if you have federal loans. You can also book a customized consultation to create a repayment plan with Student Loan Planner® to help manage your student debt.

Methodology

We surveyed 3,472 people from the Student Loan Planner® email list. Eighty-six (86%) percent of borrowers are between the ages of 20-39. Fifty-seven (57%) percent of respondents had student loan debt between $100k and $400k and sixty-three (63%) of respondents identify as female and 37% of respondents identify as male.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

For refinancing 100k or more (bonus from Student Loan Planner®, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 10:49% APR

Variable 5.88 - 10.49% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.38% APR

Variable 4.33 - 12.35% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).