When weighing your options for college living arrangements, you might be wondering, “Can I use student loans for off-campus housing?”

You can use federal and private student loans for housing, regardless of whether you live in a dorm or an off-campus apartment.

But there are some considerations to be aware of before you run out and sign your new lease using student loan funds.

How housing costs factor into your student loans

Student loans can be used to pay for your school’s full annual cost of attendance (COA), which includes housing expenses.

Each college is responsible for determining their COA based on expenses like:

- Tuition and fees

- Room and board

- Books and supplies

- Transportation

- Miscellaneous expenses (e.g. personal items, technology equipment, etc.)

Your school might provide several COA figures to account for different circumstances, such as state residency and living arrangements (e.g. on-campus versus off-campus housing).

Keep in mind that your college’s COA is a published “sticker price” and likely doesn’t reflect the true cost of attendance. Your actual cost will vary depending on your individual choices, including where you choose to live.

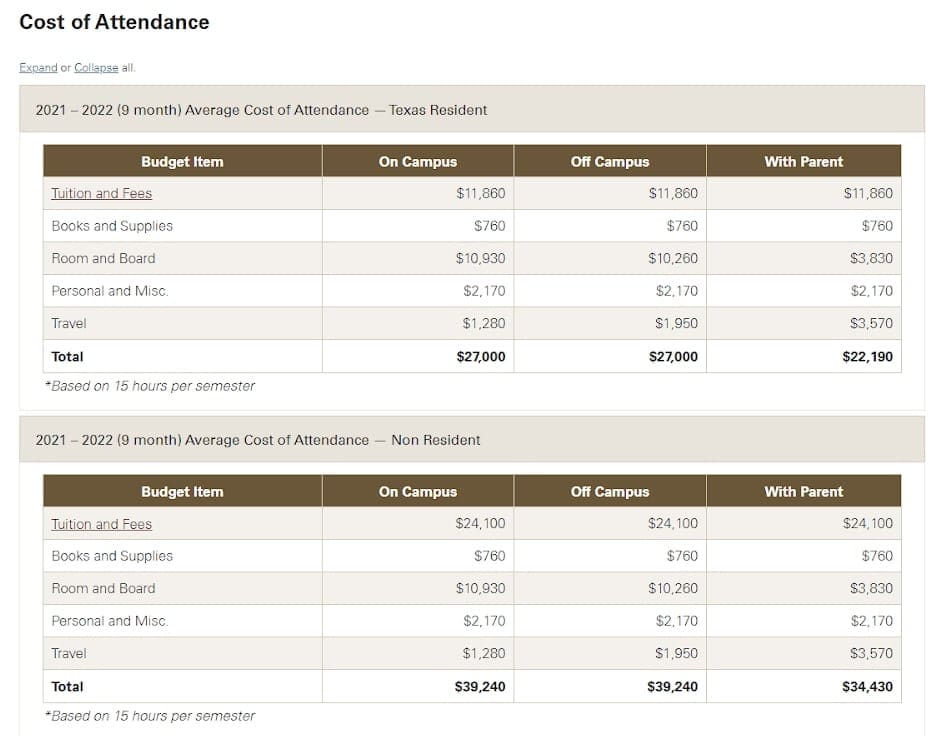

Here’s a COA example from Texas State University for the upcoming 2021-2022 academic year. It provides separate COAs for residents and non-residents. And each COA is broken down by whether the student lives on campus, off campus or with a parent.

Photo credit: Texas State University

For Texas State, on-campus room and board is estimated to be $10,930 and off-campus costs are slightly lower at $10,260. Note that room and board expenses drop significantly to $3,830 for students who live at home with a parent.

But overall, living on- or off-campus doesn’t result in differences for the total COA ($27,000 for residents and $39,240 for non-residents).

Therefore, Texas State students’ living arrangements don’t affect the amount of student loans they have access to. The exception is if they choose to live at home, in which case, it’s assumed that they won’t have similar housing costs (e.g. rent and utilities).

Does financial aid cover housing costs?

If you submitted the Free Application for Federal Student Aid (FAFSA) and received a financial aid package, those funds can be used for any legitimate college-related expense. And this includes housing costs.

Your financial need is determined by many factors. However, the basic formula comes down to:

Your school’s COA – Expected Family Contribution (EFC) = Financial aid award

Depending on your situation, your financial aid package may or may not cover your housing expenses. So, you might need additional private student loans to fill any remaining financial gap.

It’s important to note that all financial aid is sent directly to your college’s financial aid office — not to you. It is then applied to any outstanding bills, starting with tuition and fees and then on-campus housing and dining.

If you have any leftover funds, you’ll receive the remaining balance to be used as you see fit for off-campus housing expenses and other education-related expenses.

Do private student loan lenders consider off-campus living expenses?

Similar to federal loans, private student loan lenders use the school’s COA when making lending decisions rather than making distinctions about each borrower’s unique housing arrangement.

Many private lenders have high loan limits. But a student’s maximum loan won’t exceed what the school certifies as the student’s need based on their COA.

“We rely on the school's Cost of Attendance and the school's Loan Certification to determine what monies from our loan proceeds, if any, are eligible to cover other expenses like books, transportation and housing,” said Jesse Dyer, Strategic Advisory for Funding U. “Those excess loan proceeds are sent to the student and it's up to the student to use those for the approved expenses.”

Note that private student loan funds are also sent directly to the school for processing. So, it’s not a case where you send in your lease agreement and then receive a large check directly from the lender.

Instead, you’ll receive a refund from the school for any remaining balance and then it’s up to you to use the funds for approved education expenses.

Things to consider when using student loans for housing

The estimate listed in the school’s COA for off-campus housing is just that — an estimate. So, you’ll need to decide what housing costs are acceptable for both your current and future finances.

Just because you can borrow the maximum, doesn’t mean you should. Do you really need a penthouse apartment with a view? Or can you find roommates to split a small rental home with?

Student loans might feel like free money in the moment. But you’ll be paying back those borrowed funds for years to come. So, it’s best to choose housing that is affordable and realistic to minimize your debt burden.

Prioritize safety, and then figure out what level of comfort you’re willing to sacrifice your future paycheck for.

FAQs about student loans for off-campus housing

Federal and private student loans can be used for any education-related expense included in the school’s cost of attendance (COA). Each COA details estimated off-campus housing costs rather than specific allowances for individual living decisions.

When you complete the FAFSA, you’ll indicate whether you plan to live on-campus, off-campus on your own or off-campus with a parent. Each of these living arrangements is factored into your school’s COA.

Your financial aid package is determined by subtracting your Expected Family Contribution (ECF) from your school’s COA. There isn’t a specific dollar amount you’ll receive for off-campus housing. If you have additional people in your family besides yourself, ask the aid office to adjust your housing allowance higher and see what they say.

Federal and private student loans can be used for education-related expenses, including tuition and fees, room and board, and textbooks. But it can also be used for miscellaneous expenses like childcare costs, transportation to and from school and any necessary equipment (e.g. laptop and printer).

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

| Sallie Mae |

Competitive interest rates.

|

Fixed 3.49 - 15.99% APR

Variable 4.54 - 14.71% APR

|

|

| Earnest |

Check eligibility in two minutes.

|

Fixed 3.47 - 16.49% APR

Variable 4.99 - 16.85% APR

|

|

| Ascent |

Large autopay discounts.

|

Fixed 3.39 - 15.71% APR

Variable 5.01 - 15.27% APR

|

|

| College Ave |

Flexible repayment options.

|

Fixed 3.47 - 17.99% APR (1)

Variable 4.44 - 17.99% APR (1)

|