Community property states are states where both spouses have equal ownership of all income earned, assets and debts acquired during the marriage.

In community property states, a couple’s marital property and assets are split 50/50 in the event of divorce. But community property laws can also affect Americans during their marriage. And that’s especially true if one or both spouses are student loan borrowers.

In this guide, we’ll take a look at what a community property state is and how living in one can affect your taxes and student loan repayment plan.

Here’s what you need to know.

What states are community property states?

Community property states are a minority in the United States. Most states follow the common law property system and are often referred to as equitable distribution states. In these states, the courts decide on a case-by-case basis how property should be divided if the couple cannot come to an agreement on their own.

Currently, there are nine community property states. They are:

- Arizona

- California (rules also typically apply to domestic partners)

- Idaho

- Louisiana

- Nevada (rules also typically apply to domestic partners

- New Mexico

- Texas

- Washington (rules also typically apply to domestic partners)

- Wisconsin

Alaska, South Dakota, and Tennessee allow couples to choose if they want to follow the community property or common law property system.

What is considered community income, property and debt?

Only the income you earn during your marriage, while living in a community property state is considered community income. The same general rule applies to community property and marital debt accrued during marriage (credit card debts, mortgage, car loan, etc.)

It’s important to point out that both criteria must be met at the same time for community property rules to apply. Consider the two examples below:

- You bought your home while living in a community property state, but before you married your spouse.

- You bought your home while married, but before moving to a community property state.

In both examples listed above, your home would not be subject to the community property laws.

However, if the home was bought while you were married and living in a community property state, then you and your spouse would have equal ownership.

Are there any exceptions?

There are exceptions to the rules listed above. For example, gifts or inheritance that either spouse receives individually is considered separate property rather than being included in the community estate.

To learn more about what qualifies as community property vs. separate property, check out the full IRS guide to Community Property. Or you can ask a local family law attorney or property division lawyer about your state's rules.

What if you own properties in multiple states?

If you own properties in multiple states, the IRS will use the state rules of your permanent residence. The IRS considers several factors, including where you pay state income taxes, where you vote and the length of your residence, to decide which state rules apply.

Let’s imagine that you own property in Arizona (a community property state) and Florida (a common law state). And, for sake of example, let’s also imagine that you purchased both properties after marriage and while living primarily in Arizona.

In this case, how would the probate courts handle your Florida property during a divorce? According to the IRS, it all depends on your domicile — or your place of your permanent residence. All of the income and property that you accumulate during marriage and living in a community property state is subject to community property law.

So, in the example above, the Florida property would be split 50/50 in a divorce. It would be subject to Arizona’s community property law. Despite the fact that Florida is not a community property state.

How can community property laws affect your taxes?

The biggest way community property laws affect your taxes is when you choose a married filing separately filing status.

In most states, each spouse reports their individual income separately on their tax returns. So if you earned $100,000 and your spouse earned $50,000, you would solely report your $100,000 earnings.

But in community property states, you must equalize your incomes, even when you file separately. To do that, you take the total amount earned between the two of you and divide it in half.

In the example above, that would result in each of you listing an income of $75,000 on your tax return ($150,000 divided by 2 = $75,000).

This major difference could make married filing jointly the better option for certain couples. And that could especially be true if you’re repaying student loans on an income-driven repayment (IDR) plan.

Let’s take a look at why.

How community property laws can impact your student loans

In certain circumstances, living in a community property state could have a profound impact on your monthly student loan payments and eventual student loan forgiveness.

Filing separately could lower your student loan payments

Let’s say that Jenny is a doctor who makes $200,000 per year and has $300,000 in student loan debt (all federal student loans).

We’ll also say that Jenny works for a public hospital and is pursuing Public Service Loan Forgiveness (PSLF). Finally, imagine that Jenny’s spouse, Paul, is a teacher making $50,000 per year.

In most cases, choosing a married filing separately status wouldn’t be all too beneficial for Jenny.

First, she would lose out on a lot of deductions and credits. Yet her IDR payments wouldn’t drop all that much because they would still be based on her $200,000 income.

But if Jenny lived in a community property state, that could change the whole equation.

In that case, her reported income would drop to $125,000 by filing separately. And that could make a huge difference. Both in her monthly IDR payment as well as the amount of PSLF forgiveness she could eventually receive.

Related: PSLF Tax Implications for Married Couples in Community Property States

When filing separately could increase your student loan payments

It’s important to point out that the tax trick described above won’t work for everyone.

First, you’ll need to be on one of the following IDR plans: Saving on a Valuable Education (SAVE), Pay As You Earn (PAYE), Income-Based Repayment (IBR) or Income-Contingent Repayment (ICR).

Second, if you’re the spouse that earns less, you would be raising your reported income by filing separately in a community property state.

And since your IDR payments are based on your income, filing separately would cause your student loan payments to increase.

Related: How to Decide When to Use Married Filing Separately on Your Tax Return

Division of student loans after divorce in community property states

As we've already noted, any debts taken out by either spouse in a community property state is considered a joint debt. This can cause some real headaches for couples who divorce or legally separate.

For example, let's say that you're ex-spouse took out $200,000 of student loans while married to you and while living in a community property state. Upon your divorce or separation, you would owe half of that debt ($100,000). This is despite the fact that none of the loans would have been taken out in your name.

Again, this situation would only apply if your spouse's debt had been taken out while married to you. Any student loans taken out before marriage (or before moving to a community property state), are the actual borrower's sole responsibility after a divorce.

Note that some couples decide to create a prenuptial agreement (prenup) before marriage to avoid these types of problems. A prenup is a contract that details how marital property will be divided in a divorce. If a couple agree in a prenup to keep their student debts separate, this would supersede their state's community property laws.

Need help picking your filing status for student loans?

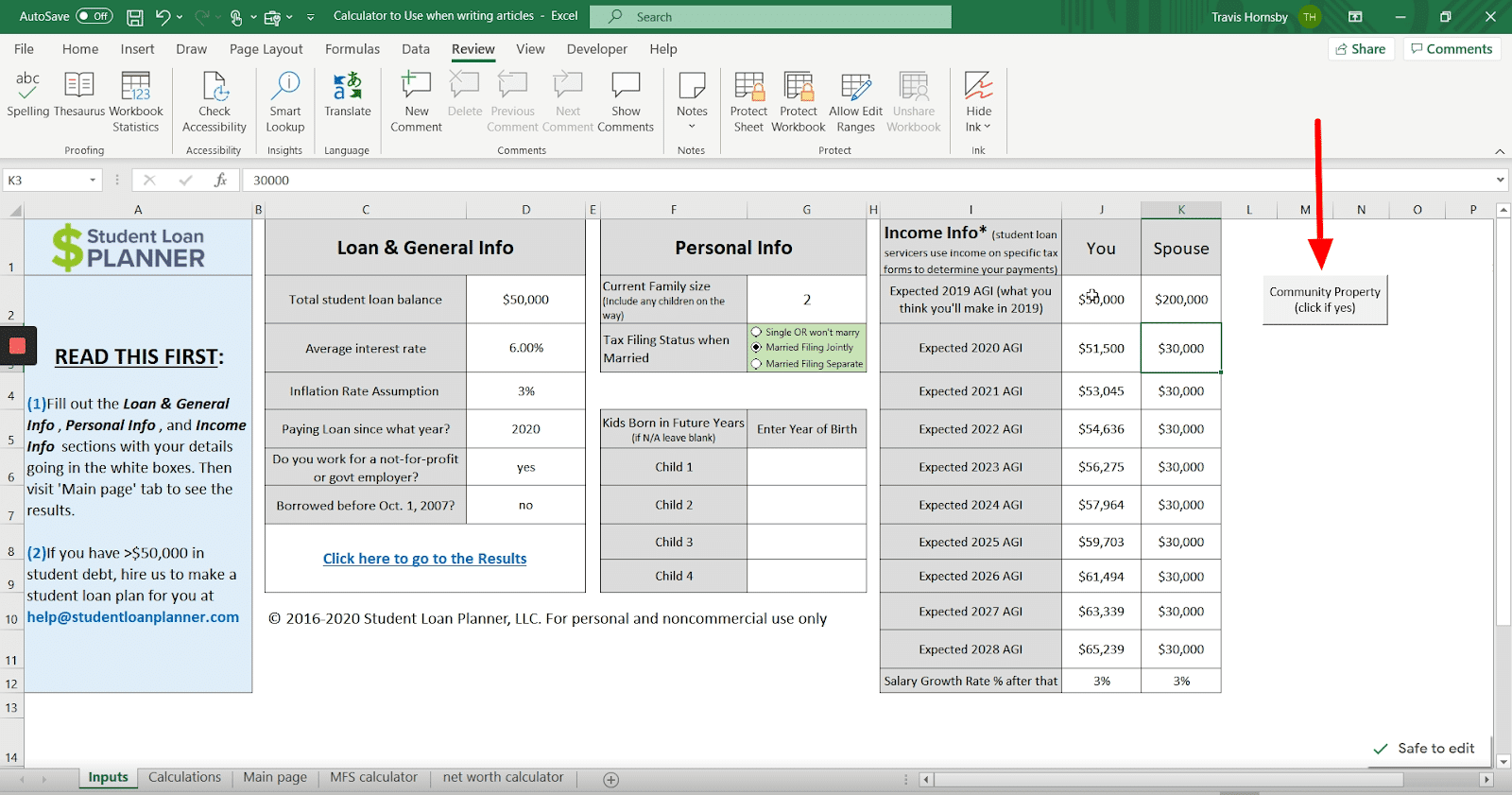

If you live in a community property state and wondering which filing status is best, you can use the Student Loan Planner® calculator to help you decide.

Inside the calculator, you can select whether or not you live in a community property state. It then shows which repayment plan would save you the most money.

Or, if you’d like to talk to someone who truly understands the ins and outs of student loans, consider booking a consultation with a Student Loan Planner® advisor.

Each of our advisors are CPA, CFP or CSLP certified. They can help you navigate the complications of student loan repayment for married couples in community property states.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.