Plastic surgeons are among the most highly trained medical doctors, performing a myriad of reconstructive or replacement procedures on the skin or extremities.

Although they’re often thought of as “cosmetic” surgeons, there’s actually a great deal of variety within the plastic surgery field. Plastic surgeons work to repair congenital or traumatic problems, and subspecialty options include microvascular surgery, cranio-maxillofacial surgery and hand surgery.

In addition to serving an important purpose in performing their work, doctors who choose a plastic surgery speciality earn an average annual compensation that ranks near the top of their field. But is the plastic surgeon salary worth the hefty medical student loans that many plastic surgeons end up with?

Yes, especially if you’re strategic with your student loan repayment strategy. Here’s what you need to know.

Education and training requirements to become a plastic surgeon

To become a plastic surgeon, you first must earn your bachelor’s degree. Next, you’ll need to pass the MCAT to gain acceptance to an accredited medical school. Medical school training programs usually take four years to complete.

To join the American Society of Plastic Surgeons (ASPS), you’ll need to become board certified with the American Board of Plastic Surgery (ABPS).

According to the ABPS medical school graduates need to complete an additional six to nine years of residency training before becoming eligible for board certification. Additionally, the ASPS mandates that at least three of these surgical training years consist of a plastic surgery residency.

Once you’ve met these requirements, you can take the ASPS written and oral exams. After passing these exams, you’ll be eligible to become an ASPS Member Surgeon. In total, plastic surgeons can expect their education and training to require a time commitment of 14 to 17 years.

How much do plastic surgeons make?

Plastic surgeons consistently rank near the top of Medscape’s annual physician compensation report. In 2018, plastic surgery ranked as the highest-paid medical specialty with an average salary of $501k (the only specialty to break the $500k mark). In 2019, its ranking dropped only slightly to #2, with an average salary of $471k.

In Medscape’s 2018 report, they compared the plastic surgeon salary of private practice owners to employed plastic surgeons. The average private practice plastic surgeon salary in 2018 was $510k while the average employed plastic surgeon earned $492k — a difference of $18,000.

How much student debt does the average plastic surgeon have?

According to the Association of American Medical Colleges (AAMC), the median debt for medical school graduates in 2018 was $200,000. Private school medical school students faced an even heavier debt load, with 21% of 2018 graduates borrowing $300,000 or more in student loans.

Unfortunately, the AAMC doesn’t typically break down student debt by specialty. A long-term JAMA Network study conducted from 2010-2016 was able to do so, however. Aspiring plastic surgeons will be happy to hear that of the 21 specialties evaluated in the study, plastic surgery reported the fourth-lowest median debt total.

Best student loan repayment strategies for plastic surgeons

Although plastic surgery is one of the more “affordable” medical specialties, $200,000 or more of student loans is still no joke. And those loans can be especially difficult to pay during residency. Medscape found that the average resident plastic surgeon salary in 2019 was $65,600.

If you’re currently in residency and you have federal student loans, you may be eligible to apply for Mandatory Medical Residency Forbearance. But we don’t typically recommend this student loan repayment strategy to physicians for a couple of reasons.

First, interest continues to accrue on your loans during your forbearance period. And six to nine years of interest accrual on $175,000 or more of loans could easily increase your balance by an additional $50,000 or more. Second, if you put your loans in forbearance, you won’t be able to make any qualifying payments toward Public Service Loan Forgiveness (PSLF).

Instead, Student Loan Planner® typically recommends that physicians with long residency requirements (like plastic surgeons) either try to earn as much forgiveness as they can with PSLF or pay down their loans as quickly as possible. Let’s take a look at a case study for each strategy.

1. Pursue Public Service Loan Forgiveness

If you completed your residency training at a nonprofit or public residency that would be a qualifying employer for Public Service Loan Forgiveness, you really need to consider applying for the program.

With PSLF, you’ll make payments on an income-driven repayment (IDR) plan, which makes your payments much more manageable during residency.

Plus, you’d only have one to four years left after residency before qualifying for loan forgiveness. To earn that forgiveness, you’ll need to take a job at a university or nonprofit hospital after you finish residency.

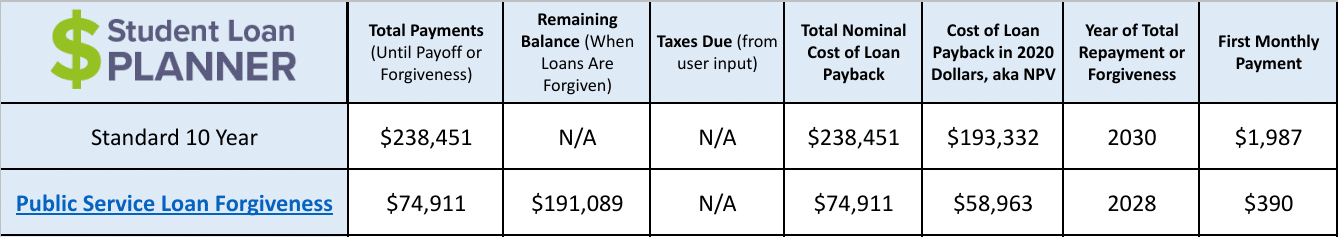

Let’s say that you graduate with $175,000 in student loans at an average interest rate of 6.5%. You spend six years in residency with an average salary of $65,000 before taking a job at a nonprofit hospital with a $450,000 starting salary.

In this case, PSLF could save you $163,540 when compared to the 10-Year Standard Repayment Plan, according to the Student Loan Planner® calculator.

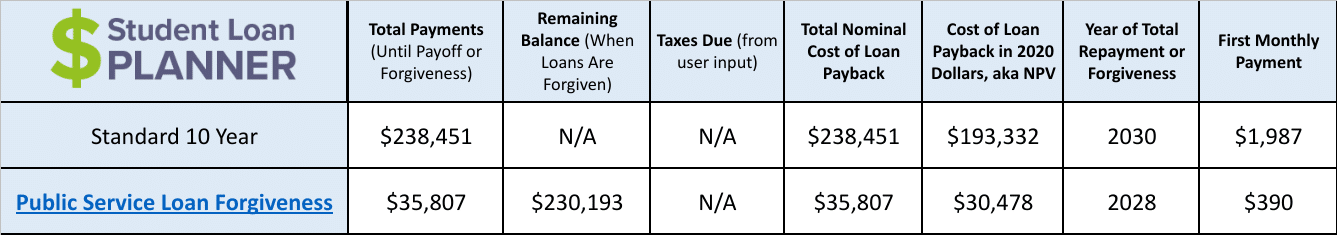

And what if your residency lasted nine years? In that case, the value of PSLF becomes even more mind-boggling because you’d only have one year of nonresidency income — and higher payments — before you’d qualify for forgiveness.

If you think the numbers above are a mistake, they’re not. With a nine-year residency, you could literally pay only a little over $35,000 of your $175,000 student loan balance before becoming eligible for forgiveness.

Related: How PSLF Distorts Physician Salaries

2. Pay off your loans as fast as you can

If you have the ability to pursue PSLF, it will often be the repayment plan that saves you the most money. But PSLF won’t work for everyone. Private practice owners and private student loan borrowers will need a different strategy.

Private student loans don’t qualify for PSLF. And the only way you could qualify for PSLF as a private practice owner would be to sell your practice and take a new job with a qualifying employer. If you’ve already gone through the difficult work of launching your own private practice, that’s unlikely to be an attractive (or practical) option.

If pursuing PSLF isn’t a viable strategy for you, then you’ll probably want to choose an aggressive repayment plan. The faster you repay your loans, the more you’ll save yourself in interest charges.

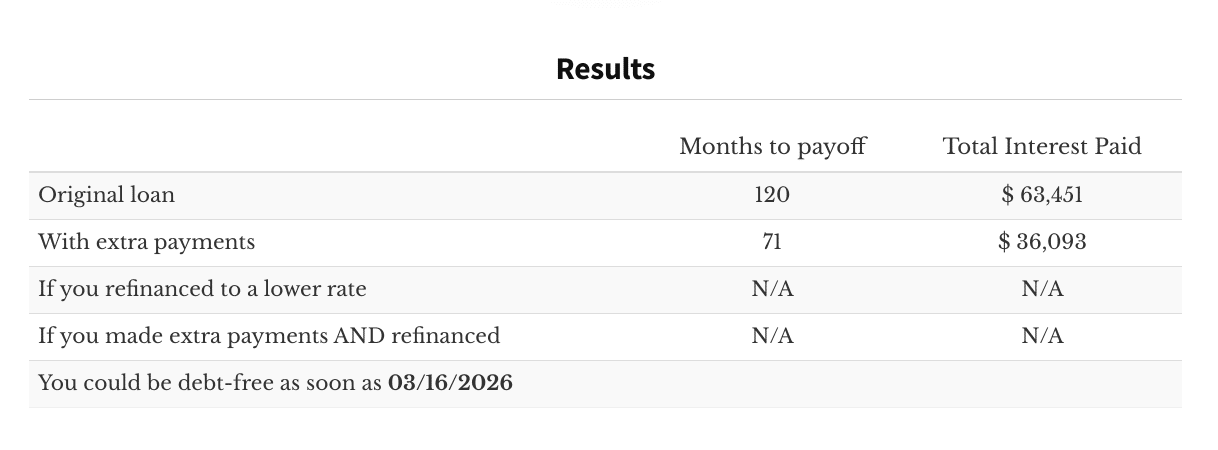

For example, if you made extra payments of $1,000 per month on your $175,000 in student loans, you’d save over $27,000 in interest and you’d be debt-free in six years instead of 10.

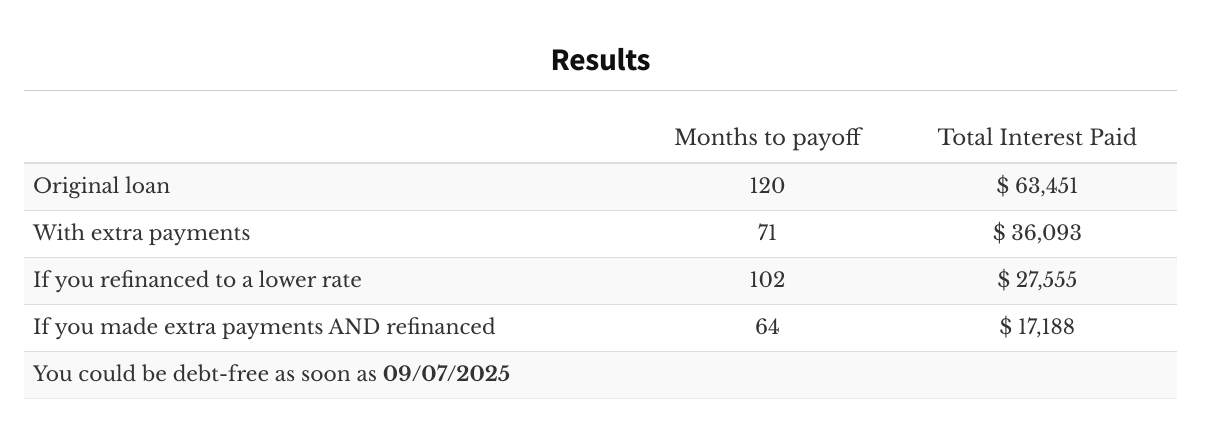

And refinancing to a lower interest rate could turbocharge your debt payoff even further. By refinancing at a 3.5% interest rate and continuing to make the $1,000 monthly payments, you’d save over $46,000 in interest and would be debt free in as little as five years.

Can plastic surgeons still become private practice owners?

As mentioned earlier, in its 2018 report, Medscape found that plastic surgeons who own their own practice made an extra $18,000 per year on average. But extra money isn’t the only reason why private practice ownership may appeal to you.

Owning your own plastic surgery practice also means that you have more autonomy in how you’re able to care for your patients. And it could also give you more freedom to expand your practice geographically, potentially giving opportunities to treat patients in multiple cities or countries.

Launching a plastic surgery practice right after your residency training could also cause you to lose out on hundreds of thousands of dollars in PSLF forgiveness.

Adopting a PSLF student loan repayment strategy doesn’t mean that plastic surgeons can’t become private practice owners, however. As we’ve already discussed, most plastic surgeons will only need to work one to four years for a qualifying public or nonprofit employer after residency to qualify for forgiveness.

So, within five years of finishing residency, you could launch your private practice with zero student debt. In fact, waiting to start your practice until after you’ve received loan forgiveness could help you qualify for private practice financing because your debt-to-income ratio will look so much better.

Practice Loan Quote Form

Get a comprehensive repayment plan for your plastic surgeon student debt

If you’re unsure which repayment strategy would work best for your plastic surgery student loans, one of our Student Loan Planner® consultants can help you. They’ll look at your specific loan and employment situation to show you which plan would save you the most money and time.

Our consultants have already helped over 3,800 borrowers find an average of $50,000 in projected loan savings, and they’d love to help you too. Book a student loan consultation today.