A 529 savings plan can be used to pay for certain education-related costs, including K-12 tuition and college expenses. But can you use a 529 for medical school and other graduate or professional programs?

Most of the discussions around saving for college center on paying for an undergrad degree. If you’re headed back to school for another degree or saving for your child’s graduate school future, you can still use a 529 for graduate school expenses.

Although 529s have many advantages — like tax-free growth and withdrawals — they aren’t always the most strategic option for graduate and professional students who plan to attend a high-cost program.

Here’s what you need to know about using a 529 for graduate school.

Can a 529 be used for graduate school?

529 funds can be used for most colleges and universities, including medical, law, business and other graduate schools. Additionally, all graduate and professional degrees qualify. You can use a 529 plan to pursue a master’s, doctoral, medical or law degree at any eligible institution with no issue.

Many trade schools are also eligible if you’re going back to school for a vocational degree. The key requirement is that the program or school must be accredited and eligible to receive Title IV federal student aid.

If you have any concerns, it’s best to confirm your graduate school’s 529 eligibility by contacting the school directly. You can also check the Department of Education’s Federal School Code List which is updated every February, May, August and November.

Eligible graduate school expenses

529 funds grow free from federal and state income tax, and withdrawals can be made tax-free when used for qualified higher-education expenses at a graduate or professional school.

Qualified higher-education expenses include:

- Tuition and fees

- Books, supplies and equipment required for learning

- Special needs services or expenses (e.g. sign language interpretation and note-taking assistance)

- Room and board expenses, as determined by the school’s cost of attendance for off-campus housing or the actual amount charged for on-campus housing

These expense qualifications remain the same for undergraduate studies and trade schools, meaning no distinction is made based on the level of education being pursued.

529 tax breaks to be aware of

In addition to tax-free growth and withdrawals, many states offer a 529 tax deduction for making contributions to a qualifying plan.

In most cases, this means opening a 529 plan in your own state. But several select states (e.g. Arizona, Minnesota and more) allow you to claim their tax deduction or credit for contributions made to any state-sponsored 529 plan.

Depending on where you live, your 529 contributions could be 100% deductible on your state income taxes. It could also mean diddly-squat if you live in a state without an income tax (e.g. Texas) or in a state that simply chooses not to provide a 529 tax incentive, like California and Maine.

Because state 529 tax deductions vary greatly across the country, you’ll need to compare plans to find the best match for your situation.

What to consider before using a 529 for graduate school

Some families choose to plan ahead for graduate or professional school expenses by maxing out their 529 plan over time. These high contribution limits, which range from $235,000 to $500,000+, can be beneficial if you know you’ll attend a high-cost program in advance.

But many times, students end up using leftover money that wasn’t drained during their undergraduate degree to help pay for graduate school. A parent might even change the beneficiary to themselves if their child decides not to go to college. In which case, they can use their 529 funds for their own graduate or professional education goals.

Whether you plan to use your 529 for graduate school or end up with leftover funds unintentionally, having access to college savings can help make your advanced degree more affordable.

However, it’s not your only option for paying for graduate school. And in some cases, it’s not the most strategic because of today’s generous student loan forgiveness programs.

A 529 for graduate school can affect financial aid eligibility

If you choose to use a 529 for graduate school, you might run the risk of having your 529 funds affect your financial aid eligibility when submitting the Free Application for Federal Student Aid (FAFSA).

StudentAid.gov states that “in almost all cases, graduate or professional students are considered independent students for the purposes of completing the FAFSA form.”

Independent student savings are treated less favorably than parental assets for dependent students. Additionally, distributions from a parent-owned 529 to pay for an independent student’s graduate expenses are counted as untaxed income on the student’s FAFSA.

Both scenarios can chip away at your financial aid eligibility, so you’ll need to weigh your options and seek further financial guidance for your specific situation.

Loan forgiveness might be better for graduate school borrowers

Graduate school is expensive, and professional program costs can easily add up to well over six-figures. But with these ultra-high costs also comes the opportunity for more options for student loan forgiveness.

If borrowers ultimately want to pursue loan forgiveness, using a 529 plan for graduate school isn’t as necessary. Federal student loan forgiveness programs are a lot more generous for graduate student loan borrowers. There’s less of a need for 529 funds if you can maximize forgiveness options after graduate school.

For example, the average physician student debt for Student Loan Planner® clients is $342,000. This is a daunting amount, but medical professionals also have some of the best opportunities to use loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF).

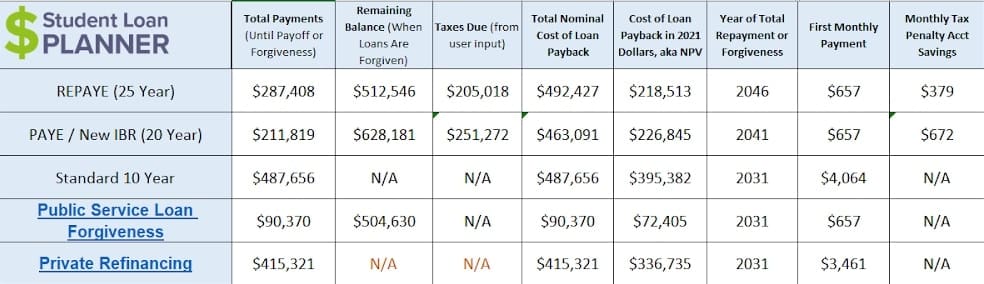

Let’s say Gabrielle has $350,000 with a 7% interest rate for her undergraduate and medical school debt. She currently works at a Veterans Affairs (VA) medical center making $110,000 annually and has a family size of 3.

Since she works for a PSLF-qualifying employer, she can use loan forgiveness to her advantage.

By enrolling in an income-driven repayment (IDR) plan to meet the PSLF requirement, Gabrielle can keep her monthly payment as low as possible.

Her payment would start out at $657 and gradually change over time to reflect her income and family size.

In this example, Gabrielle will pay less than $100,000 toward her student loans and have her entire remaining balance wiped away tax-free after only 10 years (or 120 qualifying payments to be exact).

That’s far less than the $400,000+ Gabrielle would repay under a standard 10-year plan or by refinancing her student debt with a private lender. It’s also significantly less than she would have paid using 529 savings up-front.

Note that many professions — like lawyers and physicians — have access to additional state repayment programs that can help wipe away student debt in exchange for a limited service commitment in an underserved area.

Make a plan to pay for graduate school

Each federal and state loan forgiveness program has its own requirements and nuances. It’s best to do your research and go into graduate school with your eyes wide open — especially if 529 savings or student loans are part of your financial plan.

Our team of student debt experts can show you how to maximize loan forgiveness options and plan for your education and career goals. Schedule a pre-debt consult to get an in-depth analysis of the smartest way to borrow for graduate school.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

For refinancing 100k or more (bonus from Student Loan Planner®, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 10:49% APR

Variable 5.88 - 10.49% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.38% APR

Variable 4.33 - 12.35% APR with autopay with autopay |