There are different levels of student loan fraud. If you earn $500,000 a year and claim zero income so you can get loan forgiveness, then clearly you’re breaking the law.

The Government Accountability Office (GAO) released a report in June 2019 that found some borrowers claimed a family size of 93 on their IDR form to get the lowest payment possible. Either someone accidentally fathered a small village or that’s a complete lie.

Student loan fraud is not always so clear-cut though. Sometimes borrowers, servicers, and companies in the student loan world convince themselves something is ok when it’s clearly not based on the rules.

That’s the kind of student loan fraud we’re going to tackle in this article.

Student loan fraud 1: Not reporting your bonus when you certify your income

I came across a discussion in a Facebook group about ways to lower your payments if you want to get loan forgiveness under the Public Service Loan Forgiveness (PSLF) program.

You can read 40 legitimate ways to lower your income-driven payment right here if you’re going for PSLF.

Unfortunately, one physician suggested the following:

“One great way we’ve been able to lower our payments is by only submitting our paystubs. We feel like we shouldn’t have to report our bonuses to FedLoan because those aren’t guaranteed every year. It’s literally saved us thousands of dollars.”

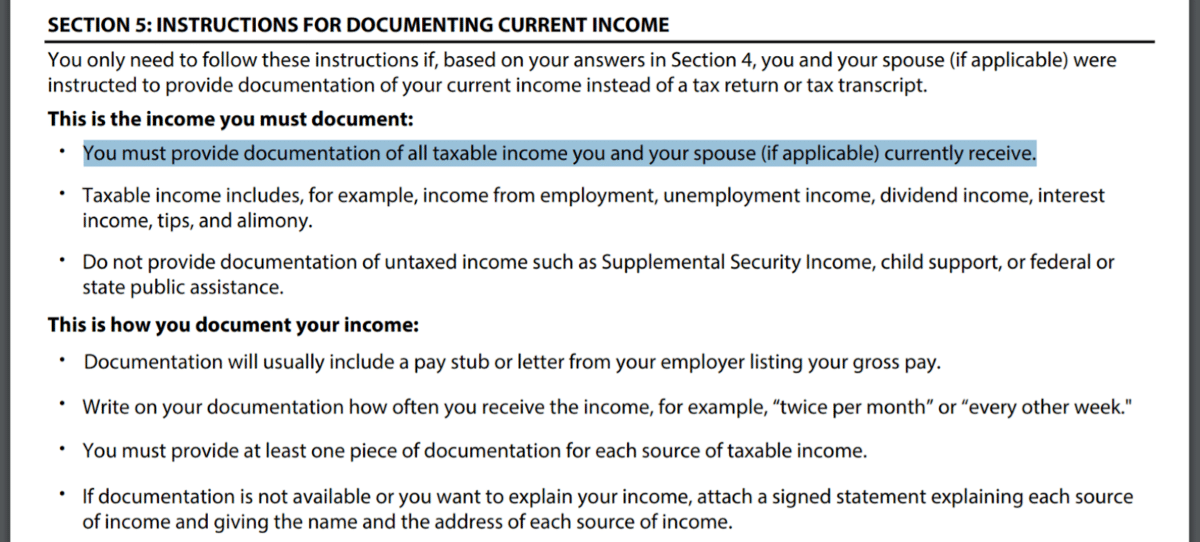

This is clearly fraud according to the rules stated on the income-driven repayment (IDR) form regarding taxable income.

Notice what I highlighted in the image below showing the instructions for documenting income in Section 5 of the form:

Why it’s important to report your bonuses

If you can make a legitimate case as to why you will no longer receive bonus income, then you are well within your rights to get a lower payment recalculated; however, the IDR form clearly says that you must report all sources of taxable income. Bonuses are taxable income, period.

To not report a bonus means you’re omitting a potentially significant amount of compensation from the number servicers use to calculate your income-driven payment. You’re making that omission to get a lower payment. That’s clearly fraud.

You can use alternative documentation of income if you believe your tax return is not an accurate reflection of your current income.

You still have to document a bonus that you got even if you apply with an alternative verification method, however. Usually we see borrowers use alternative documentation of income when they live in a community property state and are filing taxes separately.

Student loan fraud 2: Claiming that you can’t access your spouse’s income

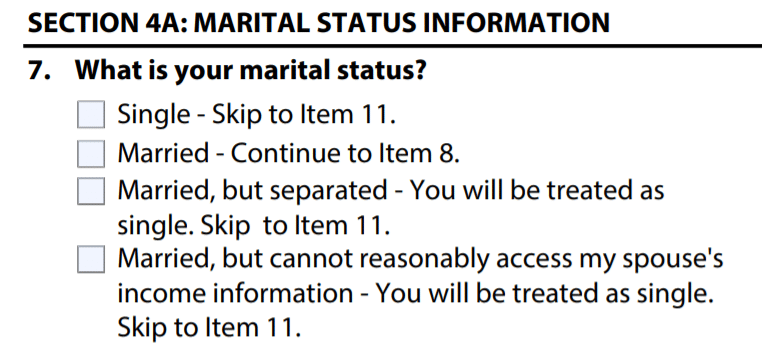

Many borrowers are on an IDR plan, which factors in household income when calculating your monthly payment. This includes your spouse's income, whether they have student loans or not. One legal way to get around including your spouse's income is to file taxes separately. But, in certain scenarios (e.g., domestic abuse), borrowers can exclude their spouse's income by indicating that they can't access it. The problem is that borrowers can commit fraud by falsely claiming they can't access spousal income.

Student loan servicers have scripts, or rules of thumb, they give phone reps. One of the most common lines is to tell everyone to sign up for SAVE (formerly known as REPAYE).

What happens when a lower-income spouse gets married and calls their servicer asking how they can lower their payment?

In many cases, loan servicer reps naturally want to please the human on the other end of the line, so they tell them to check a box that they “can’t access their spouse’s income.”

This allows the SAVE or other IDR payment to be significantly lower, usually by thousands of dollars a year.

The government added the “married but can’t access my spouse’s income” box for victims of domestic violence or individuals whose spouses have abandoned them.

Here’s what the box looks like on the IDR form:

What if my spouse refuses to give me their income information?

There are legitimate situations in which you could not access a spouse’s income. Here are a few I can think of:

- They’re serving in a war zone overseas.

- Your spouse is suffering from a serious illness.

- As mentioned earlier, you’re a victim of domestic violence.

- Your spouse has disappeared.

Note that there’s already a box for if you’re separated from your spouse. That means you need to be living apart and not maintaining a household together.

Borrowers talk themselves into checking the “can’t access spouse’s income” box by saying that their spouse refuses to give them the information.

One borrower told me that their spouse absolutely refuses to tell them anything about their financial situation, so they felt comfortable checking it.

To that I say as long as you don’t have any of the following, then you’re in the clear:

- A joint bank account

- A married-filing-jointly tax return (if you have one of those, then you signed your name that everything was truthful and your spouse’s income was directly on the form)

- Any insurance accounts with both of your names on them

- Joint investment accounts

- Property held in both your names

Like I said, there are legitimate situations in which you can’t access a spouse’s income, but many of the people checking this box right now are doing it for two reasons:

- They want to pay less and don’t mind lying.

- Their loan servicer told them to do it.

There is strong evidence that FedLoan told borrowers to lie

One loan servicer stands out for how many times I heard borrowers and clients tell me that they were told to say they couldn’t access their spouse’s income, and that’s FedLoan Servicing. Now, FedLoan is no longer a federal loan servicer. But it's still something to be aware of when talking to your existing loan servicer.

I’ve documented what they put my wife and me through, so I certainly don’t hold them in very high regard — perhaps that’s a necessary disclosure.

FedLoan reps told borrowers to lie in saying they can’t access spousal income, which in turn, encouraged them to lie on a federal form. This is based on anecdotal evidence I’ve noticed.

I’ve heard stories of all loan servicers telling borrowers very inaccurate information. Sometimes this misinformation would lead to a borrower paying too much and sometimes too little.

But the sad part is that they never had to mislead borrowers into fraudulent claims. There’s a legitimate way to exclude a spouse’s income from the payment calculation: File separately for taxes and select the SAVE or PAYE plan.

Related: Which Income-Based Repayment Plan Requires Spousal Income? A Guide for Borrowers

Student loan fraud 3: Creating a fake nonprofit to get loan forgiveness

You could theoretically start a nonprofit and work for it to qualify for tax-free student loan forgiveness after 10 years.

The problem is that starting a nonprofit means it has to be legitimate. Most student loan fraud that I’ve seen in this category involves shady nonprofits.

To be a legit nonprofit, you should be providing services at cost or for free and raising money like a charity would: through donations, fundraisers, etc.

What you can’t do is violate private inurement rules.

In English, you can’t do things through a nonprofit clearly for your own private benefit.

Many of the borrowers I’ve seen pursuing this strategy are not operating nonprofits at all. They submitted a document to the IRS that auto-approved it because the organization had revenues below a trigger level for a manual review.

According to one of my sources, who will go unnamed to protect their identity, the IRS is starting to audit these filings with much greater scrutiny because of fraud concerns.

Your private practice is probably not a legitimate charity, even if the IRS approved it

I’ve seen numerous chiropractors, naturopaths, and even dentists claiming that because they serve underprivileged patients as part of their practice they qualify as a 501(c)(3) nonprofit.

The motivation behind this is to get your loans forgiven tax-free with PSLF after 10 years.

Doctors claim this approach qualifies them for PSLF, despite:

- Earning more than their cost for their services (and not having that profit reinvested in the nonprofit mission)

- Sharing the building with a private practice arm that also employs them (so you can charge higher rates to full-paying customers)

- Somehow swearing they work at least 30 hours a week for the nonprofit even though that’s not true

I think by the time PSLF has cost the government tens of billions of dollars that a few people will go to jail over schemes like this. Don’t be one of them.

To avoid committing student loan fraud, use loopholes but don’t lie

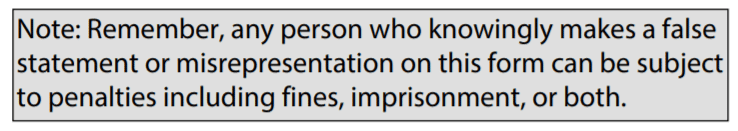

Federal student loan fraud is no joke. On the IDR form, you can clearly see what the penalties are:

I don’t know about you, but I don’t think student loans are worth going to prison over.

Instead of committing student loan fraud, utilize the legal loopholes available from the government, which include having almost a dozen different payment options.

You can do things like file taxes separately, maximize retirement savings to lower your adjusted gross income, start a business to legally shield income from your taxes, and utilize the most efficient repayment plan for your individual situation.

We can help you figure that out, too.

Remember that just because your co-worker at the hospital or the student loan servicer rep said it was ok does not make it so.

Don’t commit student loan fraud, and please, if you’re using one of the three most common fraudulent strategies I mentioned above, stop using it and start filing the right way like the rules require.

Have you used any of these strategies? Do you feel like you were misled into doing so? Maybe you think the above approaches are legit and want to state your case. You can do all three below.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.