How does student loan interest work? It can seem like a tricky concept which is why it’s one of the most common misconceptions that I run into. Private student loan interest usually has a positive amortization schedule. That means you pay down at least $1 of principal with every payment. However, with federal student loan interest, you can often pay less than the interest that’s due every month.

This is called negative amortization. When you owe $5,000 on a credit card and only pay the minimum $25 monthly payment, the interest you’re not paying compounds. That is, the interest generates interest.

With federal student loan interest, the interest accrues. Instead of interest charges growing exponentially, they grow additively.

I’ll take you under the hood of the giant backdoor subsidy of student loan interest accrual with federal student loans.

How to keep your student loan Interest Accrual from Compounding

Here are three ways to ensure your student loan interest does not grow exponentially:

- You’re enrolled in school (using deferment)

- You make payments using an income-driven repayment plan like Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), or Income Based Repayment (IBR)

- The monthly payment you make is larger than your monthly interest charge

With deferment your interest still grows while you’re enrolled in school, but you’re not charged interest on interest.

When you’re on an income-driven plan, the government adds the interest you don’t pay every month onto the “accrued interest” column. This prevents the student loan interest from adding to your principal balance.

Obviously, if you were to refinance or simply make payments above the interest you owe, your loan amount will decrease.

Mistakes that compound your student loan interest

Here are three common mistakes that cause your student loan interest to compound

- Forbearance (every time you use forbearance, the government adds any accrued student loan interest to your principal, which generates additional interest charges)

- Switching repayment plans (each time you go from IBR to REPAYE or REPAYE to PAYE, accrued interest becomes principal)

- Forgetting to submit your income driven certification on time

Forbearance is one of the worst actions you can take for your student loan debt. In rare cases, it makes sense to use forbearance to clean up other more troublesome debt.

However, most people using forbearance should be using income-driven repayment instead.

When you switch repayment plans, interest gets added to principal. Sometimes this is a minor concern if you’re moving from IBR, which costs 15% of your discretionary income to PAYE, which costs 10%. You do not want to get in the habit of switching between plans frequently though.

Sometimes the paperwork mistake is the loan servicer’s fault. Readers frequently share stories in the comments section about how their loan servicer messed up and compounded their interest. Of course, life happens, you move addresses or other priorities take all your bandwidth, and suddenly you missed your certification and your interest compounds.

Try not to let it happen to you.

What does student loan interest accrual mean?

Longtime readers of this site know that the REPAYE plan covers 50% of the interest not due every month. While that subsidy is great if you plan to eventually pay off your loans and currently have a low income, the student loan interest accrual subsidy is even more powerful.

Better yet, student loan interest accrual applies to PAYE, IBR, and REPAYE.

Pretend I will pay $500 a month every month for the entire 20 year payment period of PAYE. Assume my monthly interest charge is $2,000 a month. The leftover amount is $1,500 a month, or $18,000 per year.

Assuming I start off with $350,000, at the end of the 20 years I would owe $350,000+$18,000*20 = $710,000. That’s the amount I’d have to pay income taxes on, the $710,000.

Examples of student loan interest accrual

Of course, payments on a plan like PAYE would increase over time with your income. Let’s assume a chiropractor named Sarah comes out of school with $300,000 in debt at 7%. She earns $50,000 per year, which grows at 3%, roughly the rate of inflation.

Her first payment under the PAYE plan is $268 a month, and her final payment is $470 a month. Each month, the actual interest charge stays the same, $21,000.

This is true because she submits her income documentation on time, so her principal balance of $300,000 never changes. Hence, 7%*$300,000 = $21,000. Payments first go to her accrued interest. Hence, any leftover interest she still owes adds on top of her accrued interest amount.

Here’s an example of how Sarah’s total amount owed looks over the 20 years.

Year | Interest Charge | Amount Owed |

2019 | $21,000 | $300,000 |

2020 | $21,000 | $317,782 |

2021 | $21,000 | $335,467 |

2022 | $21,000 | $353,053 |

2023 | $21,000 | $370,537 |

2024 | $21,000 | $387,915 |

2025 | $21,000 | $405,185 |

2026 | $21,000 | $422,342 |

2027 | $21,000 | $439,384 |

2028 | $21,000 | $456,308 |

2029 | $21,000 | $473,109 |

2030 | $21,000 | $489,785 |

2031 | $21,000 | $506,330 |

2032 | $21,000 | $522,742 |

2033 | $21,000 | $539,016 |

2034 | $21,000 | $555,149 |

2035 | $21,000 | $571,135 |

2036 | $21,000 | $589,971 |

2037 | $21,000 | $602,652 |

2038 | $21,000 | $618,174 |

What if student loan interest compounded?

Under the scenario where interest under the PAYE plan compounded instead, the approximately $17,000 of unpaid interest from the first year would add to her principal balance and Sarah would have a principal of $317,000 instead of $300,000. Hence, her interest charge would be about $22,200 the following year instead of $21,000.

This interest charge would grow exponentially as more and more interest added to2 the principal balance.

Many readers build models this way, and the models are wrong. Since student loan interest accrues and does not compound, many borrowers overestimate the size of their tax bomb that they will owe in the future.

Here is an example of what would happen to Sarah if her interest compounded:

Interest Charge | Amount Owed |

$21,000 | $300,000 |

$22,245 | $317,782 |

$23,570 | $336,712 |

$24,981 | $356,868 |

$26,483 | $378,332 |

$28,084 | $401,194 |

$29,788 | $425,547 |

$31,604 | $451,493 |

$33,540 | $479,139 |

$35,602 | $508,603 |

$37,800 | $540,006 |

$40,144 | $573,482 |

$42,642 | $609,171 |

$45,306 | $647,225 |

$48,146 | $687,805 |

$51,176 | $731,084 |

$54,407 | $777,246 |

$57,854 | $826,789 |

$61,532 | $879,025 |

$65,455 | $935,078 |

Notice Sarah’s interest charge is more than $300,000 higher with just from compounding interest!

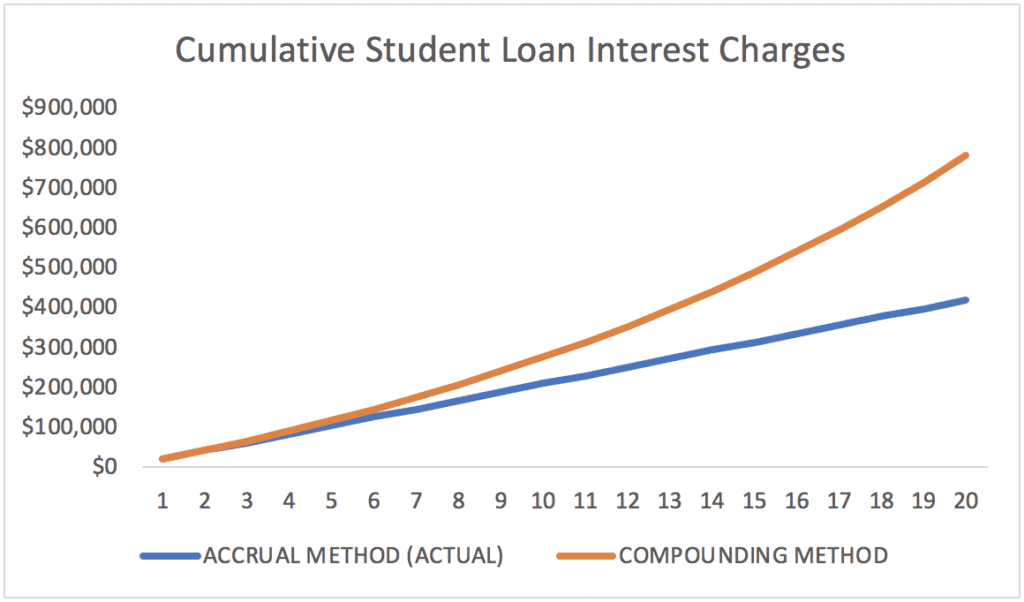

Here are the cumulative interest charges over the 20 years of PAYE for Sarah under the student loan interest accrual method that actually exists vs. the student loan interest compounding method that many people assume exists.

How does student loan interest work?

Whenever a client expresses fear over their student loan interest, I remind them that we know how bad it can get assuming income driven payment does not go away.

In the case of Sarah, she’d have to pay income tax on about $618,000 in 20 years. While that sum could easily be $250,000 or more, thanks to inflation the cost would probably be more like 1.5 to 2 times her salary.

While that’s not a small sum, she could prepare for it easily with smart planning.

Student loan interest accrual only works if you’re paying less than your interest charges. Refinancing still makes sense if you know you need to pay off your debt.

Student loan interest accrual simply ensures borrowers do not get buried under even more debt.

In real life, there are lots of things to consider like PAYE vs REPAYE vs IBR, refinancing or forgiveness, tax filing status and how marriage affects student loans.

We love taking away the stress from figuring out student loans by making custom plans for readers like you.

What are your thoughts about student loan interest accrual? Does it make your repayment journey any less daunting? Share your thoughts below.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

For refinancing 100k or more (bonus from Student Loan Planner®, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 10:49% APR

Variable 5.88 - 10.49% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.38% APR

Variable 4.33 - 12.35% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.