Veterinarians are faced with suffocating student loan balances and one of the toughest roads to get loan forgiveness. Often times, veterinarians don’t get PSLF because going for PSLF could take DVMs off their career path and end up costing even more money.

If you’re a veterinarian and feel like you’ll never be out of debt, listen up.

We’ve done nearly 1,200 consults with people who have 6-figure student debt, and veterinarians have one of the steepest hills to climb to pay off their loans. Part of that is because their student debt compared to their income is one of the highest out there. The other part is that getting loan forgiveness is not all that easy.

It’s just not right.

Getting accepted into a DVM program is tougher than med school and you have to be dedicated, hard-working and intelligent. There are so many anatomies to learn, school is darn expensive, and in the end, the income compared to the loans is just not enough. Here's why veterinarians don’t get PSLF and how they could if they really wanted loan forgiveness.

So Why Would Anyone Want to Become a Veterinarian?

We’ve worked with over 200 veterinarians and I can tell you the one thing that sets veterinarians apart from so many other people.

Veterinarians are some of the most passionate people I talk to. They love helping animals and fostering the bond between people. They’re all in!

So much so that DVMs are willing to go through a very rigorous curriculum and find out how to pay for veterinary school (often by taking out $200k+ of loans) to pursue their passion. Now that’s commitment!

Their love of animals makes it challenging to find a gratifying career path at a non-profit or government employer to qualify for PSLF.

Should Veterinarians Take a Non-Profit or Government Job to Qualify for PSLF?

Veterinarians could dramatically lower the cost to pay back their loans if they choose a job that will qualify for veterinary student loan forgiveness. It can be quite enticing.

Let’s say that Laura just graduated and has an average vet student debt $275,000 at 6.5%. She can either work for a good clinic doing what she loves where she’d earn $80,000 with her salary plus production bonus with her compensation growing 3% each year. Plus, there could be some ownership in the future.

Her other option would be to take a job at a non-profit shelter making $60,000 for 10 years to qualify for PSLF.

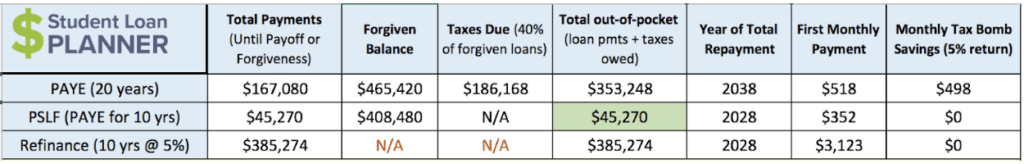

Here’s what the projected loan repayment costs look like:

First, let’s talk about the challenge Laura would face if she wanted to be debt free in 10 years or less without student loan forgiveness for veterinarians.

If she refinanced to a 10-year term at a 5% interest rate and left the federal loan program, she’d end up making $385,274 in projected payments over the next 10 years. Her monthly payment would be $3,123. That’s certainly possible making $80,000 but she’d have to live on a very tight budget for the next 10 years.

PAYE (Pay As You Earn) without PSLF is a decent option (top row of the table above). She’d make $167,080 in payments toward her loans over the next 20 years. The forgiven balance of $465,420 looks to be high, but she’d only have to come up with that taxes on that of $186,168 and would have 20 years to build that up.

The projections show that if she invests $498 per month with a goal of earning a 5% annualized investment return, that would give her enough to cover the tax bomb in 20 years. Certainly doable.

After all is said and done, between the payments and the taxes owed in 20 years, her total out-of-pocket cost is projected to be cheaper than refinancing by about $32,000.

PSLF is the clear winner financially. Laura is projected to pay only $45,270 over 10 years on PAYE as she goes for Public Service Loan Forgiveness. She’d have $408,480 in loans forgiven tax-free.

You can see why veterinarians entertain the idea of sacrificing the first 10 years of their career to get this huge financial benefit.

If the animal shelter job resonated with her and is in line with her career path, then it’s a no-brainer. However, most veterinarians don’t last very long in jobs like that.

The Cold Hard Truth for Veterinarians and PSLF

Rarely do I hear, “I’ve always wanted to be a food safety inspector,” or “A career in animal control is the path for me.”

The truth is that there just aren’t a lot of satisfying non-profit or government jobs out there for veterinarians.

Most veterinarians go into the profession because they love animals and want to work directly with them. Their main driver is to provide fantastic care and treatment to animals especially in the very challenging times.

Because of the monster loan balances, some veterinarians find work at an employer that qualifies for PSLF, an animal shelter, the FDA, a non-profit clinic. These jobs could provide a massive financial benefit by providing loan forgiveness, but they don’t provide the job satisfaction they were seeking by going into the field. Sometimes, these jobs can even pose a direct conflict with their views on animals’ well-being.

Many veterinarians we talk to don’t make it the full 10 years on the PSLF path because the types of jobs are very challenging physically and emotionally.

In fact, they don’t make it anywhere close to 10 years. We’ve worked with veterinarians talk after only 2 years on that path. They also tell us that many of their co-workers severely dislike their jobs at the non-profit employer and there is extremely high turnover. Those that were hired a year or two before them have already left.

They thought they could do it, but the work is too challenging or in conflict with their values. They are burnt out and ready to make a change.

If Laura started working at the shelter and decided to switch to a clinic after 2 years, she probably gave up $45,000 of extra in income between salary and production increases. That’s real money! Not only that, but they’ve given their lives to an extremely stressful line of work for 2 years without any tangible payoff.

How Veterinarians Can Get Loan Forgiveness with PSLF

Veterinarians have 2 main job choices to qualify for PSLF:

The first would be to take a job at a non-profit or government employer like the FDA or an animal shelter. Before taking a job like this, veterinarians should turn the tables during the job interview.

Ask the potential employer questions like how long the average DVM stays there, what a normal work week looks like in terms of time and responsibilities. Also, ask to speak with 2-3 veterinarians who work there to get a feel for it. It could be that this is a good path, but a DVM should be fairly certain they can stick it out for 10 years, not just 2.

The second way would be to get a job working 30 hours a week at a non-profit even if the work is not veterinary medicine. If the DVM wanted to, they could also work part-time practicing medicine that follows their passion. Perhaps becoming a professor at a local college or university could be a way to go to.

Veterinarians can get creative with this, but as long as they work 30 or more hours per week at a non-profit (practicing veterinary medicine or not), that could satisfy the job requirement of PSLF.

How Veterinarians Can Get Loan Forgiveness without PSLF

Even if veterinarians might not be able to get 100% of their remaining loans forgiven in the end, there are two other ways they could get a nice chunk forgiven.

The first would be to apply for the USDA’s Veterinary Medicine Loan Repayment Program (VMLRP). For veterinarians who work in areas where there is a shortage of care, they could get up to $25,000 a year in loan forgiveness for 3 years if they get accepted.

It’s highly competitive to get accepted into the program but there are also plenty of “shortage areas” that veterinarians might not know would qualify even in more dense metropolitan areas. Travis lays out how the plan works in an article he wrote in June 2018.

The second and most common way that veterinarians can get loan forgiveness would be on an income-driven repayment plan like PAYE, REPAYE or IBR.

This is taxable loan forgiveness where the borrower makes payments for 20 to 25 years and the remaining balance after that time is forgiven.

The forgiven balance is considered taxable income in the year the loans are forgiven so the borrower has to pay a “tax bomb” that year.

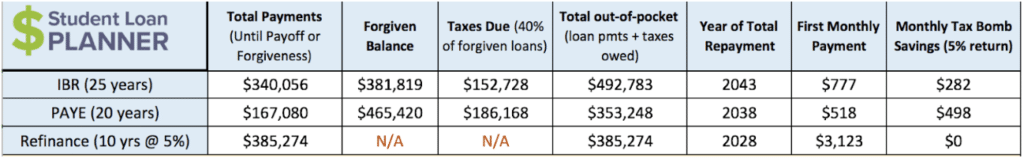

Let’s say that Laura is deciding between IBR and PAYE. Laura is thinking that IBR (payments = 15% of “discretionary income”) would be better than PAYE (payments = 10% of “discretionary income”) because the higher payments would mean a lower tax bomb. This is true, but IBR would end up costing her so much more money:

As you can see from the table, her IBR total payments end up being about twice what they would be on PAYE ($340,056 vs $167,080). She’d end up paying $173,000 more in payments on IBR. The tax bomb is lower by $34,000 compared to PAYE, but the out-of-pocket cost of IBR (payments + taxes owed) is $140,000 more expensive than PAYE. Despite the higher tax bomb, PAYE is projecting significant overall savings vs IBR.

The tax bomb scares most people seeing that they’d owe a chunk of money to the IRS at one time, but it’s actually a blessing in disguise.

In Laura’s case, her loans aren’t 100% wiped away after 20 years on PAYE, but there’s still significant loan forgiveness.

She’s projected to have $465,420 in remaining loans at the end of 20 years and let’s say she’d be in a 40% tax bracket at that time and have a tax bomb of $186,168.

That means that the other 60% of her loans (or $279,252) would be wiped away clean. That’s a huge benefit!

That right there illustrates the power of keeping payments as low as possible on an income-driven repayment plan and maximizing the loan forgiveness. Would Laura rather pay an extra $1 today when she might only have to pay $0.40 in 20 years with the other $0.60 forgiven?

Best Student Loan Repayment Strategy for Veterinarians

Yes, veterinarians have challenges paying back their student loans and most veterinarians don’t get PSLF. But the best way to approach the debt is to get on a plan that will save the most money and fit in with a veterinarian’s career path and lifestyle.

We’ve consulted with over 200 veterinarians and have noticed some similar patterns, but each situation is unique.

Whether you want to talk through PSLF, VMLRP, or taxable loan forgiveness, we can walk you through the numbers and give you the action steps to implement the plan in just an hour.

If you’re a DVM wondering the best path to pay back your loans, schedule a one-hour consult today to receive a customized student loan repayment plan.

Comments are closed.