Pretend you are a brand new Doctor of Veterinary Medicine. Your first year out of graduation, you do a veterinary internship and make about $30,000. Then you do a veterinary residency program for three to five years and make $40,000 each year.

Clearly, this is a horrible financial decision compared to an immediate $75,000 salary in private practice right? Veterinary residents have the most attractive job financially in the entire veterinary profession. Every veterinarian with student debt needs to know why.

Everyone in the Veterinary Industry Needs to Know About the PSLF Program

The bonus I'm referring to comes from the Public Service Loan Forgiveness Program (PSLF). The higher your student loan balance, the greater the value of this benefit. With PSLF, veterinarians could make income based payments while working at a not-for-profit or government employer and have their entire student debt forgiven tax-free in 10 years.

Compare this benefit to the forgiveness available to private sector veterinarians, who comprise most of the profession. For this group, you have to make payments for 20 to 25 years to be eligible for forgiveness, not 10. At the end of this long period, the “forgiven” loan balance is considered taxable income by the IRS.

During many of my private student loan consultations for veterinarian clients, we have to plan for a huge six-figure tax bill decades into the future. This often ranges anywhere from $100,000 to $300,000. Even so, my average client's student loan savings is over $84,000 as of November 15, 2016. That's only possible because the total cost of loan repayment for veterinarians in the private sector is frequently over $400,000 over the life of their loans.

As I mentioned, not only does PSLF allow a 10 year forgiveness period, but the benefit is tax-free. The difference between non-profit employers and for-profit employers in terms of federal student loan forgiveness benefits is massive.

How Can Most Veterinary Residents Qualify for this Benefit?

From speaking with friends and colleagues in the industry, I've learned that most veterinary internships last 1 year. They can be at different kinds of employers too. If you want to take advantage of the loophole for veterinary residents, the first thing you must do is make sure your internship is at a not-for-profit institution. That means you need to prioritize university College of Veterinary Medicine-based internships at all costs and do the same for residencies.

After this internship, you have the choice of going straight into private practice or continuing on in a veterinary residency. Based on current student loan rules, every single person with debt who is facing this decision should choose a residency. After training, you would need to continue with a not-for-profit employer such as a university or government agency for 5-6 years until the loans are forgiven. That means finding something at the FSIS, a CVM, not-for-profit animal shelter, or state or local public health organization. At that point, you could join the private sector as a board-certified veterinarian and earn more than $200,000 without having any student loan debt.

The veterinary residency needs to be at a not-for-profit employer such as a College of Veterinary Medicine. Yes, your pay will be rock bottom compared to peers going into private practice, but only on the surface. After adjusting for the hidden PSLF student loan benefit, many veterinary residents with student loan debt will be earning six-figure salaries.

Let's Compare Two Veterinarians, Brett and Jessi

To illustrate how veterinary residents with student loans can earn so much money, let's look at an example. Meet two young veterinarians in training, Brett and Jessi.

Brett and Jessi both started undergrad in the fall of 2008, so they're eligible for all of the student loan repayment plans. They both graduated in spring of 2016. Brett chose to go straight into private practice after earning his DVM and Jessi chose the internship route and is planning to pursue a four year residency program.

Here are the assumptions that both of them share. Both Brett and Jessi graduate from vet school with $200,000 in student loans. Their interest rate is at 6.8%.

Assumptions for Brett: His starting salary as a private practice veterinarian is $75,000. This salary grows to $100,000 over his first five years of practice because of increasing production payments. After that, his salary grows at a 3% rate of inflation.

Assumptions for Jessi: Her salary during her one year as an intern is $30,000. Her salary over each of the four years of residency is $40,000. After residency, she takes a job as a clinical assistant professor at a College of Veterinary Medicine making $120,000 a year. After that, her salary grows at a 3% rate of inflation.

Brett's Private Practice Student Loan Forgiveness Looks Bleak

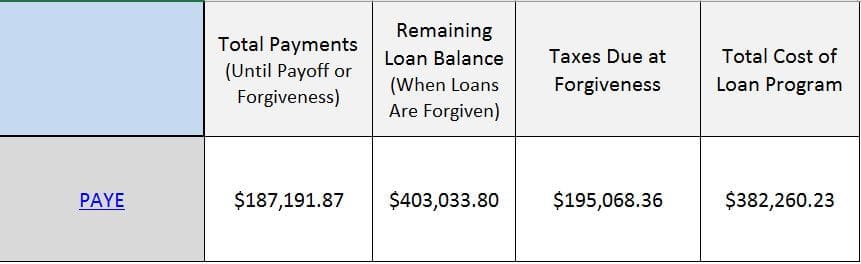

If Brett had to pay off his student loans in 10 years, his monthly payment would be around $2,300. On a modest $75,000 a year salary, this would place too great a strain on his personal finances. Instead, he is going to use the Pay As You Earn (PAYE) program to limit his monthly payments to 10% of his discretionary income.

Because his payments would not even cover his accruing interest, Brett's balance would continue to grow. In 20 years, Brett would finally be eligible for private sector loan forgiveness through the PAYE program. The remaining balance would be added onto his taxable income, and he would pay income taxes on this amount. I estimate that his marginal tax bracket would be 43.4% for federal and 5% for state. Here is the summary of the costs below:

So by 2036, Brett is finally debt-free, but at the cost of $382,260.23. Furthermore, this large tax payment comes at an inopportune time. Brett is in his mid-to-late 40's at this point. He probably has a family, and maybe he even has a few kids of his own. Writing this huge check to the IRS will interfere with saving for his kids' college, paying down his mortgage, saving for retirement, and many other important financial goals in your 40's.

Jessi's PSLF Tax-Free Student Loan Forgiveness Benefit Looks Incredible

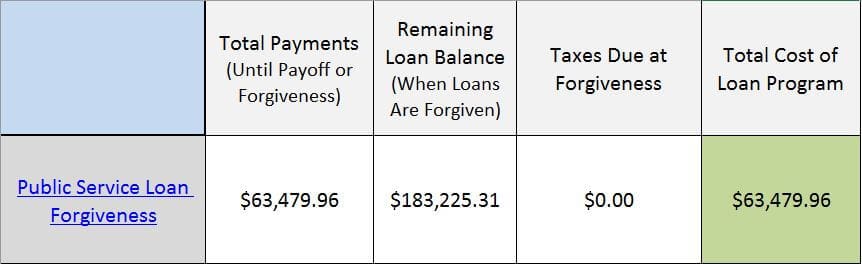

Recall that Jessi is doing a one-year internship and four year residency instead. Learning of the unbelievably generous PSLF program, she decides to enter repayment right away on the same PAYE plan that Brett used. Remember that her income is only $30,000 in the first year and $40,000 every year thereafter during residency. Therefore, her total income based payments on student loans amount to a little over $8,000 during her first five years after graduation.

After she completes residency and earns her board certification, Jessi takes a clinical assistant professor position. As I stated earlier, she will start out at $120,000 a year, not to mention all the superior benefits available with university jobs. When her salary jumps, so do her monthly student loan payments. Even so, these higher payments are only for five more years. After that, the entire balance is paid off by the federal government tax free. Here's the summary below:

This shows how enormous the value of PSLF is for veterinary residents. Not only did Jessi obtain board certification, but she also got a huge student loan benefit worth hundreds of thousands of dollars. After five years as a clinical assistant professor, she could move into private practice debt-free and earn well over a $200,000 salary while her friend Brett is struggling under a massive debt load on a ~$100,000 salary.

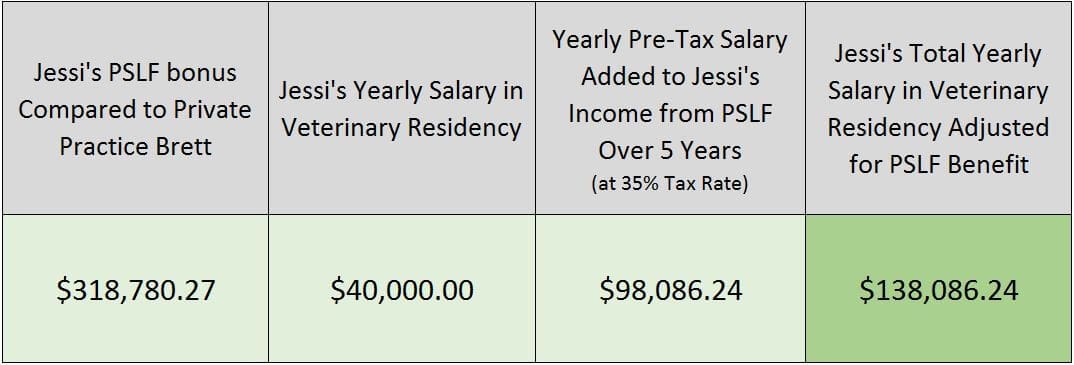

Veterinary Residents Have Enormous Incomes After Adjusting for PSLF

Brett could have sought out a Food Safety and Inspection Service job with the federal government and received the PSLF benefit too. He could have also chosen a job at a not-for-profit animal shelter. Even so,

The best option to take full advantage of the PSLF benefit is veterinary residency. Since there is already a lot of competition over these programs, Jessi could have also gone for the PSLF benefit through another not-for-profit employer straight out of vet school. Working at a university is not the only option, it's just a great one.

Jessi gets to keep her payments ultra low during the first five years of her career. Then, she gets a board certification and a professor job with slightly higher payments. Once her loans are gone, she could quit her university post and make serious bank in the private sector. This strategy is by far the most lucrative option available to veterinarians who graduate with more than $100,000 in student debt.

To say that Jessi's salary during veterinary residency is only $40,000 would be a misrepresentation. That's like saying a self-employed entrepreneur making $40,000 a year is equivalent to a unionized firefighter who makes $40,000 but pays nothing for health insurance, gets a pension at 50, and has 20 paid days off a year. The proper way to evaluate salaries for veterinary residents is to add in the PSLF student loan benefit over each year of residency and compare that number to salaries in private practice.

The PSLF Benefit is Worth Even More in Salary the More Indebted You Are

For veterinarians with greater debt than the $200,000 I modeled, the PSLF benefit would be even higher. Last week, I did a consultation with a veterinarian who had over $450,000 in student debt. I uncovered a potential $150,000 benefit each year over 10 years as she did part-time work at a not-for-profit animal shelter. If she worked another 10 hours a week and got full-time status there, it would be like earning an additional $150,000 per year over the 10 year PSLF payment period. I calculate that figure from the full cost of private sector loan repayment over 20-25 years as I did for Brett above.

Only Catch is Post Veterinary Residency Employment Has to Be Not For Profit, After That Choose Anything You Want

Jessi does have a major restriction on her employment choices after residency. She absolutely must choose a qualifying not-for-profit or government employer and work there for at least five years. She should submit the PSLF employment certification form within the first couple of months of work to make sure her employer qualifies.

Jessi needs to be willing to relocate anywhere in the country for the five-year period after training. Once she completes her loan forgiveness period, then the world is her oyster. She can stay on with the university and become a full professor. She might even become the Dean of the Veterinary College and earn over $300,000 annually. That of course does not include the generous fringe benefits that go along with a faculty position.

Additionally, if academia isn't really for her, she could work as a specialist in the private sector. In my first viral hit on veterinary student loans, I learned in the comments section that board-certified veterinarians can easily make over $200,000 a year this way.

Now that Jessi is debt-free, she can pay down her mortgage, get rid of car loans, save for her kid's college, and supercharge her retirement savings so she can retire in her 50's if she wants to. Life looks really bright for Jessi and it's entirely due to the way she took advantage of the student loan rules.

Get Into a Veterinary Residency First, then Spread the Word

Please apply to a veterinary residency at a university if you have a lot of student loan debt. Congress created PSLF in October 2007. The federal government will forgive the first loan balances tax-free in October 2017. That's why many people still do not know about this benefit. Internships and residencies are already highly competitive. They will become even more so as knowledge of the PSLF program becomes more widespread.

I predict that getting into a veterinary residency will eventually be more competitive than applying for Google or Harvard. Keep in mind that this is not the only route to PSLF for veterinarians. Many folks could optimize their employment situation to take advantage of this federal student loan program. If you do not qualify and work in the private sector, I can help you too through other routes. Please share your knowledge or thoughts in the comments section. If you have a bunch of student debt, check out my blurb below. Thanks for stopping by!

I Can Help Figure Out Vet School Loans

My business model here at Student Loan Planner®, LLC is providing people with student loan advice. I've worked with many veterinarians and saved the average client over $80,000 through optimization of government repayment programs and private refinancing where applicable.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.