“Will I actually get my loans forgiven?”

This is a question we get a lot in our Student Loan Planner consultations regarding Public Service Loan Forgiveness, or PSLF. This question is understandable, given the historic “rejection rates” of PSLF applicants and prior attempts to repeal the program.

Congress passed the PSLF program in September 2007 with the College Cost Reduction and Access Act. The program offers loan forgiveness for borrowers’ remaining federal student debt, after 120 qualifying payments. The earliest anyone could’ve been eligible for forgiveness under this program was late-2017 or early-2018.

The earliest PSLF data report available for viewing the program's forgiveness statistics was for pre-March 2019 on StudentAid.gov, and it was damning. Only 610 of 58,293 applications processed had been approved by their loan servicer for forgiveness. That’s a 1.05% approval rate.

These stats were the origin of that “99% of PSLF applicants denied” headline in the media. Given this statistic, how or why would you trust that this program is worth pursuing?

We can answer that for you.

PSLF’s 99% rejection rate needs to be further clarified

To call it a 99% rejection rate with no context is misguiding borrowers who might be great candidates for the PSLF program. In this original data set, specifically, that 99% number doesn’t explain the fact that it wasn’t possible to determine PSLF eligibility for more than 1/4th of those applications.

Of the 58,293 applications being processed, 26% of those applications were denied due to “missing information”. This suggests that the application for forgiveness submitted was incomplete or didn’t have all of the required information necessary to process the application.

In 2019, the PSLF data report came out every three months with updated statistics, and in 2020, new statistics were published monthly until November. “Missing information” continued to be the reason for 23% to 26% of rejected PSLF applications for every data report until November 2020.

This leaves ~76% or less of applications being denied because they didn’t meet PSLF program requirements, not 99%. So let’s break that down further.

Why are people not meeting the PSLF program requirements?

“Qualifying payments” (or lack thereof) was the application rejection reason for 53% to 59% of the rejected PSLF applications until 11/2020. This means that a borrower submitted a completed application, it was reviewed, and the results show the borrower hasn’t made 120 qualifying payments.

So why have so many people applied, prematurely? Here’s a possible few reasons:

Confusion with paperwork

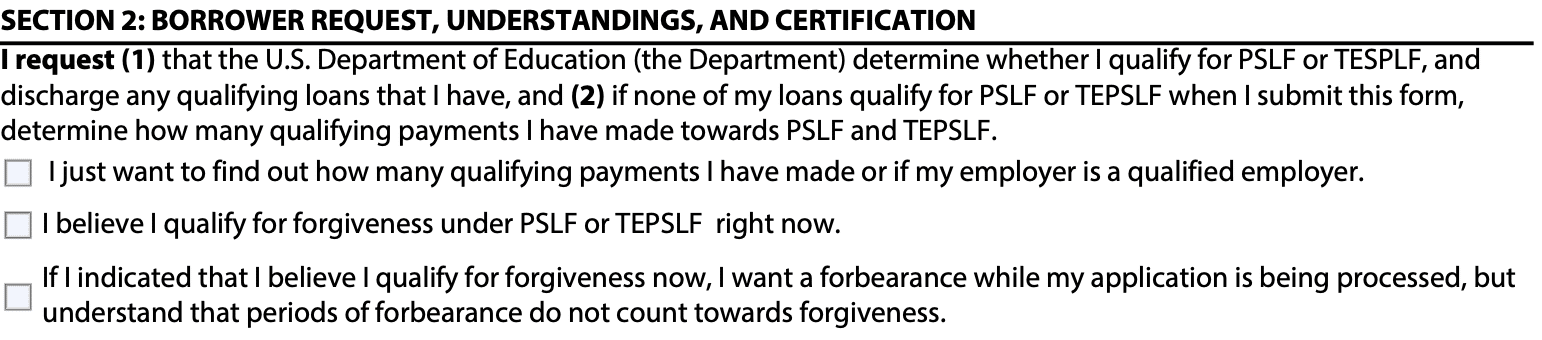

Before 2021, there were actually two official PSLF documents you could submit for the program: The Employment Certification Form (ECF) and the Public Service Loan Forgiveness Application.

- An Employment Certification Form is meant to confirm that your employer is a qualifying employer for PSLF and to find out how many qualifying payments you’ve made toward the 120 payment threshold.

- The Public Service Loan Forgiveness Application used to be a separate document that looked VERY similar to the ECF, but it was for folks who believed they hit 120 qualifying monthly payments and were officially applying for forgiveness of their remaining balance.

Borrowers previously had to submit separate forms to certify their employment or to apply for forgiveness, and it’s possible that many borrowers unintentionally applied for forgiveness when they were trying to update their payment count with the Employment Certification Form. This could have inflated the PSLF rejection rate.

In November 2020, FSA released a new combined Certification and Application form that covers both PSLF and TEPSLF which will help avoid confusion on what document to submit since it’s now one and the same.

Those wanting to update their payment count would check the first box:

Those who have made 120 payments and are applying for the actual forgiveness check box 2. Box 3 is optional.

There’s a common misconception that PSLF is a 10-year program

The reality is: It can be… 10 years the soonest you could achieve PSLF, but the program allows for forgiveness after making 120 qualifying payments.

A qualifying payment is one that is made on time and in full on a qualifying loan after 10/1/2007 where the following four factors exist at the same time:

- Working for a qualifying employer. This includes the government, a not-for-profit organization that is tax-exempt under Section 501(c)(3) of the Internal Revenue Code, or a private not-for-profit organization that provides certain public services.

- Working full-time. This means working for one or more qualifying employers for the greater of: (1) an annual average of at least 30 hours per week or, for a contractual or employment period of at least eight months, an average of 30 hours per week; or (2) unless the qualifying employment is with two or more employers, the number of hours the employer considers full time.

- Payment made on a Direct Loan. You have an eligible federal loan that’s not in default.

- Payment made on a qualifying repayment plan. This includes Revised Pay As You Earn (REPAYE), Pay As You Earn (PAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), or the Standard Repayment Plan with a maximum 10-year repayment period.

This rejection reason (not having enough qualifying payments) doesn’t mean that people aren’t going to receive forgiveness in the future, it just means people have more payments to get to 120 required payments.

Here’s our five-step guide to correct your payment count if you think you're missing any payment credits.

Not knowing where one's payment count is

Originally, there was no real-time way a borrower could find out where their payment count stood toward PSLF without submitting a new ECF, and having an official letter generated (and snail-mailed to them) for an updated payment count.

Thankfully, there have been improvements to this.

PSLF payment tracker

FSA introduced a new PSLF payment tracker that closely examines borrowers’ progress toward loan forgiveness, real-time, through their online Fedloan Servicing portal.

This tool lists out each of your loans and reflects your eligible payments, separating out payments that have already qualified via an ECF and those that need employment certification.

This tool helps you see your progress toward getting PSLF, transparently. You can also see the payments you’ve made since your last ECF submission — something you would’ve had to track on your own in the past. If you have any “ineligible payments”, the tracker helps you identify them and provides a reason.

Now it’s not so much of a secret to know where you stand on your payment count. The tracker feature can help you avoid applying for PSLF too soon (before you've made 120 payments).

The roughly 15% or fewer PSLF rejections between 2019 to November 2020 were due to having ineligible loans, ineligible employers, or issues with employment dates.

The most recent PSLF data report is very positive

The most recent PSLF data report posted on StudentAid.gov covers results from November 9, 2020, to April 30, 2021, and shows that of the 168,702 processed Employment Certification Forms, 3,458 met the requirements for forgiveness. That’s a 2.1% approval rate for forgiveness from processed ECFs.

You might be thinking, “But how’s that much better??”

This new report does a better job of reflecting people’s successful progress toward PSLF rather than categorizing those who haven’t hit 120 payments yet as a failed PSLF attempt. It provides greater insight into why many borrowers aren’t meeting forgiveness requirements. For most borrowers, it’s simply a matter of timing.

Of the 168,702 processed ECFs, 99.7% resulted in an updated qualifying payment count to track PSLF/TEPSLF progress. This is huge! 168,702 processed ECF’s are on track for PSLF!

This leaves only 0.3% not on track for PSLF due to either not having Direct Loans, their employer not being eligible, issues with employment dates, or the loans being in default/ineligible status.

This PSLF data report still records reasons that ECFs didn’t meet requirements for PSLF. But again, its new reporting model paints a clearer picture that not everyone submitting an ECF is eligible for (or expecting to be eligible for) forgiveness at that time, specifically; they just need time to get there.

Bottom line: Will you get your loans forgiven?

If you answer yes to ALL questions below, you’re on track to get your loans forgiven through PSLF:

- Do you work for a qualifying employer?

If you’re not sure, complete the PSLF help tool and submit to FedLoan Servicing. Mail, fax, or upload to: U.S. Department of Education, FedLoan Servicing, P.O. Box 69184, Harrisburg, PA 17106-9184; Fax to: 717-720-1628; Upload to: MyFedLoan.org/FileUpload, if FedLoan Servicing is already your servicer.

- Do you work full-time?

Full-time is at least 30 hours a week on average with 1 or more qualifying employers. If you have 1 employer, you must work their definition of full-time hours.

- Do you have Federal Direct loans?

You can confirm with your servicer or by using the PSLF help tool.

- Are you making payments on an income-driven repayment plan?

Apply for an Income-driven repayment plan here. If you’re unsure of what repayment plan is best for you, hire us to create your custom plan.

You can review your payment history and payment count toward the 120 qualifying payments via Fedloan's PSLF Payment Tracking System.

Maintenance of PSLF

To maintain your path towards PSLF each year:

- Make your payments on time, and in full, each month. Set up automatic payments to make sure you’re always on track.

- Continue to recertify income each year on time. This process is called recertification.

- Submit a new Employment Certification Form once a year. This keeps a pulse on your qualifying payments.

- Continue working full-time at a qualifying employer. Submit a new ECF if you switch jobs to have your new employer on file, and submit a final ECF for your old employer to capture all payments made up until the last day of your prior employment.

If you need some additional guidance with your specific student loan situation, schedule a consultation with us. Our team has helped thousands of people handle their student loan debt.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.