If you're a veterinarian, want to be one, are in training , or love someone who is, you should know about the extreme unfairness toward the animal health profession that exists today. Veterinarians are treated horribly under student loan repayment rules. Students graduate with huge balances, are not eligible for the best student loan forgiveness options, and don't earn high enough incomes to pay back their debt.

To top it off, most of their peers in human medicine have access to a massive loophole in the student loan rules that many veterinarians don't. This results in veterinarians paying hundreds of thousands of dollars more on their educational loans than human doctors making five times their salaries. This piece should serve as a call to action for the veterinary profession.

Veterinarian student debt among the highest of any profession

I've worked with hundreds of veterinarians in my student loan consulting practice. Their average student loan debt is $265,000. From what they've told me, most of their friends have debt loads that are a similar size. This is so wrong for a bunch of reasons.

First, the average med school grad I've spoken with has a lower balance. Regardless of what schools tell you, it has to be more expensive to educate a med student than a vet student. Why then does vet school result in so much higher student loan balances? I believe there is price gouging going on.

There are not many accredited vet schools to choose from. Because of the limited access, getting into vet school is harder now than getting into medical school. Since so many college students want to become veterinarians, schools have the ability to raise prices.

Some affordable options still exist, but the competition for these seats at state public universities is fierce. You're more likely to get a spot at one of the types of vet schools that will wreck your finances.

Furthermore, the federal government does not impose any caps for practical purposes on how much student debt you can borrow. In the absence of any market-imposed restraint on the cost of tuition, it grows steadily higher each year.

Hence, veterinarians start off with a crushing debt load. Unfortunately, I have far more serious evidence that veterinarians are treated horribly under student debt rules.

Veterinarians have little eligibility for the best forgiveness option, PSLF

Assume that you are a vet student who graduates with $300,000 in student debt and receives an offer of $80,000 a year at a private vet hospital. Your loan payments will never touch the high balance unless you dedicate 50% of your income to your debt. That's not a realistic proposition.

In the legal profession, a student could graduate with a similar debt load and work for the government for 10 years. After this period, the lawyer's entire student loan balance is wiped away tax-free thanks to the Public Service Loan Forgiveness program, or PSLF for short.

Veterinarians have almost no in-field not-for-profit jobs available to them. Sure, there are scattered opportunities here and there, but nothing widespread like a prosecutor or public defender jobs as in the legal profession.

For that reason, virtually all veterinarians graduate and take a job in the private sector. Because of the lack of nonprofit jobs, almost no veterinarians qualify for the PSLF program, which is by far the most generous benefit available to students today.

Some states offer veterinary medicine loan repayment programs. Unfortunately, the federal PSLF program makes them look irrelevant by comparison.

Pay is high enough to owe a lot each month, but not high enough to make a dent in your student loans

Veterinarians certainly make more money than the average American household. That said, of course they should. They have four years of freaking graduate level education! Unfortunately, vet salaries are far below those of human doctors.

No matter how much a family loves their dog, there just isn't the same financial desire to pay thousands of dollars for a surgery to save its life. Most families who face a huge vet bill to save their pet will instead decide to put the pet down.

It's very sad, and I've spoken with many veterinarian friends who want to save the lives of their patients but are not allowed to provide certain veterinary services because of financial constraints.

Even so, veterinary salaries are high enough to require large payments in the income-driven repayment (IDR) plans. Paying almost $10,000 per year toward your student loans is no joke.

That said, only paying $10,000 on a $300,000 loan amount does not even cover the interest. The federal student loan rules trap veterinarians. They have to pay big monthly payments when they graduate, but they aren't able to pay down their debt.

Refinancing vet school loans is difficult because of debt-to-income ratios

The average vet school debt for borrowers who owed money after graduation in 2019 was about $183,000 according to the AVMA. If you refinanced that debt amount at a 5% over 10 years, you would owe $1,941 a month, or $23,292 a year.

After a few years in the workforce, some veterinarians start earning in the $110,000 to $140,000 range with production bonuses included. Even if you make a decent income, paying 20 grand a year is no joke.

Most lenders want to see debt-to-income (DTI) ratios below two-to-one. That means if you earned $80,000, they would want to see student debt of less than $160,000. When young doctors ask me if I think they should refinance, I suggest that you follow this two-to-one DTI rule of thumb.

Since so many veterinarians have high student loan balances relative to their incomes, getting the low interest rate through refinancing that's needed to rapidly pay back debt in the first place is challenging. If you do work in the private sector and can afford to pay down your loans in 10 years or less, get a cash-back bonus for refinancing your vet school loans and aim for at least a 1% reduction in your interest rate.

The human doctor loan forgiveness loophole should make veterinarians furious

I'm going to show how unfair student loan policy is for the veterinary profession with a hypothetical example. I've made a super powerful, free calculator available here that I use to power these examples. Feel free to use it model your own student loans and explore various repayment options.

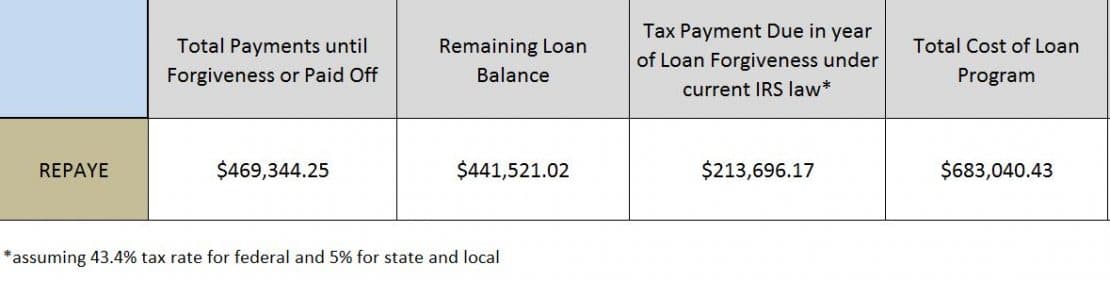

Assume Sarah the veterinarian graduated in 2012 and has been paying on her debt every year. She now has a $350,000 balance with an average interest rate on her consolidated loans of 7.25%. Sarah makes $85,000 a year in a private animal hospital.

She will never be able to pay off her debt completely making the monthly payments in the income-based forgiveness program.

However, she will be eligible for taxable loan forgiveness in 2037 and will have to pay income taxes on the forgiven amount that year. Here's how the cost looks:

So, her total cost is $683,000 for her veterinary education over 25+ years.

How four years of med school can cost less than one year of vet school

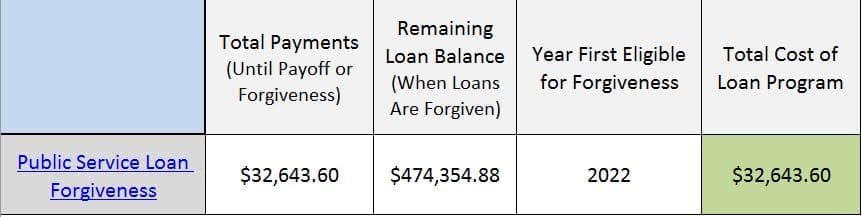

Now let's look at one of Sarah's friends Christine who went to medical school. She graduated in the same year 2012 and has been making payments since this time. Christine is about to start her fifth year of training in her neurosurgery residency. She wants to do a fellowship as well, which will allow her to keep her payments low for the first 10 years of student loan payments. Here's how much her loans will cost her:

Sarah the veterinarian will pay $683,000 over 25+ years to her student loans, and Christine the neurosurgeon will pay $33,000 over 10 years to her student loans.

Sarah the vet will be making payments her entire professional life, and Christine the neurosurgeon will have her $474,000 debt balance completely forgiven tax-free before she starts making over $500,000 per year as a fellowship trained human doctor specialist.

Not only do human doctors make five times as much in salary, but they can also pay 5% of the amount toward their student loans. After 10 years, the government COMPLETELY FORGIVES THE LOANS TAX-FREE!

Veterinarians are treated horribly under student loan rules, and it's the federal government's fault

How is this you ask? Human doctors work for not-for-profit institutions during their training. Therefore, they qualify for super low payments during residency and fellowship that count toward the PSLF program. After 10 years of payments, the federal government forgives their debt tax-free.

Veterinarians work in the private sector as there are not many not-for-profit vet hospitals. That means the forgiveness vets get comes after 20 to 25 years. Furthermore, the government treats that forgiveness as if someone handed them a check for $500,000. The IRS turns around and tells you that you now owe $200,000 in taxes.

If you are a veterinarian, you must be preparing for this huge vet school loan tax bill that you will likely face one day from the IRS. Hopefully Congress passes a law and does away with the tax bomb forever. However, do not plan that they will so you can be ready. Save a few hundred dollars a month in an index fund account at Vanguard or Betterment.

I don't believe Congress ever worried or thought about the horrible impact on the veterinary profession they had by passing new loan rules. If I was a member of the American Veterinary Medical Association (AVMA), I'd be up in arms. I'd write letters to all of my congressmen and congresswomen demanding equitable treatment for animal doctors and human doctors.

The federal student loan program does not work correctly. It's time for the veterinarian profession to rise up. It's time to put pressure on elected officials. Veterinarians deserve fair treatment under the law.

I can help you come up with the best strategy to pay back veterinary school loans

We have worked with a huge number of veterinarians to help them find the lowest cost repayment plan for their veterinary student loans. We charge a one-time fee and perform a holistic loan analysis to make sure you're not making a four-, five-, or six-figure mistake with loan repayment strategy.

*Note: We've written a bunch of free content for veterinarians struggling with massive student loans. If you'd like to see some of it, I suggest checking out the Vet School Section of the blog.

Comments are closed.