Some states use community property law to regulate marriage income taxes and assets. These states are California, Texas, Arizona, New Mexico, Louisiana, Nevada, Idaho, Washington, and Wisconsin. If you live in one of those states and are thinking about going for student loan forgiveness, you might be able to save a lot of money with the tips in this article.

When married federal student loan borrowers desire to exclude their spouse's income from their income driven repayment, most simply just select “married filing separate” as their tax filing status.

However, residents of community property states (AZ, CA, ID, LA, NM, NV, TX, WA, WI) have unique rules pertaining to how to split income when filing taxes separately. This applies to about 3 in 10 married Americans with student loans.

On a federal tax return, when you file separately in a community property state, you “must report half of all community income” per the IRS.

And most borrowers will need to use their 2023 tax return to recertify their IDR payments in 2024 for the first time in several years.

So how should you certify your income if you pay student loans on an Income Driven Repayment (IDR) plan? We'll explain.

What Does Living in a Community Property State Mean for Student Loans?

Community property rules in the US can generally be traced to some states operating under Spanish civil law when they used to be a part of Mexico and others that operated under English civil law.

In a community property state when you file taxes separately as a married couple, you must split income on your tax return equally between spouses.

For example, if two spouses make $60,000 and $40,000, you would make an adjustment on the tax return and both would show as earning $50,000.

Which income should you report for your IDR plan? Each individual income? Or perhaps the income that represents 50% of your joint income?

Filing Taxes Separately For PSLF Tax Implications for Married Couples in a Non-Community Property State

Let’s look at a simpler situation in a state with normal common law marital tax rules, such as Florida. Pretend a physician (Sarah) is married to a teacher (Dwayne) with no student loan debt.

Sarah the physician owes $400,000 of student loans at a 7% interest rate. She has five years of credit towards the PSLF program.

If Sarah the physician files jointly with her teacher spouse Dwayne, who earns $50,000 a year, then she can use SAVE married filing jointly. Both will result in the same monthly payment amount of about $2,000 a month.

If she files separately, then Sarah’s payment on SAVE would be about $1,700. That difference is about $300 a month. An inexperienced person might look at that payment difference and conclude, “we should file separately to get a lower monthly payment!”

However, in non-community property states, which is most of the country, you’d pay more in taxes by filing separately if you have a big income difference.

This is because the higher earning spouse is often placed into a higher tax bracket.

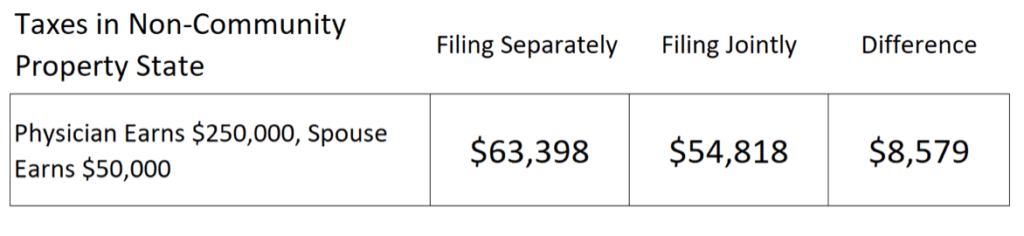

Here's an example of the multi-thousand dollar extra tax bill that often comes with filing separate outside of community property states.

In this case, Sarah and Dwayne would pay $8,579 extra for filing taxes separately. This happens because Sarah gets put into the 35% tax bracket while filing separately but would only be in the 24% bracket if she filed jointly. That higher bracket creates an additional tax liability.

Since the student loan payment savings are much lower than the tax costs, this couple would file jointly.

Now let's look at an example in a community property state to see why many borrowers won't need to worry about the additional tax costs of filing separate.

Tax Implications of Filing Separately in the Community Property States

Recall that the only reason to file separately when you have student loans is to exclude your spouse’s income from your income-based repayment amount on an IDR plan. When you’re in a community property state, your Adjusted Gross Income (AGI) is going to be split evenly.

That means the cost of filing separately and filing jointly will be very similar as neither spouse will get placed into a higher tax bracket. The only exception would be if you claim certain less common tax write offs.

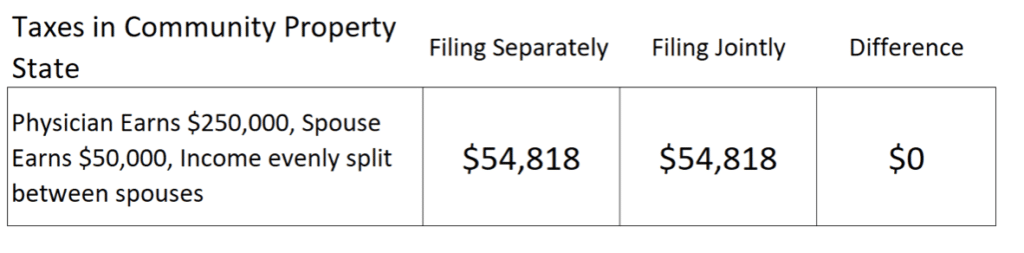

If Sarah and Dwayne lived in Arizona, they’d be subject to community property rules.

Let's look at their taxes again.

In this new case, the difference in tax payments between filing jointly and separately would be minimal.

For Sarah's student loans, Sarah’s new SAVE payment would be about $1,000 a month.

Compared to the filing jointly payment, this filing separate approach saves her about $12,000 a year on her student loans.

Since Sarah is the higher earner and she’s going for loan forgiveness, she could save a ton of money through this strategy, which we call the “breadwinner loophole.”

However, if Dwayne was the one with the student debt, they’d be hit with a higher payment filing separately than they would if they lived in a non-community property state.

How can a lower earning spouse pay less and still exclude his spouse's income on his IDR payment?

Meet the “alternative documentation of income” approach.

Related: How to Decide When to Use Married Filing Separately on Your Tax Return

Using Paystubs or Alternate Documentation of Income for a Better Student Loan Payment in a Community Property State

Here are the two acceptable ways to verify your income with a loan servicer if you’re on an income-driven repayment option:

- Your tax return showing your AGI

- Alternative income documentation, such as a letter testifying to your income or paystubs

Your plan should be to use your tax return or your paystubs.

The way a lower earning borrower in a community property state can use the alternative documentation method is to check a box when recertifying income that says “my income has declined since my last federal tax return.”

This should be checked every year, since every year, your income would be lower than what your 50/50 federal split income tax return shows.

Considerations for Married Couples Who Both Have Student Loans in a Community Property State

Due to new changes in the student loan rules under the new SAVE income driven plan, you can earn 225% of the poverty line before having to pay anything.

This deduction is determined by the size of your family if you file joint, or the size of your family excluding your spouse if you file separate.

Here's a quick example. A family of 5 would deduct about $78,000 of income before paying 10% under SAVE.

If they both have loans, they could file separate and each claim a family size of 4, allowing a deduction of about $67,000.

Since both borrowers would get this deduction, the savings would be 10% times $67,000*2 – $78,000 = $5,600 per year.

This is enormous savings, and many families with children will want to file separately even if there isn't much IDR benefit.

Families with Spousal Borrowers Who Have Large Differences in Debt to Income Ratios

Imagine a dual debt couple. One has $800,000 of loans from orthodontics residency and dental school. The other has $100,000 of loans from law school. Each earn about $300,000 per year.

Because the debt to income ratio is so high for the orthodontist, he should consider filing separate and pursuing an income driven repayment plan. The lawyer earning $300,000 who has $100,000 of debt will not be able to get forgiveness with income much higher than her loans.

Hence, the high debt to income ratio spouse should pursue forgiveness, the low debt spouse should pay off her loans, and both should file taxes separately while splitting income to give the high debt spouse a low payment.

Why Tax Advisors or CPAs Might Give You Incorrect Information About Filing Taxes Separately in a Community Property State

If you ask your tax preparer or advisor about what filing status to choose based on your student loan balance, he or she will most likely have no idea.

Student loans are not taught in CPA curriculum.

And a tax professional's job is to minimize your tax burden. Filing taxes separately is usually useless for taxes, and it can often be negative, particularly outside of community property states.

Hence, tax professionals generally do not understand these types of requests.

It's also common for software built for professional tax preparers to not make this easy. Even though the IRS clearly expects community property state returns to split community income across both spouses, software does not make this easy or straightforward.

We legally of course have to tell you to consult with your tax professional, but if you book a student loan consult with our team, we can suggest language and examples to provide to your tax professional to make tax time easier for both of you.

Figure Out Your Best Tax Filing Status as a Community Property State Resident for Your Student Loans

Now that you know the tax implications for married couples filing separately in community property states, you still might have some questions about your student loans.

If you’re confused about your student debt, then we can help with our flat fee student loan consult. You’ll understand all your options and all the questions you should be asking, many you probably didn’t even know about.

If you have experience with filing separately to get a lower student loan payment, whether in a community property state or not, let us know in the comments.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.