When you leave graduate school or finish a residency program, one of the many firsts you’ll encounter is salary negotiations. Although it might not be obvious to you or your prospective employer, your student loan balance can be included in your total compensation salary negotiations.

Here’s how student loan-based salary negotiations can help you earn more money while staying engaged with the work you do for an employer.

Federal loans and Public Service Loan Forgiveness

Let’s say that you have federal Direct Loans from school.

If you worked full-time for a qualified employer (a nonprofit, state, or government employer), you could apply payments made on those loans toward the Public Service Loan Forgiveness (PSLF) program while on an income-driven repayment plan.

In the PSLF program, the relevant cost to measure is the sum total of your projected qualified payments made over 120 months.

If that total is less than paying the loans down to zero over the same time period, then you could benefit from working for a qualified employer.

How much you could benefit from the PSLF program

The all-too-common answer to that question is “it depends.” To get around that, let’s walk through a quick example.

Sandy owes $200,000 from graduate school and is looking at a qualified employer job offer of $150,000:

- Non-qualified employer offer: $155,000

- Qualified employer offer: $150,000

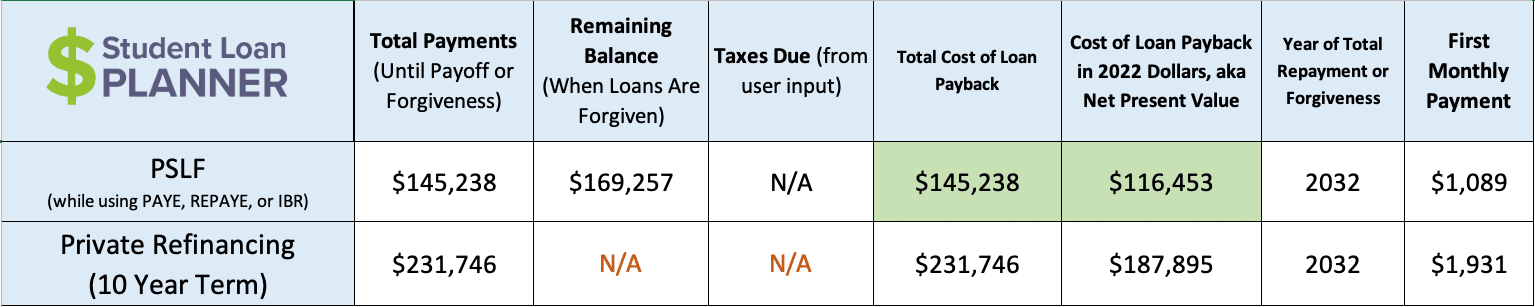

Below is a table showing a comparison of cost for Sandy, over a 120 month period in pursuit of PSLF:

Sandy could spend about $86,500 less over time pursuing the PSLF strategy instead of paying it down to zero at a 3% interest rate. This means that the for-profit employer offer would need to be equal to, or better than, that after-tax amount over the same 10-year period.

Now employers don’t translate what lands in your checking account (i.e. after-tax) from your salary offer. You have to gross up the $86,500 by income taxes.

Also, the payment difference of $86,500 happens over time, with inflation. Instead of looking at the payment difference over time, use the “Net Present Value” column and that tells you what Sandy would pay if she had a check to write for the balance of either loan strategy today.

Using those numbers, it’s $187,895 – $116,453 = $71,442 more costly to pay the loans down to zero.

Divide that number by 10 years and you get $7,144.20. Gross that number up by taxes (Federal, State, Local, FICA = could use 30% ) and we arrive at $10,206.

If Sandy were comparing job offers, she’d start by looking for a for-profit offer that’s at least $10,000 higher than her $150,000 qualified employer offer.

How to bring up your student loans

If your employer is basing part of its decision to make an offer because of where you received your education or continued education, then it might be willing to negotiate based on the cost of that education over another candidate. But this will never come up in the interview process.

It’s up to you to bring it up. You can be straightforward or creative in your approach.

Start by asking your prospective employer(s) for the reasons why they chose you, basing the request on curiosity.

Your prospective employer might tell you that the compensation they are willing to pay is based on the work that you perform and the availability of others out there to perform the same work. This is a widely accepted rationale but can be improved with current information on the cost of creating the candidate pool.

You could share the current debt balance of your peers and point out where you fall due to your choice in education:

- If your balance is higher than average due to the academic rigor of the university behind your degree, lean on that.

- If your balance is lower than average perhaps due to a conscious choice on your part to minimize your debt burden down the road, then share your approach and how that makes you seem more reasonable and hard working.

The bottom line

Going back to Sandy’s loan situation, she can look at the situation from a more holistic angle by asking herself a couple of questions.

- What defines a “best-fit” situation for her?

- How does the work culture with a qualified employer in her career path differ from a non-qualified employer?

Perhaps one type of employer generally offers more stability while the other type of employer generally offers more frontier-level excitement.

Selecting an employer when faced with multiple offers has always been a multi-layered decision. Student loans are yet another layer to add to the negotiation process.

And remember, the negotiation process doesn’t stop once you’ve started work. If you’ve been working for a non-qualified employer for a few years, and still have the option to switch to a qualified employer, present the value of your continued service at your next performance review to move your salary forward.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

Bonus for eligible users who refinance $100k or more (bonus from Student Loan Planner, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 10:49% APR

Variable 5.88 - 10.49% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.38% APR

Variable 4.33 - 12.35% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).